The Suspicious Activity Reporting (SAR) form is a crucial tool used by financial institutions to report suspicious transactions to the Financial Crimes Enforcement Network (FinCEN). The SAWs 2A SAR form, in particular, is used to report suspicious activity related to terrorist financing and money laundering. In this article, we will delve into the 5 key features of the SAWs 2A SAR form and explore its importance in the fight against financial crimes.

What is the SAWs 2A SAR Form?

The SAWs 2A SAR form is a type of Suspicious Activity Report (SAR) that is specifically designed to report suspicious activity related to terrorist financing and money laundering. It is used by financial institutions to report transactions that appear to be suspicious or unusual, and that may indicate a potential threat to national security or the integrity of the financial system.

Key Feature 1: Information on the Suspicious Activity

Details of the Suspicious Transaction

The SAWs 2A SAR form requires financial institutions to provide detailed information about the suspicious activity, including:

- Date and time of the transaction

- Type of transaction (e.g., deposit, withdrawal, transfer)

- Amount of the transaction

- Parties involved (e.g., customer, beneficiary)

- Description of the suspicious activity

This information helps FinCEN to identify patterns and trends of suspicious activity and to investigate potential terrorist financing and money laundering schemes.

Key Feature 2: Customer Information

Customer Details

The SAWs 2A SAR form requires financial institutions to provide detailed information about the customer involved in the suspicious activity, including:

- Name and address

- Date of birth

- Identification number (e.g., Social Security number, passport number)

- Occupation and employer

This information helps FinCEN to identify and track individuals who may be involved in terrorist financing and money laundering activities.

Key Feature 3: Suspicious Activity Indicators

Red Flags of Suspicious Activity

The SAWs 2A SAR form requires financial institutions to identify the suspicious activity indicators that triggered the filing of the SAR. These indicators may include:

- Unusual or unexplained transactions

- Transactions that involve high-risk countries or entities

- Transactions that involve cash or other high-risk payment methods

- Transactions that are structured to avoid reporting requirements

By identifying these indicators, financial institutions can help FinCEN to identify and investigate potential terrorist financing and money laundering schemes.

Key Feature 4: Investigative Information

Details of the Investigation

The SAWs 2A SAR form requires financial institutions to provide information about any investigation that has been conducted into the suspicious activity, including:

- Description of the investigation

- Results of the investigation

- Any action taken as a result of the investigation

This information helps FinCEN to understand the context of the suspicious activity and to identify any potential connections to terrorist financing and money laundering schemes.

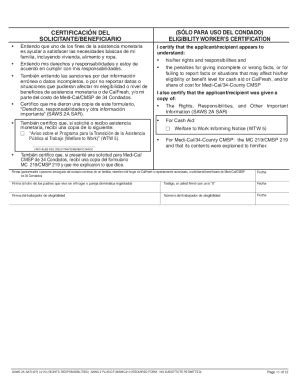

Key Feature 5: Certification

Certification and Verification

The SAWs 2A SAR form requires financial institutions to certify that the information provided is accurate and complete. This certification is a critical component of the SAR form, as it ensures that the information provided is reliable and trustworthy.

By certifying the accuracy and completeness of the information, financial institutions can help FinCEN to identify and investigate potential terrorist financing and money laundering schemes.

Importance of the SAWs 2A SAR Form

The SAWs 2A SAR form plays a critical role in the fight against terrorist financing and money laundering. By providing detailed information about suspicious activity, financial institutions can help FinCEN to identify and investigate potential threats to national security and the integrity of the financial system.

In conclusion, the SAWs 2A SAR form is a powerful tool in the fight against financial crimes. Its 5 key features – information on the suspicious activity, customer information, suspicious activity indicators, investigative information, and certification – provide FinCEN with the information it needs to identify and investigate potential terrorist financing and money laundering schemes.

Share Your Thoughts!

We invite you to share your thoughts and experiences with the SAWs 2A SAR form. Have you ever filed a SAR? What challenges have you faced? Share your comments below!

What is the purpose of the SAWs 2A SAR form?

+The SAWs 2A SAR form is used to report suspicious activity related to terrorist financing and money laundering.

Who is required to file a SAWs 2A SAR form?

+Financial institutions are required to file a SAWs 2A SAR form when they suspect a transaction may be related to terrorist financing or money laundering.

What information is required on the SAWs 2A SAR form?

+The SAWs 2A SAR form requires detailed information about the suspicious activity, including the date and time of the transaction, type of transaction, amount of the transaction, parties involved, and description of the suspicious activity.