As a lender, financial institution, or investor, you've likely encountered the 4506-C form, also known as the "IVS (Income Verification Services) Request for Transcript of Tax Return." This form is a crucial tool for verifying an individual's or business's income and tax compliance. In this article, we'll delve into the world of the 4506-C form, exploring its purpose, benefits, and essential things to know.

Unlocking the Power of the 4506-C Form

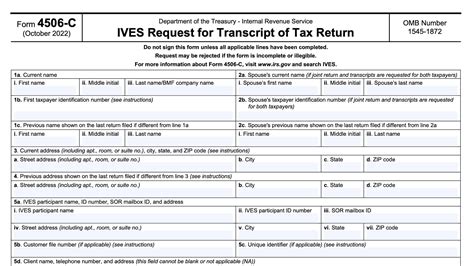

The 4506-C form is a standardized document issued by the Internal Revenue Service (IRS) that allows lenders, financial institutions, and investors to request transcripts of tax returns for borrowers or potential borrowers. This form is typically used to verify income, employment, and tax compliance, which are essential factors in determining creditworthiness.

Why is the 4506-C form important? For lenders and financial institutions, verifying income and tax compliance is crucial in minimizing risk and ensuring compliance with regulatory requirements. By using the 4506-C form, lenders can obtain accurate and reliable information about a borrower's income and tax history, enabling them to make informed lending decisions.

The Benefits of Using the 4506-C Form

Using the 4506-C form offers several benefits for lenders, financial institutions, and investors. Some of the key advantages include:

- Improved accuracy: The 4506-C form provides access to accurate and reliable information about a borrower's income and tax history, reducing the risk of errors or misrepresentation.

- Enhanced compliance: By using the 4506-C form, lenders can ensure compliance with regulatory requirements, such as the Dodd-Frank Act and the Fair Credit Reporting Act.

- Increased efficiency: The 4506-C form streamlines the income verification process, reducing the need for manual documentation and minimizing the risk of human error.

- Better risk management: By verifying income and tax compliance, lenders can better assess creditworthiness and manage risk, leading to more informed lending decisions.

5 Essential Things to Know About the 4506-C Form

Now that we've explored the benefits of using the 4506-C form, let's dive into the essential things to know about this critical document.

1. What is the Purpose of the 4506-C Form?

The primary purpose of the 4506-C form is to request transcripts of tax returns from the IRS. This form is used to verify income, employment, and tax compliance, which are essential factors in determining creditworthiness.

2. Who Can Use the 4506-C Form?

The 4506-C form can be used by lenders, financial institutions, and investors to verify income and tax compliance for borrowers or potential borrowers. This includes:

- Banks and credit unions

- Mortgage lenders

- Auto lenders

- Student loan lenders

- Investors

3. What Information is Required on the 4506-C Form?

To complete the 4506-C form, you'll need to provide the following information:

- Borrower's name and Social Security number or Employer Identification Number (EIN)

- Tax year(s) for which transcripts are being requested

- Type of transcript requested (e.g., individual, business, or both)

- Purpose of the request (e.g., income verification, loan application)

4. How Do I Submit the 4506-C Form?

The 4506-C form can be submitted to the IRS through various channels, including:

- Mail: Submit the completed form to the IRS address listed on the form.

- Fax: Fax the completed form to the IRS fax number listed on the form.

- Online: Submit the completed form through the IRS Online Account or the IRS Taxpayer Assistance Center.

5. What are the Fees Associated with the 4506-C Form?

There are no fees associated with submitting the 4506-C form. However, lenders and financial institutions may charge borrowers a fee for obtaining transcripts of tax returns.

Best Practices for Using the 4506-C Form

To ensure accurate and efficient use of the 4506-C form, follow these best practices:

- Verify borrower information: Ensure that borrower information, including name and Social Security number or EIN, is accurate and complete.

- Use the correct form: Use the latest version of the 4506-C form, which can be obtained from the IRS website.

- Submit the form correctly: Submit the completed form through the correct channel, such as mail, fax, or online.

- Keep records: Maintain accurate records of the 4506-C form submission, including the date and time of submission.

Common Challenges and Solutions

Despite its importance, the 4506-C form can be challenging to use. Some common challenges and solutions include:

- Incorrect or incomplete information: Verify borrower information and use the correct form to avoid errors.

- Delayed or lost transcripts: Submit the form correctly and follow up with the IRS to ensure timely receipt of transcripts.

- Compliance issues: Ensure compliance with regulatory requirements by using the 4506-C form and verifying income and tax compliance.

Conclusion: Unlocking the Power of the 4506-C Form

In conclusion, the 4506-C form is a powerful tool for verifying income and tax compliance. By understanding the benefits, essential things to know, and best practices for using this form, lenders, financial institutions, and investors can unlock its power and make more informed lending decisions.

We invite you to share your experiences and insights about using the 4506-C form. Have you encountered any challenges or successes with this form? Share your thoughts in the comments below!

What is the purpose of the 4506-C form?

+The primary purpose of the 4506-C form is to request transcripts of tax returns from the IRS to verify income, employment, and tax compliance.

Who can use the 4506-C form?

+The 4506-C form can be used by lenders, financial institutions, and investors to verify income and tax compliance for borrowers or potential borrowers.

What information is required on the 4506-C form?

+To complete the 4506-C form, you'll need to provide borrower information, tax year(s) for which transcripts are being requested, type of transcript requested, and purpose of the request.