In the state of California, businesses are required to file a Statement of Information (SOI) with the California Secretary of State's office. This form is a crucial document that provides the state with up-to-date information about a business's structure, ownership, and operations. In this article, we will provide a step-by-step guide on how to complete the California Statement of Information form, also known as the SI-550 or SI-550 LLC form.

Why is the Statement of Information Important?

The Statement of Information is a critical document that helps the state of California maintain accurate records of businesses operating within its borders. By filing this form, businesses demonstrate their compliance with state regulations and provide essential information that can be used by the public, lenders, and other stakeholders. The SOI also helps businesses maintain their good standing with the state, which is essential for securing loans, entering into contracts, and conducting other business activities.

Who Needs to File the Statement of Information?

In California, the following types of businesses are required to file the Statement of Information:

- Corporations (including non-profit corporations)

- Limited liability companies (LLCs)

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

Step 1: Gather Required Information

Before completing the Statement of Information form, businesses should gather the following information:

- Business name and address

- Business type (corporation, LLC, LP, or LLP)

- Business owner information (names, addresses, and titles)

- Business activity description

- Name and address of the chief executive officer (CEO) or managing member

- Name and address of the chief financial officer (CFO) or treasurer

- Name and address of the secretary or other authorized person

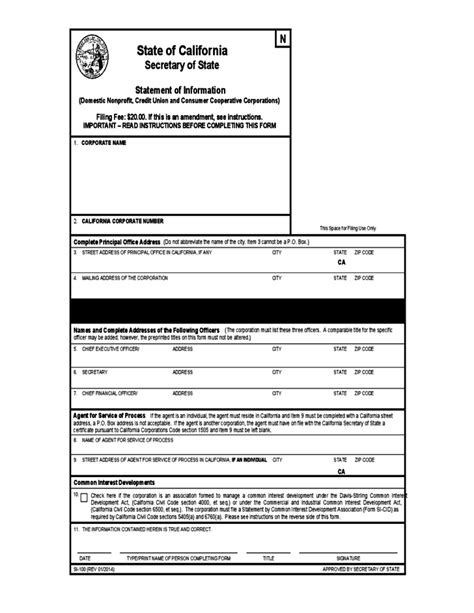

Step 2: Complete the Statement of Information Form

The Statement of Information form can be completed online or by mail. The form typically includes the following sections:

- Business Information: Provide the business name, address, and type.

- Business Owner Information: List the names, addresses, and titles of all business owners.

- Business Activity Description: Provide a brief description of the business activities.

- Officer/Director Information: List the names, addresses, and titles of the CEO, CFO, secretary, and other authorized persons.

- Additional Information: Provide any additional information required by the state.

Where to File the Statement of Information

The Statement of Information form can be filed online through the California Secretary of State's website or by mail to the following address:

California Secretary of State Business Entities 1500 11th Street Sacramento, CA 95814

Step 3: Pay the Filing Fee

The filing fee for the Statement of Information varies depending on the type of business and the method of filing. The current filing fees are as follows:

- Online filing: $25

- Mail filing: $30

Step 4: File the Statement of Information

Once the form is complete and the filing fee is paid, businesses can file the Statement of Information online or by mail. Online filings are typically processed within 24 hours, while mail filings may take several weeks to process.

Statement of Information Due Dates

The Statement of Information is due every two years, on the anniversary of the business's registration date. For example, if a business was registered on January 1, 2020, the SOI would be due on January 1, 2022, and every two years thereafter.

Penalties for Late Filing

Businesses that fail to file the Statement of Information on time may be subject to penalties and fines. The penalties for late filing are as follows:

- $250 fine for failure to file the SOI within 60 days of the due date

- $500 fine for failure to file the SOI within 120 days of the due date

- $1,000 fine for failure to file the SOI within 180 days of the due date

Conclusion

In conclusion, the Statement of Information is a critical document that businesses in California must file every two years. By following the steps outlined in this guide, businesses can ensure that they are in compliance with state regulations and avoid penalties and fines. If you have any questions or concerns about filing the Statement of Information, it is recommended that you consult with a qualified attorney or business advisor.

What is the purpose of the Statement of Information?

+The Statement of Information is a document that provides the state of California with up-to-date information about a business's structure, ownership, and operations.

Who needs to file the Statement of Information?

+Corporations, limited liability companies (LLCs), limited partnerships (LPs), and limited liability partnerships (LLPs) are required to file the Statement of Information.

How often do I need to file the Statement of Information?

+The Statement of Information is due every two years, on the anniversary of the business's registration date.