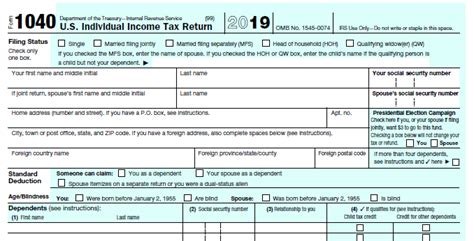

The 2019 IRS 1040 form is a crucial document for individuals to report their income and claim deductions and credits to the Internal Revenue Service (IRS). The form has undergone significant changes in recent years, making it essential for taxpayers to understand the new layout and requirements. In this article, we will provide a simplified tax filing guide for the 2019 IRS 1040 form, helping you navigate the process with ease.

Understanding the 2019 IRS 1040 Form Changes

The 2019 IRS 1040 form has been redesigned to be more concise and easier to read. The new form is divided into three main sections: income, deductions and credits, and additional taxes and payments. The form also includes six new schedules, which are used to report specific types of income, deductions, and credits.

Section 1: Income

The first section of the 2019 IRS 1040 form is dedicated to reporting your income. This includes:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income and expenses

- Farm income and expenses

You will need to report all sources of income, including employment income, investment income, and self-employment income.

Section 2: Deductions and Credits

The second section of the 2019 IRS 1040 form is dedicated to reporting your deductions and credits. This includes:

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable contributions

- Medical expenses

- Child tax credit

You will need to report all eligible deductions and credits to reduce your taxable income.

Section 3: Additional Taxes and Payments

The third section of the 2019 IRS 1040 form is dedicated to reporting additional taxes and payments. This includes:

- Self-employment tax

- Alternative minimum tax

- Net investment income tax

- Payments made towards your tax bill

You will need to report any additional taxes owed or payments made towards your tax bill.

Schedules and Supporting Forms

The 2019 IRS 1040 form includes six new schedules, which are used to report specific types of income, deductions, and credits. These schedules include:

- Schedule 1: Additional income and adjustments to income

- Schedule 2: Tax

- Schedule 3: Non-refundable credits

- Schedule 4: Other taxes

- Schedule 5: Other payments and refundable credits

- Schedule 6: Foreign address and third-party designee

You may also need to complete additional forms, such as Form 8949 for capital gains and losses or Form 8962 for the premium tax credit.

Filing Status and Dependents

Your filing status and dependents will affect your tax bill. You will need to report your filing status and dependents on the 2019 IRS 1040 form. This includes:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You may also be eligible to claim dependents, such as children or elderly parents.

Signature and Verification

Once you have completed the 2019 IRS 1040 form, you will need to sign and date it. You will also need to verify your identity and provide your social security number or individual taxpayer identification number.

Additional Resources

If you need additional help with the 2019 IRS 1040 form, you can:

- Visit the IRS website at irs.gov

- Contact the IRS by phone at 1-800-829-1040

- Visit a local IRS office

- Consult with a tax professional

Remember to file your tax return by the deadline to avoid penalties and interest.

Conclusion

Filing your tax return can be a daunting task, but with the right guidance, you can navigate the process with ease. The 2019 IRS 1040 form is a crucial document for individuals to report their income and claim deductions and credits. By understanding the changes to the form and following the simplified tax filing guide, you can ensure a smooth and accurate tax filing experience.

What's Next?

Take the first step towards a hassle-free tax filing experience. Review the 2019 IRS 1040 form and schedules, gather your supporting documents, and start filing your tax return today. Don't forget to share this article with friends and family who may need help with their tax return.

FAQ Section

What is the deadline for filing the 2019 IRS 1040 form?

+The deadline for filing the 2019 IRS 1040 form is April 15, 2020.

Can I file the 2019 IRS 1040 form electronically?

+Yes, you can file the 2019 IRS 1040 form electronically using the IRS e-file system.

What is the standard deduction for the 2019 tax year?

+The standard deduction for the 2019 tax year is $12,200 for single filers and $24,400 for married filing jointly.