The 1098-T form is a crucial document for students and families who are navigating the world of higher education taxes. As a student at the University of Texas at San Antonio (UTSA), it's essential to understand the ins and outs of this form to maximize your tax benefits. In this article, we'll delve into the 5 key things you need to know about your 1098-T form at UTSA.

What is the 1098-T Form?

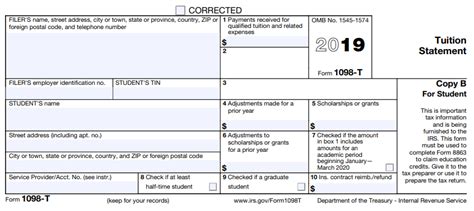

What Information is Reported on the 1098-T Form?

- Student's name, address, and taxpayer identification number (TIN)

- Institution's name, address, and employer identification number (EIN)

- Academic period for which the form is being issued

- Amounts billed for qualified tuition and related expenses

- Amounts paid for qualified tuition and related expenses

- Scholarships and grants received

- Adjustments to prior year's qualified tuition and related expenses

Why is the 1098-T Form Important?

The 1098-T form is essential for students and families who want to claim tax credits or deductions for education expenses. The form provides the necessary information to complete tax forms, such as the Form 8863 (Education Credits) or the Form 8917 (Tuition and Fees Deduction). By claiming these tax credits or deductions, students and families can reduce their tax liability and increase their refund.How to Read and Understand Your 1098-T Form

- Box 1: Payments received for qualified tuition and related expenses

- Box 2: Amounts billed for qualified tuition and related expenses

- Box 3: Check if the institution changed its reporting method

- Box 4: Adjustments made to prior year's qualified tuition and related expenses

- Box 5: Scholarships and grants received

- Box 6: Adjustments to prior year's scholarships and grants

- Box 7: Check if the amount in box 1 or 2 includes amounts for an academic period beginning in the next tax year

- Box 8: Check if the student is at least half-time

- Box 9: Check if the student is a graduate student

What to Do if You Receive an Incorrect 1098-T Form

Additional Tips and Reminders

- Keep your 1098-T form with your tax documents, as you'll need it to complete your tax return.

- Make sure to review your 1098-T form carefully for any errors or discrepancies.

- If you have any questions or concerns about your 1098-T form, contact the UTSA Bursar's Office for assistance.

- Don't forget to claim your tax credits or deductions for education expenses on your tax return.

By understanding your 1098-T form, you can take advantage of tax credits and deductions that can help reduce your tax liability and increase your refund. Remember to review your form carefully, and don't hesitate to reach out to the UTSA Bursar's Office if you have any questions or concerns.

We hope this article has provided you with valuable insights into the 1098-T form and its importance for students at UTSA. If you have any further questions or topics you'd like to discuss, please leave a comment below.

What is the deadline for receiving the 1098-T form?

+The deadline for receiving the 1098-T form is January 31st of each year.

Who is eligible to receive the 1098-T form?

+Students who have paid qualified tuition and related expenses during the tax year are eligible to receive the 1098-T form.

What if I receive an incorrect 1098-T form?

+If you receive an incorrect 1098-T form, contact the UTSA Bursar's Office immediately to resolve any discrepancies.