Unlocking the Power of 4506-C Form: A Comprehensive Guide

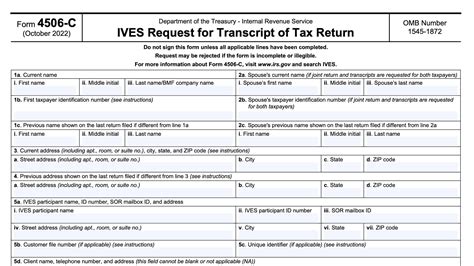

In the world of finance, taxes, and lending, the 4506-C form is a crucial document that plays a significant role in verifying an individual's or business's income and employment history. This form, also known as the "IVS Request for Transcript of Tax Return," is used by lenders, creditors, and other authorized parties to obtain a transcript of a taxpayer's tax return information from the Internal Revenue Service (IRS). In this article, we will explore five ways to discover the 4506-C form and its significance in various financial transactions.

What is the 4506-C Form?

Before we dive into the five ways to discover the 4506-C form, it's essential to understand what this document is and why it's crucial. The 4506-C form is a request for transcript of tax return, which allows authorized parties to obtain a taxpayer's tax return information from the IRS. This form is typically used in lending, credit, and other financial transactions where verifying an individual's or business's income and employment history is necessary.

Why is the 4506-C Form Important?

The 4506-C form is vital in various financial transactions because it provides lenders and creditors with a reliable way to verify a taxpayer's income and employment history. This information is crucial in determining a borrower's creditworthiness and ability to repay loans. By obtaining a transcript of tax return, lenders can:

- Verify income and employment history

- Evaluate creditworthiness

- Determine loan eligibility

- Reduce the risk of default

5 Ways to Discover the 4506-C Form

Now that we understand the significance of the 4506-C form, let's explore five ways to discover this crucial document:

1. IRS Website

The most straightforward way to discover the 4506-C form is to visit the IRS website. The IRS provides a comprehensive guide to the 4506-C form, including its purpose, eligibility, and instructions on how to complete and submit the form. You can download the form from the IRS website or order it by phone or mail.

2. Lender or Creditor

If you're applying for a loan or credit, your lender or creditor may require you to complete the 4506-C form as part of the application process. In this case, your lender or creditor will typically provide you with the form and guide you through the process of completing and submitting it.

3. Tax Professional

Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), often have experience working with the 4506-C form. They can provide guidance on how to complete the form, ensure it's submitted correctly, and help you understand the implications of the information obtained from the IRS.

4. Online Search

You can also discover the 4506-C form through an online search. However, be cautious when searching for the form online, as some websites may provide outdated or incorrect information. Ensure you're accessing the form from a reputable source, such as the IRS website or a trusted tax professional's website.

5. Financial Institutions

Financial institutions, such as banks and credit unions, may also provide access to the 4506-C form. If you're a customer of a financial institution, you can contact their customer service department to inquire about the form and the process for completing and submitting it.

How to Complete the 4506-C Form

Completing the 4506-C form requires careful attention to detail to ensure it's submitted correctly. Here are the steps to follow:

- Download or obtain the form: Access the 4506-C form from the IRS website, your lender or creditor, or a tax professional.

- Read the instructions: Carefully read the instructions provided with the form to ensure you understand what's required.

- Complete the form: Fill out the form accurately, providing all required information, including your name, social security number, and tax year(s) for which you're requesting transcripts.

- Sign and date the form: Sign and date the form, ensuring it's legible and accurate.

- Submit the form: Submit the form to the IRS, either by mail or online, following the instructions provided.

Common Challenges and Solutions

While completing the 4506-C form may seem straightforward, challenges can arise. Here are some common issues and solutions:

- Incorrect or incomplete information: Double-check your information before submitting the form to avoid delays or rejection.

- Missing signatures or dates: Ensure you sign and date the form accurately to avoid rejection.

- Submission issues: Follow the instructions provided for submitting the form, and consider submitting it online for faster processing.

Conclusion

The 4506-C form is a crucial document in various financial transactions, providing lenders and creditors with a reliable way to verify an individual's or business's income and employment history. By understanding the significance of this form and following the five ways to discover it, you can ensure a smooth and successful financial transaction. Remember to complete the form accurately, submit it correctly, and address any challenges that may arise.

Take Action Today!

If you're involved in a financial transaction that requires the 4506-C form, don't hesitate to take action. Download the form, complete it accurately, and submit it to the IRS. If you're unsure about any aspect of the process, consider consulting a tax professional or financial advisor for guidance.

Share Your Thoughts!

Have you had experience with the 4506-C form? Share your thoughts and insights in the comments below. Your feedback can help others navigate the process successfully.

FAQ Section

What is the purpose of the 4506-C form?

+The 4506-C form is used to request a transcript of tax return from the IRS, which is used to verify an individual's or business's income and employment history.

Who can complete the 4506-C form?

+The 4506-C form can be completed by an individual or business, or by a tax professional or financial advisor on their behalf.

How long does it take to process the 4506-C form?

+The processing time for the 4506-C form varies depending on the method of submission and the workload of the IRS. Online submissions are typically processed faster than mail submissions.