In New York City, tax season can be a daunting experience, especially when it comes to navigating the complexities of the NYC 210 tax form. As a responsible taxpayer, it's essential to ensure that you're filling out this form accurately to avoid any potential penalties or delays in receiving your refund. In this article, we'll provide you with five valuable tips to help you fill out the NYC 210 tax form with confidence.

Understanding the NYC 210 Tax Form

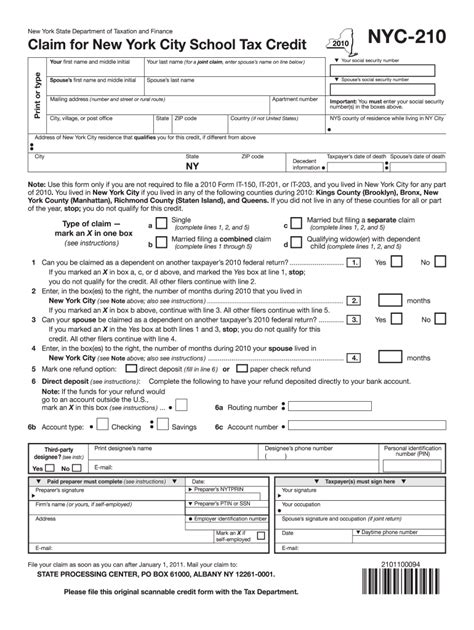

Before we dive into the tips, let's take a brief moment to understand what the NYC 210 tax form is and why it's necessary. The NYC 210 tax form is used to report and pay taxes on income earned in New York City. This form is required for individuals, businesses, and self-employed individuals who earn income within the city limits.

Tips for Filling Out the NYC 210 Tax Form

Tip 1: Gather All Necessary Documents

Before starting to fill out the NYC 210 tax form, make sure you have all the necessary documents and information readily available. This includes:

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance or self-employment income

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your NYC Tax Account Number (if you've filed taxes in NYC before)

- Any supporting documentation for deductions or credits you're claiming

Having all these documents in one place will save you time and reduce the risk of errors or omissions.

Common Mistakes to Avoid

When gathering your documents, be aware of common mistakes that can lead to delays or penalties:

- Missing or incorrect Social Security numbers or ITINs

- Failure to report all income earned in NYC

- Incorrect or incomplete business information (for business owners)

Tip 2: Choose the Correct Filing Status

Your filing status affects your tax liability, so it's essential to choose the correct one. The NYC 210 tax form offers the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that best applies to your situation, and make sure to review the eligibility requirements for each status.

Tip 3: Report All Income Earned in NYC

The NYC 210 tax form requires you to report all income earned in NYC, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Rent and royalty income

Make sure to report all income earned in NYC, regardless of the source. Failure to report all income can result in penalties and fines.

Types of Income to Report

- Wages, salaries, and tips: Report all income earned from employers in NYC, including tips and bonuses.

- Self-employment income: Report all income earned from freelance work, consulting, or other self-employment activities in NYC.

- Interest and dividends: Report all interest and dividends earned from investments, including bank accounts, stocks, and bonds.

Tip 4: Claim Eligible Deductions and Credits

The NYC 210 tax form allows you to claim various deductions and credits to reduce your tax liability. Some common deductions and credits include:

- Standard deduction

- Itemized deductions (e.g., mortgage interest, charitable donations)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Review the eligibility requirements for each deduction and credit, and make sure to claim only those that apply to your situation.

Tip 5: Review and Double-Check Your Return

Before submitting your NYC 210 tax form, review and double-check your return for accuracy and completeness. Make sure to:

- Verify all income and deduction amounts

- Check for math errors and ensure calculations are correct

- Review your filing status and make sure it's accurate

A thorough review will help you avoid errors and ensure that your return is processed smoothly.

Conclusion: Filling Out the NYC 210 Tax Form with Confidence

Filling out the NYC 210 tax form doesn't have to be a daunting experience. By following these five tips, you'll be well on your way to accurately and confidently completing your return. Remember to gather all necessary documents, choose the correct filing status, report all income earned in NYC, claim eligible deductions and credits, and review your return carefully before submission.

By taking the time to understand the NYC 210 tax form and following these tips, you'll be able to navigate the tax filing process with ease and ensure that you're in compliance with all NYC tax regulations.

We hope this article has been helpful in providing you with the information and guidance you need to fill out the NYC 210 tax form with confidence. If you have any further questions or concerns, please don't hesitate to reach out.

What is the deadline for filing the NYC 210 tax form?

+The deadline for filing the NYC 210 tax form is typically April 15th of each year. However, this deadline may vary depending on your specific situation and the type of return you're filing.

Do I need to file the NYC 210 tax form if I don't owe any taxes?

+Yes, you're still required to file the NYC 210 tax form even if you don't owe any taxes. This form is used to report all income earned in NYC, regardless of whether you owe taxes or not.

Can I e-file the NYC 210 tax form?

+Yes, you can e-file the NYC 210 tax form using the NYC Department of Finance's online filing system. This is a convenient and efficient way to file your return and receive your refund faster.