In California, businesses are required to file various compliance documents to maintain their good standing and avoid penalties. One of the crucial documents is the Statement of Information (L1f form), also known as the California LLC Statement of Information. This document is filed with the California Secretary of State's office and provides essential information about the Limited Liability Company (LLC).

The L1f form is a critical document for California LLCs, as it helps the state keep track of the company's vital information, such as its name, address, and management structure. In this article, we will delve into the world of L1f form compliance, discussing its importance, requirements, and the steps to file it successfully.

What is the Purpose of the L1f Form?

The L1f form is a biennial report that California LLCs must file with the Secretary of State's office. The primary purpose of this document is to update the state's records with the company's current information, ensuring that the state has the most up-to-date details about the LLC.

Why is Filing the L1f Form Important?

Filing the L1f form is crucial for California LLCs to maintain their good standing with the state. Failure to file this document can result in penalties, fines, and even suspension of the company's license to operate. By filing the L1f form, LLCs can:

- Update their company information, such as their name, address, and management structure

- Maintain their good standing with the state

- Avoid penalties and fines for non-compliance

- Ensure compliance with California's business regulations

Who Needs to File the L1f Form?

All California LLCs, including domestic and foreign LLCs, must file the L1f form with the Secretary of State's office. This includes:

- Domestic LLCs: LLCs formed in California

- Foreign LLCs: LLCs formed outside of California but doing business in the state

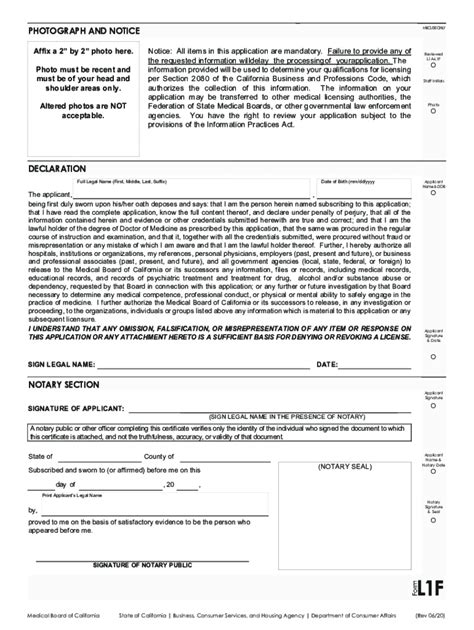

What Information is Required on the L1f Form?

The L1f form requires the following information:

- Company name and address

- Name and address of the registered agent

- Name and title of the chief executive officer (CEO) or manager

- Name and address of the LLC's members or managers

- Description of the LLC's business activities

- Additional information, such as the LLC's tax classification and its California tax ID number

How to File the L1f Form

Filing the L1f form can be done online or by mail. To file online, LLCs can use the California Secretary of State's online portal. To file by mail, LLCs can download the L1f form from the Secretary of State's website and submit it with the required fee.

Filing Fees and Deadlines

The filing fee for the L1f form is $25, and the deadline for filing is every two years, typically on the last day of the anniversary month of the LLC's formation. For example, if the LLC was formed on January 15, 2020, the L1f form would be due on January 31, 2022.

Penalties for Non-Compliance

Failure to file the L1f form can result in penalties, fines, and even suspension of the company's license to operate. The penalty for non-compliance is $250, and the LLC may also be subject to additional fees and fines.

Conclusion

In conclusion, filing the L1f form is an essential compliance requirement for California LLCs. By understanding the importance, requirements, and steps to file the L1f form, LLCs can maintain their good standing with the state and avoid penalties and fines for non-compliance. Remember to file the L1f form every two years, and ensure that the information provided is accurate and up-to-date.

Take Action

Don't wait until it's too late! File your L1f form today and ensure that your California LLC is in compliance with the state's regulations. If you have any questions or need assistance with filing the L1f form, contact us today.

FAQs

What is the L1f form?

+The L1f form, also known as the California LLC Statement of Information, is a biennial report that California LLCs must file with the Secretary of State's office.

Who needs to file the L1f form?

+All California LLCs, including domestic and foreign LLCs, must file the L1f form with the Secretary of State's office.

What is the filing fee for the L1f form?

+The filing fee for the L1f form is $25.