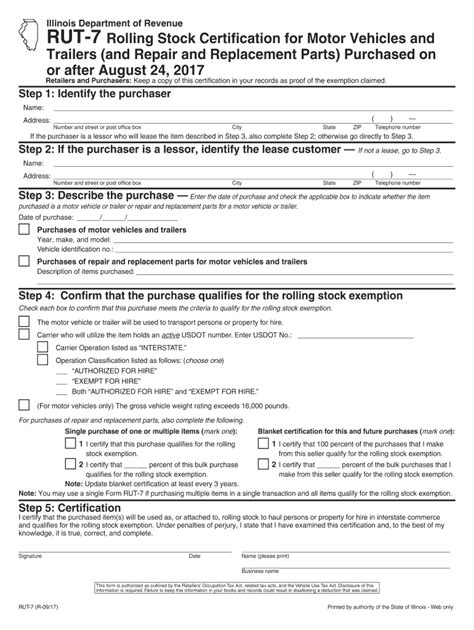

Filling out forms can be a daunting task, especially when it comes to tax-related documents. The RUT-7 form, specifically designed for the state of Illinois, is no exception. This form is used to report and remit sales tax, use tax, and other miscellaneous taxes to the Illinois Department of Revenue. In this article, we will guide you through the process of filling out the RUT-7 form Illinois with ease.

Understanding the RUT-7 Form Illinois

Before we dive into the tips, let's briefly discuss the purpose of the RUT-7 form. This form is used by businesses and individuals to report and remit various taxes to the state of Illinois. The form is typically filed on a monthly or quarterly basis, depending on the taxpayer's specific situation.

Who Needs to File the RUT-7 Form?

The RUT-7 form is required for businesses and individuals who:

- Collect sales tax on behalf of the state of Illinois

- Have a tax liability of $200 or more per month

- Are required to file a sales tax return, even if no tax is due

Tips to Fill Out the RUT-7 Form Illinois

Now that we've covered the basics, let's move on to the tips to help you fill out the RUT-7 form Illinois with ease.

1. Gather All Necessary Information

Before you start filling out the form, make sure you have all the necessary information and documents. This includes:

- Your business's Federal Employer Identification Number (FEIN)

- Your Illinois Department of Revenue account number

- Total sales tax collected for the reporting period

- Total use tax due for the reporting period

- Any other relevant tax information

2. Choose the Correct Filing Period

The RUT-7 form is typically filed on a monthly or quarterly basis. Make sure you choose the correct filing period to avoid any penalties or fines. The filing periods are as follows:

- Monthly: If your business has a tax liability of $200 or more per month

- Quarterly: If your business has a tax liability of less than $200 per month

3. Calculate Your Tax Liability

To calculate your tax liability, you'll need to determine the total amount of sales tax collected and use tax due for the reporting period. You can use the following formula to calculate your tax liability:

- Sales tax collected: Total sales x Sales tax rate

- Use tax due: Total purchases x Use tax rate

4. Complete the Form Accurately

Once you have all the necessary information and calculations, it's time to complete the form. Make sure to:

- Fill out the form in black ink

- Use a separate line for each type of tax

- Calculate the total tax liability correctly

- Sign and date the form

5. Submit the Form On Time

Finally, make sure to submit the form on time to avoid any penalties or fines. The due dates for the RUT-7 form are as follows:

- Monthly: The 20th day of the month following the reporting period

- Quarterly: The 20th day of the month following the reporting period

Additional Tips and Reminders

In addition to the tips above, here are a few more reminders to keep in mind:

- Make sure to keep accurate records of your tax filings and payments

- Use the correct tax rates and calculations to avoid any errors

- File for an extension if you're unable to meet the filing deadline

- Seek professional help if you're unsure about any part of the process

Conclusion: Filling Out the RUT-7 Form Illinois with Ease

Filling out the RUT-7 form Illinois can seem daunting, but with the right tips and information, it can be a breeze. By following the tips outlined in this article, you'll be able to accurately and efficiently complete the form and submit it on time. Remember to stay organized, calculate your tax liability correctly, and submit the form on time to avoid any penalties or fines.

What is the RUT-7 form used for?

+The RUT-7 form is used to report and remit sales tax, use tax, and other miscellaneous taxes to the Illinois Department of Revenue.

Who needs to file the RUT-7 form?

+The RUT-7 form is required for businesses and individuals who collect sales tax on behalf of the state of Illinois, have a tax liability of $200 or more per month, or are required to file a sales tax return, even if no tax is due.

How often do I need to file the RUT-7 form?

+The RUT-7 form is typically filed on a monthly or quarterly basis, depending on the taxpayer's specific situation.