As a taxpayer, claiming the Earned Income Tax Credit (EITC) can be a significant relief, especially for low-to-moderate-income working individuals and families. However, to ensure a smooth and successful submission, it's essential to navigate the Form 886 EIC process with care. In this article, we'll delve into five valuable tips to help you avoid common pitfalls and maximize your EITC benefits.

Understanding Form 886 EIC

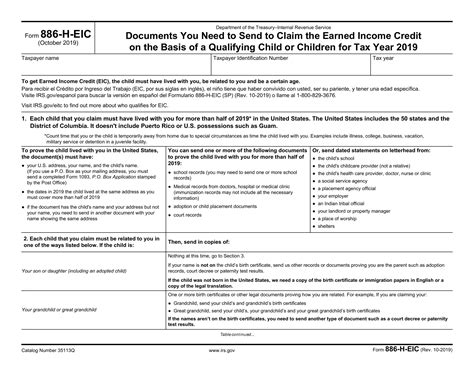

Before we dive into the tips, let's quickly review what Form 886 EIC is all about. Form 886 is a notice sent by the IRS to taxpayers who claim the EITC, requesting additional documentation to verify their eligibility. This form is usually sent when the IRS needs more information to process the tax return accurately.

Tip 1: Respond Promptly to the IRS Notice

When you receive Form 886, it's crucial to respond promptly to the IRS notice. The notice will specify the required documentation and the deadline for submission. Failing to respond on time may lead to a delay in processing your tax return, which can impact your EITC benefits.

Make sure to carefully review the notice and gather all the necessary documents, such as:

- Proof of income (e.g., W-2 forms, 1099 forms)

- Proof of identity (e.g., driver's license, passport)

- Proof of residency (e.g., utility bills, lease agreement)

- Dependent information (e.g., birth certificates, Social Security numbers)

Tip 2: Verify Your Eligibility

To avoid any potential issues, double-check your EITC eligibility before submitting Form 886. Ensure you meet the basic requirements, such as:

- Having a valid Social Security number

- Filing a tax return (even if you don't owe taxes)

- Meeting the income limits

- Being a U.S. citizen or resident alien

You can use the IRS's EITC Assistant tool to determine your eligibility and estimate your credit amount.

Tip 3: Provide Complete and Accurate Documentation

When submitting Form 886, it's essential to provide complete and accurate documentation to avoid any delays or issues. Make sure to:

- Use the correct form and attach all required documents

- Fill out the form accurately and completely

- Sign and date the form

Double-check that you've included all the necessary documentation, such as:

- Proof of income for all family members

- Dependent information, including birth certificates and Social Security numbers

- Proof of residency, such as utility bills or a lease agreement

Tip 4: Use the Correct Mailing Address

When submitting Form 886, ensure you use the correct mailing address specified on the notice. Using the wrong address may lead to delays or lost documentation.

If you're unsure about the mailing address, you can:

- Check the IRS notice for the correct address

- Visit the IRS website for the most up-to-date information

- Contact the IRS directly for assistance

Tip 5: Seek Professional Help if Needed

If you're unsure about the Form 886 EIC submission process or need help with the documentation, consider seeking professional assistance. A tax professional can:

- Review your documentation and ensure everything is accurate and complete

- Help you understand the EITC eligibility requirements

- Assist with the submission process and ensure timely delivery

Don't hesitate to reach out to a tax professional if you need guidance or support.

Take Action

By following these five tips, you can ensure a smooth and successful Form 886 EIC submission. Remember to respond promptly, verify your eligibility, provide complete and accurate documentation, use the correct mailing address, and seek professional help if needed.

If you have any questions or concerns about Form 886 EIC or the EITC submission process, please don't hesitate to comment below. Share this article with friends and family who may benefit from this information.

What is Form 886 EIC?

+Form 886 is a notice sent by the IRS to taxpayers who claim the EITC, requesting additional documentation to verify their eligibility.

How do I respond to Form 886 EIC?

+Respond promptly to the IRS notice by gathering the required documentation and submitting it to the IRS by the specified deadline.

What documentation do I need to provide for Form 886 EIC?

+You'll need to provide proof of income, identity, residency, and dependent information, as specified on the notice.