Are you tired of dealing with complex tax calculations and worrying about underpayment penalties? The Form 2210 Worksheet is here to simplify your tax underpayment calculation and help you avoid any unwanted surprises from the IRS. In this article, we'll break down the Form 2210 Worksheet, its importance, and provide a step-by-step guide on how to use it.

Why is the Form 2210 Worksheet important?

The Form 2210 Worksheet is a crucial tool for individuals and businesses to calculate their tax underpayment and avoid penalties. The IRS requires taxpayers to make estimated tax payments throughout the year if they expect to owe more than $1,000 in taxes. Failure to make these payments or underpaying taxes can result in penalties and interest.

What is the Form 2210 Worksheet?

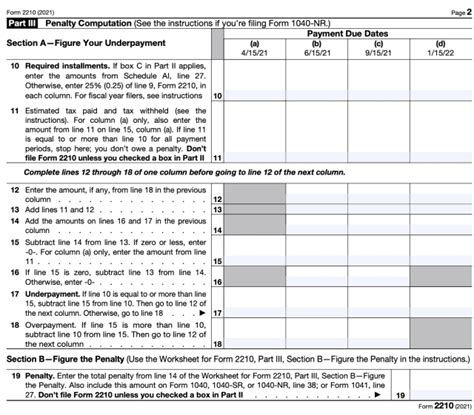

The Form 2210 Worksheet is a calculation tool provided by the IRS to help taxpayers determine their tax underpayment and calculate any penalties owed. The worksheet takes into account the taxpayer's income, deductions, and credits to calculate the total tax liability.

How to use the Form 2210 Worksheet

Using the Form 2210 Worksheet is a straightforward process. Here's a step-by-step guide:

Step 1: Gather necessary information

Before starting the worksheet, gather the necessary information, including:

- Your total tax liability from your tax return

- Your estimated tax payments made throughout the year

- Any credits or deductions that may affect your tax liability

Step 2: Calculate your total tax liability

Use your tax return to calculate your total tax liability. This includes any taxes owed, minus any credits or deductions.

Step 3: Calculate your estimated tax payments

Calculate the total estimated tax payments made throughout the year. This includes any quarterly payments or annual payments made.

Step 4: Calculate the underpayment

Subtract the estimated tax payments from the total tax liability to calculate the underpayment.

Step 5: Calculate the penalty

Use the underpayment amount to calculate the penalty owed. The penalty is calculated based on the number of days the underpayment was owed.

Benefits of using the Form 2210 Worksheet

Using the Form 2210 Worksheet provides several benefits, including:

- Accurate calculations: The worksheet ensures accurate calculations, reducing the risk of errors and penalties.

- Simplified process: The worksheet simplifies the calculation process, making it easier to understand and complete.

- Avoid penalties: By using the worksheet, taxpayers can avoid penalties and interest on underpaid taxes.

Common mistakes to avoid

When using the Form 2210 Worksheet, avoid the following common mistakes:

- Inaccurate information: Ensure all information is accurate and up-to-date to avoid errors.

- Missing payments: Make sure to include all estimated tax payments made throughout the year.

- Incorrect calculations: Double-check calculations to ensure accuracy.

Tips for reducing tax underpayment

To reduce tax underpayment, consider the following tips:

- Make timely payments: Make estimated tax payments on time to avoid penalties.

- Adjust withholding: Adjust withholding amounts to ensure accurate tax payments.

- Consult a tax professional: Consult a tax professional to ensure accurate calculations and avoid penalties.

Conclusion

The Form 2210 Worksheet is a valuable tool for taxpayers to simplify their tax underpayment calculation and avoid penalties. By following the steps outlined in this article and avoiding common mistakes, taxpayers can ensure accurate calculations and reduce their tax liability. Remember to consult a tax professional if you're unsure about any aspect of the worksheet or tax calculations.

What is the Form 2210 Worksheet?

+The Form 2210 Worksheet is a calculation tool provided by the IRS to help taxpayers determine their tax underpayment and calculate any penalties owed.

Why is the Form 2210 Worksheet important?

+The Form 2210 Worksheet is important because it helps taxpayers avoid penalties and interest on underpaid taxes by accurately calculating their tax underpayment.

How do I use the Form 2210 Worksheet?

+Using the Form 2210 Worksheet involves gathering necessary information, calculating your total tax liability, estimated tax payments, and underpayment, and calculating the penalty owed.