The importance of filing tax forms accurately and on time cannot be overstated. However, mistakes can happen, and when they do, it's crucial to correct them as soon as possible. The Form 941-X is used by employers to correct errors on their previously filed Form 941, Employer's Quarterly Federal Tax Return. If you need to file a Form 941-X without payment, you're probably wondering where to mail it. In this article, we'll guide you through the process, explain the importance of accuracy, and provide additional information to ensure you're in compliance with the IRS.

Where to Mail Form 941-X Without Payment

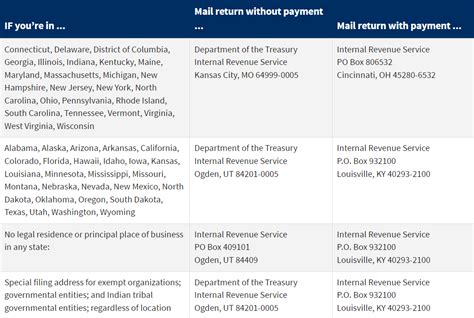

The IRS has specific mailing addresses for different types of tax forms, including the Form 941-X. To ensure your form is processed correctly, it's essential to use the correct address. The mailing address for Form 941-X without payment is:

Internal Revenue Service Department of the Treasury Cincinnati, OH 45999

However, if you're filing a Form 941-X with payment, you'll need to use a different address. It's crucial to check the IRS website or the instructions for Form 941-X to confirm the correct mailing address.

Why Accuracy Matters When Filing Form 941-X

Filing Form 941-X accurately is crucial to avoid delays, penalties, and interest on your tax debt. Here are some reasons why accuracy matters:

- Avoid penalties and interest: If you fail to report or pay taxes correctly, you may be subject to penalties and interest. Filing Form 941-X accurately can help you avoid these additional costs.

- Ensure compliance: Filing Form 941-X accurately ensures you're in compliance with IRS regulations. This can help you avoid audits, fines, and other consequences.

- Maintain a good reputation: Accurate filing can help maintain a good reputation with the IRS and other regulatory bodies.

Common Mistakes to Avoid When Filing Form 941-X

When filing Form 941-X, it's essential to avoid common mistakes that can delay processing or lead to penalties. Here are some mistakes to avoid:

- Incorrect employer identification number (EIN): Make sure to use the correct EIN on Form 941-X.

- Incorrect quarter and year: Ensure you're reporting the correct quarter and year on Form 941-X.

- Math errors: Double-check your math calculations to avoid errors.

- Incomplete information: Make sure to provide all required information on Form 941-X.

How to File Form 941-X Electronically

The IRS encourages employers to file Form 941-X electronically through the Electronic Federal Tax Payment System (EFTPS). Here are the steps to file Form 941-X electronically:

- Create an EFTPS account: If you don't already have an EFTPS account, create one on the IRS website.

- Log in to your EFTPS account: Log in to your EFTPS account and select "Make a Tax Payment."

- Select Form 941-X: Select Form 941-X as the tax form you want to file.

- Enter required information: Enter the required information, including your EIN, quarter and year, and corrected tax liability.

- Submit your payment: Submit your payment electronically through EFTPS.

Benefits of Filing Form 941-X Electronically

Filing Form 941-X electronically offers several benefits, including:

- Faster processing: Electronic filing is faster than mailing a paper form.

- Increased accuracy: Electronic filing reduces the risk of math errors and other mistakes.

- Convenience: Electronic filing is convenient and can be done from anywhere with an internet connection.

Additional Resources

If you need additional help with filing Form 941-X, here are some resources to consider:

- IRS website: The IRS website offers detailed instructions and FAQs on filing Form 941-X.

- IRS customer service: You can contact IRS customer service for assistance with filing Form 941-X.

- Tax professional: Consider hiring a tax professional to help with filing Form 941-X.

Conclusion

Filing Form 941-X accurately and on time is crucial to avoid delays, penalties, and interest on your tax debt. By following the instructions in this article, you can ensure you're filing Form 941-X correctly and avoiding common mistakes. Remember to use the correct mailing address, avoid math errors, and consider filing electronically for faster processing and increased accuracy.

What is the mailing address for Form 941-X without payment?

+The mailing address for Form 941-X without payment is:

Internal Revenue Service

Department of the Treasury

Cincinnati, OH 45999

Why is accuracy important when filing Form 941-X?

+Accuracy is important when filing Form 941-X to avoid delays, penalties, and interest on your tax debt. It also ensures compliance with IRS regulations and maintains a good reputation with the IRS and other regulatory bodies.

How do I file Form 941-X electronically?

+To file Form 941-X electronically, create an EFTPS account, log in, select "Make a Tax Payment," select Form 941-X, enter required information, and submit your payment electronically.