As a taxpayer, facing an unexpected tax bill can be overwhelming, especially if you're not entirely responsible for the debt. The Internal Revenue Service (IRS) offers a way out for individuals who are being held jointly liable for taxes they didn't owe or can't pay. Form CT-8822, Application for Relief from Joint Liability, is the key to seeking relief from this financial burden. In this article, we'll delve into the world of joint liability, the benefits of filing Form CT-8822, and provide a step-by-step guide on how to complete this application.

Understanding Joint Liability

When you file a joint tax return with your spouse, you're both equally responsible for the tax debt, even if only one of you earned the income. This is known as joint and several liability. The IRS can collect the full amount of the tax debt from either spouse, regardless of who earned the income or who's responsible for the debt. This can lead to financial difficulties and even damage your credit score.

The Benefits of Filing Form CT-8822

Form CT-8822 is designed to provide relief from joint liability for taxpayers who meet specific criteria. By filing this application, you may be eligible for:

- Innocent Spouse Relief: If you can prove that your spouse or former spouse is solely responsible for the tax debt, you may be eligible for innocent spouse relief.

- Separation of Liability Relief: If you're separated or divorced, you may be able to allocate the tax debt between you and your former spouse.

- Equitable Relief: If you don't qualify for innocent spouse relief or separation of liability relief, you may still be eligible for equitable relief.

Eligibility Criteria for Form CT-8822

To be eligible for relief from joint liability, you must meet one of the following conditions:

- You're an innocent spouse who didn't know about the tax debt or didn't benefit from the tax debt.

- You're separated or divorced and can allocate the tax debt between you and your former spouse.

- You're eligible for equitable relief, which considers factors such as economic hardship, lack of knowledge, and lack of benefit.

How to Complete Form CT-8822

Completing Form CT-8822 requires careful attention to detail and accurate documentation. Here's a step-by-step guide to help you navigate the application process:

- Determine Your Eligibility: Review the eligibility criteria and ensure you meet one of the conditions for relief from joint liability.

- Gather Required Documents: Collect all necessary documents, including:

- Joint tax returns (Forms 1040) for the tax years in question.

- Proof of separation or divorce (if applicable).

- Proof of income and expenses (if applicable).

- Any other relevant documentation to support your claim.

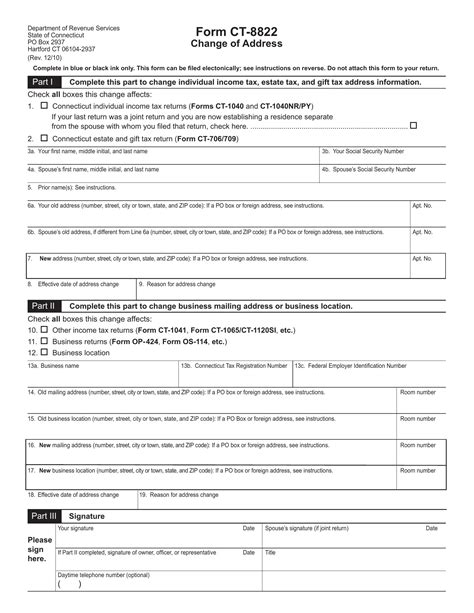

- Complete Form CT-8822: Fill out Form CT-8822, which includes:

- Your personal and contact information.

- Information about your spouse or former spouse.

- Details about the tax debt and the tax years in question.

- Your eligibility criteria and supporting documentation.

- Submit Form CT-8822: Mail or fax Form CT-8822 to the IRS address or fax number listed in the instructions.

Tips and Reminders

- Act Promptly: Don't delay in submitting Form CT-8822, as the IRS has a limited time frame to process your application.

- Seek Professional Help: If you're unsure about the application process or need help with documentation, consider consulting a tax professional or attorney.

- Keep Accurate Records: Maintain accurate records of your application, including receipts and documentation, in case of an audit or follow-up.

Additional Resources

For more information on Form CT-8822 and relief from joint liability, visit the IRS website or consult the following resources:

- IRS Publication 971 (Innocent Spouse Relief)

- IRS Form CT-8822 Instructions

- IRS Taxpayer Advocate Service (TAS)

Common Mistakes to Avoid When Filing Form CT-8822

When filing Form CT-8822, it's essential to avoid common mistakes that can delay or deny your application. Here are some mistakes to watch out for:

- Incomplete or Inaccurate Information: Ensure you provide complete and accurate information on Form CT-8822, including your personal and contact information, tax debt details, and supporting documentation.

- Insufficient Documentation: Failing to provide sufficient documentation to support your claim can result in a denied application.

- Missing Deadlines: Don't miss the deadline for submitting Form CT-8822, as this can impact the processing of your application.

Consequences of Not Filing Form CT-8822

If you're held jointly liable for a tax debt and fail to file Form CT-8822, you may face:

- Financial Hardship: You may be responsible for paying the full amount of the tax debt, even if you're not entirely responsible.

- Damage to Credit Score: Unpaid tax debt can damage your credit score, making it harder to obtain credit or loans in the future.

- Collection Actions: The IRS may take collection actions, such as wage garnishment or bank levies, to collect the tax debt.

Conclusion

Filing Form CT-8822 can provide relief from joint liability and help you avoid financial hardship. By understanding the eligibility criteria, gathering required documents, and completing the application accurately, you can increase your chances of a successful outcome. Remember to act promptly, seek professional help if needed, and maintain accurate records to ensure a smooth application process.

FAQ Section

What is joint liability?

+Joint liability occurs when you file a joint tax return with your spouse, and you're both equally responsible for the tax debt.

What are the eligibility criteria for Form CT-8822?

+To be eligible for relief from joint liability, you must meet one of the following conditions: innocent spouse relief, separation of liability relief, or equitable relief.

How long does it take to process Form CT-8822?

+The processing time for Form CT-8822 varies, but it can take several months to a year or more for the IRS to review and respond to your application.