Understanding the 32BJ 401(k) Plan

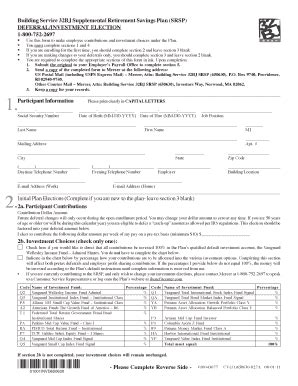

The 32BJ 401(k) plan is a retirement savings plan designed for members of the Service Employees International Union (SEIU) Local 32BJ. The plan allows participants to save a portion of their income on a tax-deferred basis, helping them build a secure financial future. If you're a 32BJ member, completing the 32BJ 401k form is a crucial step in enrolling in the plan and starting to save for retirement. In this article, we'll guide you through the process of completing the form in five easy steps.

Step 1: Gathering Required Information

Before starting the enrollment process, you'll need to gather some personal and financial information. This includes:

- Your social security number or tax identification number

- Your date of birth

- Your address and contact information

- Your employment information, including your employer's name and address

- Your annual income and desired contribution amount

Having this information readily available will make the enrollment process smoother and faster.

Why is this information necessary?

The information gathered in this step is necessary to verify your identity, ensure accurate plan administration, and facilitate compliance with relevant tax laws and regulations.

Step 2: Choosing Your Investment Options

The 32BJ 401(k) plan offers a range of investment options, including various mutual funds and a target-date fund. You'll need to choose how you want to allocate your contributions among these options. Consider factors such as your risk tolerance, investment goals, and time horizon when making your selection.

- Review the plan's investment menu and fund descriptions

- Consider consulting with a financial advisor or using online investment tools to help with your decision

- Allocate your contributions among the available investment options

Tips for selecting investment options:

- Diversify your portfolio by spreading your contributions across multiple asset classes

- Consider your overall financial situation and goals when selecting investment options

- Take advantage of any available investment education resources or guidance

Step 3: Determining Your Contribution Amount

You'll need to decide how much you want to contribute to the plan each pay period. Contributions can be made on a pre-tax or Roth after-tax basis. Consider your budget, financial goals, and the plan's contribution limits when determining your contribution amount.

- Review the plan's contribution limits and guidelines

- Calculate your desired contribution amount based on your income and expenses

- Choose your contribution frequency (e.g., biweekly, monthly)

Contribution amount tips:

- Contribute at least enough to take full advantage of any employer matching contributions

- Consider increasing your contribution amount over time as your income grows

- Review and adjust your contribution amount regularly to ensure it aligns with your financial goals

Step 4: Completing the Enrollment Form

Now that you've gathered the necessary information, chosen your investment options, and determined your contribution amount, it's time to complete the enrollment form. You can typically find the form on the plan's website or by contacting the plan administrator.

- Fill out the form accurately and completely

- Review the form carefully before submitting it

- Submit the form according to the plan's instructions (e.g., online, mail, fax)

Form completion tips:

- Double-check your information for accuracy

- Make sure to sign and date the form

- Keep a copy of the completed form for your records

Step 5: Reviewing and Updating Your Account

After completing the enrollment form, it's essential to review and update your account information regularly. This ensures that your account remains accurate and aligned with your changing financial goals.

- Log in to your online account regularly to review your balance and investment options

- Update your account information as needed (e.g., change of address, beneficiary updates)

- Take advantage of any available plan resources or guidance to help manage your account

Account review tips:

- Regularly review your account statements and investment performance

- Consider consulting with a financial advisor to optimize your investment strategy

- Keep your account information up to date to ensure accurate plan administration

By following these five easy steps, you can complete the 32BJ 401k form and start saving for a secure financial future.

Now, take a moment to share your thoughts on the 32BJ 401(k) plan and the enrollment process. Have any questions or concerns about completing the form? Share your experiences and tips in the comments below!

What is the deadline for enrolling in the 32BJ 401(k) plan?

+The enrollment deadline varies depending on your employer and the plan's guidelines. Typically, you can enroll in the plan during your initial eligibility period or during annual open enrollment periods. Contact the plan administrator for specific details.

Can I change my investment options or contribution amount after enrolling in the plan?

+Yes, you can change your investment options or contribution amount at any time. Simply log in to your online account or contact the plan administrator to make the necessary changes.

Is the 32BJ 401(k) plan portable if I change employers?

+The 32BJ 401(k) plan is generally portable, meaning you can take your account balance with you if you change employers. However, some plan provisions may vary depending on your new employer's plan. Contact the plan administrator for specific details.