Understanding tax forms is a crucial part of managing one's financial obligations to the state and federal governments. Among the numerous tax forms that individuals and businesses must navigate, Form FTB 3895 holds a special place for California residents. This form is specifically used for reporting pass-through entity (PTE) annual tax, which can be a bit complex. Here's an overview of three essential facts about Form FTB 3895 that you should know.

The Importance of Accurate Tax Reporting

Accurate and timely tax reporting is vital for any entity operating in California. Pass-through entities, such as partnerships, limited liability companies (LLCs), and S corporations, distribute their income, deductions, and credits to their owners or members. These entities must file an annual tax return with the state of California, detailing this information. The process can be intricate, involving various schedules and forms, including Form FTB 3895.

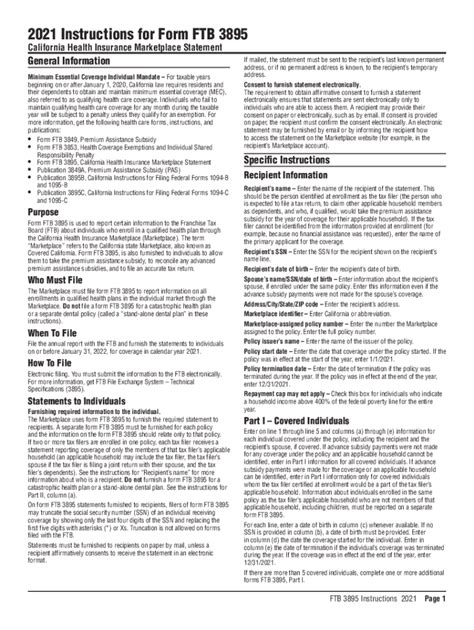

What is Form FTB 3895?

Form FTB 3895 is specifically designed for pass-through entities to report their annual tax. This form is crucial for ensuring that PTEs comply with California's tax laws and regulations. It provides the necessary details for the state to assess the tax liabilities of these entities accurately.

Key Components of Form FTB 3895

- Entity Information: The form requires basic information about the pass-through entity, including its name, address, and tax identification number.

- Tax Computation: This section involves calculating the entity's tax liability, taking into account income, deductions, credits, and any applicable tax rates.

- Schedules and Attachments: Depending on the nature of the PTE and its activities, various schedules and attachments may be required. These provide additional information on income, deductions, and credits.

Who Needs to File Form FTB 3895?

Pass-through entities operating in California are generally required to file Form FTB 3895 annually. This includes:

- Partnerships: General and limited partnerships, as well as limited liability partnerships (LLPs), must file this form.

- Limited Liability Companies (LLCs): LLCs classified as partnerships or S corporations for federal tax purposes are required to file Form FTB 3895.

- S Corporations: These entities must also file this form, reporting their pass-through income, deductions, and credits.

Special Considerations

- Due Date: The due date for filing Form FTB 3895 typically aligns with the federal tax filing deadline for pass-through entities, which is usually March 15th for partnerships and S corporations.

- Penalties: Failure to file or late filing may result in penalties and interest on the unpaid tax amount.

- Electronic Filing: California encourages electronic filing for efficiency and faster processing. Entities can use the California Franchise Tax Board's (FTB) e-file system or tax preparation software that supports FTB e-file.

Benefits of Accurate and Timely Filing of Form FTB 3895

Accurately and timely filing Form FTB 3895 offers several benefits, including:

- Avoidance of Penalties: Filing on time avoids late filing penalties and interest.

- Accurate Tax Reporting: Ensures that the entity's tax liabilities are accurately reported, reducing the risk of audits and disputes.

- Compliance with State Laws: Demonstrates compliance with California's tax laws and regulations, maintaining a positive standing with the state.

Practical Tips for Filing Form FTB 3895

- Seek Professional Help: If you're unsure about any part of the filing process, consider consulting a tax professional or accountant experienced in California tax law.

- Double-Check Information: Ensure all information is accurate and complete before submitting the form.

- Maintain Records: Keep detailed records of the filing process and supporting documentation for future reference.

Accurate and timely filing of Form FTB 3895 is a critical aspect of tax compliance for pass-through entities in California. Understanding the intricacies of this form and its requirements can help entities navigate the complex world of state taxation, ensuring they remain in good standing with the California Franchise Tax Board.

What is the purpose of Form FTB 3895?

+Form FTB 3895 is used by pass-through entities in California to report their annual tax. It provides necessary details for the state to assess tax liabilities accurately.

Who is required to file Form FTB 3895?

+Pass-through entities operating in California, including partnerships, LLCs classified as partnerships or S corporations, and S corporations, are required to file Form FTB 3895 annually.

What is the due date for filing Form FTB 3895?

+The due date for filing Form FTB 3895 typically aligns with the federal tax filing deadline for pass-through entities, which is usually March 15th.