As a business owner, understanding the complexities of tax forms is essential to ensuring your company remains compliant and avoids any potential penalties. One of the most critical forms for S corporations is the Form 1120-S Schedule K-1. This form is used to report the income, deductions, and credits of an S corporation, as well as the share of each item that is allocated to the shareholders. In this article, we will provide you with five essential tips for filing Form 1120-S Schedule K-1.

Understanding the Basics of Form 1120-S Schedule K-1

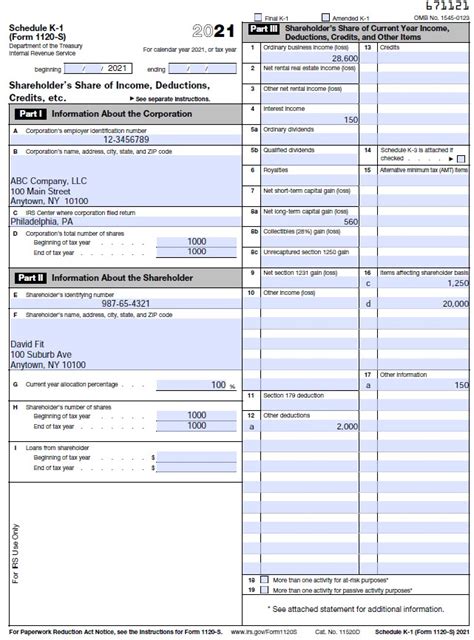

Before we dive into the tips, it's essential to understand the basics of Form 1120-S Schedule K-1. This form is used by S corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). The form is divided into two parts: Schedule K, which reports the corporation's total income, deductions, and credits, and Schedule K-1, which reports the share of each item that is allocated to each shareholder.

Tip 1: Ensure Accuracy and Completeness

The first and most crucial tip for filing Form 1120-S Schedule K-1 is to ensure accuracy and completeness. This form requires detailed information about the corporation's income, deductions, and credits, as well as the share of each item that is allocated to each shareholder. Any errors or omissions can lead to delays or even penalties. To avoid this, it's essential to:

- Double-check all calculations and ensure they are accurate

- Verify the accuracy of all shareholder information, including names, addresses, and tax identification numbers

- Ensure all required schedules and statements are attached to the form

Common Errors to Avoid

Some common errors to avoid when filing Form 1120-S Schedule K-1 include:

- Failing to report all income, including interest, dividends, and capital gains

- Failing to claim all eligible deductions and credits

- Incorrectly allocating income, deductions, and credits to shareholders

- Failing to attach required schedules and statements

Tip 2: Understand the Importance of Schedule K

Schedule K is a critical component of Form 1120-S Schedule K-1. This schedule reports the corporation's total income, deductions, and credits, and is used to calculate the corporation's taxable income. To ensure accuracy and completeness, it's essential to:

- Understand the different types of income, including ordinary income, interest, dividends, and capital gains

- Accurately calculate deductions and credits, including business expenses, depreciation, and tax credits

- Ensure all required information is reported on Schedule K

Understanding Schedule K

Schedule K is divided into several parts, including:

- Part I: Income

- Part II: Deductions and Credits

- Part III: Additional Information

Tip 3: Allocate Income, Deductions, and Credits Correctly

One of the most critical aspects of Form 1120-S Schedule K-1 is allocating income, deductions, and credits to shareholders. This allocation is reported on Schedule K-1 and is used to calculate each shareholder's taxable income. To ensure accuracy and completeness, it's essential to:

- Understand the corporation's ownership structure and the percentage of ownership for each shareholder

- Accurately allocate income, deductions, and credits to each shareholder

- Ensure all required information is reported on Schedule K-1

Understanding Schedule K-1

Schedule K-1 is divided into several parts, including:

- Part I: Shareholder's Share of Income, Deductions, and Credits

- Part II: Additional Information

Tip 4: Meet the Filing Deadline

The filing deadline for Form 1120-S Schedule K-1 is typically March 15th of each year. However, if the corporation needs an extension, it can file Form 7004 to request an automatic six-month extension. To avoid penalties and interest, it's essential to:

- File the form on time or request an extension if needed

- Ensure all required information is reported on the form

- Pay any required taxes or estimated taxes

Understanding the Filing Deadline

The filing deadline for Form 1120-S Schedule K-1 is typically March 15th of each year. However, if the corporation needs an extension, it can file Form 7004 to request an automatic six-month extension.

Tip 5: Seek Professional Help if Needed

Filing Form 1120-S Schedule K-1 can be complex and time-consuming. If you're unsure about any aspect of the form, it's essential to seek professional help. A tax professional can help you:

- Understand the requirements of the form

- Ensure accuracy and completeness

- Avoid common errors and penalties

Conclusion

Filing Form 1120-S Schedule K-1 is a critical aspect of tax compliance for S corporations. By following these five essential tips, you can ensure accuracy and completeness, avoid common errors and penalties, and meet the filing deadline. Remember to seek professional help if needed, and don't hesitate to reach out to the IRS or a tax professional if you have any questions or concerns.

What is Form 1120-S Schedule K-1?

+Form 1120-S Schedule K-1 is used by S corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS).

What is the filing deadline for Form 1120-S Schedule K-1?

+The filing deadline for Form 1120-S Schedule K-1 is typically March 15th of each year.