The Illinois use tax is a type of tax that is levied on the use, consumption, or storage of tangible personal property within the state of Illinois. However, there are certain situations where individuals or businesses may be exempt from paying this tax. One way to claim this exemption is by using the ST-556 form. In this article, we will explain what the ST-556 form is, how to use it, and the benefits of claiming an exemption from Illinois use tax.

What is the ST-556 Form?

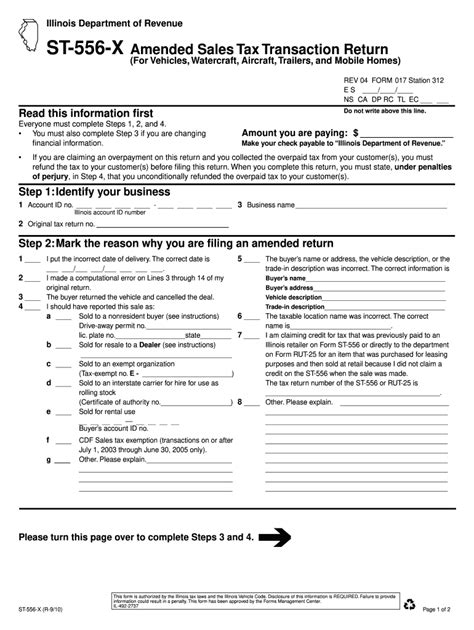

The ST-556 form, also known as the "Certificate of Exemption from Illinois Use Tax," is a document that allows individuals or businesses to claim an exemption from paying Illinois use tax on certain purchases. The form is used to certify that the property being purchased will be used in a manner that is exempt from use tax under Illinois law.

Why Do I Need the ST-556 Form?

The ST-556 form is necessary for individuals or businesses that make purchases that are exempt from Illinois use tax. Without this form, the seller may be required to charge use tax on the purchase, even if it is exempt. By providing the ST-556 form, the buyer can ensure that they are not charged use tax on their purchase.

How Do I Fill Out the ST-556 Form?

To fill out the ST-556 form, you will need to provide certain information, including:

- Your name and address

- The name and address of the seller

- A description of the property being purchased

- The reason for the exemption (e.g. resale, manufacturing, etc.)

You will also need to sign the form and date it.

Benefits of Using the ST-556 Form

Using the ST-556 form can provide several benefits, including:

- Saving money on use tax: By claiming an exemption, you can avoid paying use tax on your purchases.

- Simplifying tax compliance: The ST-556 form can help to simplify tax compliance by providing a clear and concise way to claim an exemption.

- Reducing administrative burdens: By using the ST-556 form, you can reduce the administrative burdens associated with claiming an exemption.

Common Exemptions from Illinois Use Tax

There are several common exemptions from Illinois use tax, including:

- Resale exemption: This exemption applies to purchases made for resale, such as by retailers or wholesalers.

- Manufacturing exemption: This exemption applies to purchases made for use in manufacturing, such as raw materials or equipment.

- Agricultural exemption: This exemption applies to purchases made for use in agriculture, such as farm equipment or supplies.

How to Qualify for an Exemption

To qualify for an exemption from Illinois use tax, you will need to meet certain requirements, such as:

- Purchasing property for resale, manufacturing, or agricultural use

- Providing the ST-556 form to the seller

- Maintaining records to support the exemption

Record Keeping Requirements

To claim an exemption from Illinois use tax, you will need to maintain certain records, including:

- A copy of the ST-556 form

- Records of the purchase, including the invoice or receipt

- Records of the use of the property, such as sales records or production records

Common Mistakes to Avoid

When using the ST-556 form, there are several common mistakes to avoid, including:

- Failing to provide the form to the seller

- Failing to maintain records to support the exemption

- Claiming an exemption that does not apply to the purchase

Conclusion

In conclusion, the ST-556 form is an important document that allows individuals or businesses to claim an exemption from Illinois use tax. By understanding how to use the form and the benefits of claiming an exemption, you can save money on use tax and simplify tax compliance.

We hope this article has been helpful in explaining the ST-556 form and the process of claiming an exemption from Illinois use tax. If you have any further questions or would like to learn more, please don't hesitate to contact us.

Additional Resources

For more information on the ST-556 form and Illinois use tax exemptions, please visit the Illinois Department of Revenue website. You can also contact a tax professional or attorney for guidance on claiming an exemption.

Frequently Asked Questions

What is the ST-556 form used for?

+The ST-556 form is used to claim an exemption from Illinois use tax on certain purchases.

How do I fill out the ST-556 form?

+To fill out the ST-556 form, you will need to provide certain information, including your name and address, the name and address of the seller, a description of the property being purchased, and the reason for the exemption.

What are some common exemptions from Illinois use tax?

+Some common exemptions from Illinois use tax include the resale exemption, manufacturing exemption, and agricultural exemption.

We hope this article has been helpful in explaining the ST-556 form and the process of claiming an exemption from Illinois use tax. If you have any further questions or would like to learn more, please don't hesitate to contact us.