As a contractor or subcontractor in the construction industry, you understand the importance of accurate and timely billing to ensure smooth project cash flow. One crucial aspect of billing is retaining, which can be a challenge, especially when working with AIA forms. In this article, we will explore the five ways to bill retainage on AIA Form G703, helping you navigate the complexities of retainage billing.

Understanding Retainage and AIA Form G703

Before diving into the methods of billing retainage, it's essential to understand the concepts of retainage and AIA Form G703. Retainage refers to the practice of withholding a portion of the payment due to a contractor or subcontractor until the project is complete or a milestone is reached. This practice helps ensure that the contractor completes the project as agreed upon.

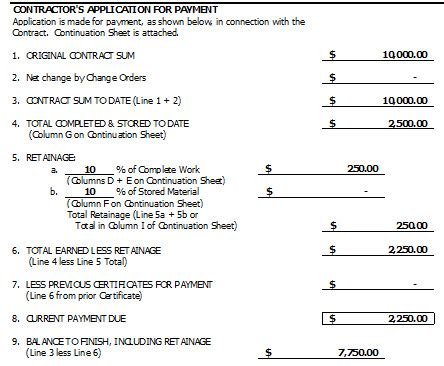

AIA Form G703, also known as the Continuation Sheet, is a document used in conjunction with AIA Form G702, the Application and Certificate for Payment. The G703 form provides a detailed breakdown of the work completed, including the percentage of completion and the amount of retainage.

Method 1: Billing Retainage as a Separate Line Item

One common method of billing retainage on AIA Form G703 is to include it as a separate line item. This approach requires you to clearly indicate the amount of retainage being withheld and provide a detailed explanation of the calculation.

Step-by-Step Instructions:

- Complete the G703 form, ensuring that all relevant project information is accurate.

- Include a separate line item for retainage, clearly labeling it as such.

- Calculate the amount of retainage based on the percentage agreed upon in the contract.

- Provide a detailed explanation of the retainage calculation, including the percentage and amount.

Example:

| Line Item | Description | Amount |

|---|---|---|

| 1 | Work Completed | $100,000 |

| 2 | Retainage (10%) | -$10,000 |

Method 2: Billing Retainage as a Reduction in Payment

Another method of billing retainage is to reduce the payment amount by the retainage percentage. This approach requires you to calculate the payment amount minus the retainage and provide a clear explanation of the calculation.

Step-by-Step Instructions:

- Calculate the payment amount due based on the work completed.

- Determine the retainage percentage agreed upon in the contract.

- Reduce the payment amount by the retainage percentage.

- Provide a detailed explanation of the retainage calculation, including the percentage and amount.

Example:

| Payment Amount | Retainage Percentage | Reduced Payment Amount |

|---|---|---|

| $100,000 | 10% | $90,000 |

Method 3: Billing Retainage as a Separate Payment Application

You can also bill retainage as a separate payment application, using a separate G703 form for the retainage amount. This approach requires you to complete a separate form for the retainage, clearly indicating the amount and calculation.

Step-by-Step Instructions:

- Complete a separate G703 form for the retainage amount.

- Clearly indicate the amount of retainage being withheld.

- Provide a detailed explanation of the retainage calculation, including the percentage and amount.

- Submit the separate retainage payment application with the original payment application.

Example:

G703 Form - Retainage Payment Application

| Line Item | Description | Amount |

|---|---|---|

| 1 | Retainage (10%) | $10,000 |

Method 4: Billing Retainage as a Percentage of the Total Payment

Another method of billing retainage is to bill it as a percentage of the total payment. This approach requires you to calculate the retainage amount based on the total payment and provide a clear explanation of the calculation.

Step-by-Step Instructions:

- Calculate the total payment amount due.

- Determine the retainage percentage agreed upon in the contract.

- Calculate the retainage amount based on the total payment.

- Provide a detailed explanation of the retainage calculation, including the percentage and amount.

Example:

| Total Payment Amount | Retainage Percentage | Retainage Amount |

|---|---|---|

| $100,000 | 10% | $10,000 |

Method 5: Billing Retainage as a Lump Sum Payment

The final method of billing retainage is to bill it as a lump sum payment. This approach requires you to calculate the total retainage amount due and provide a clear explanation of the calculation.

Step-by-Step Instructions:

- Calculate the total retainage amount due based on the contract agreement.

- Clearly indicate the lump sum payment amount.

- Provide a detailed explanation of the retainage calculation, including the percentage and amount.

Example:

| Retainage Lump Sum Payment | Amount |

|---|---|

| Total Retainage | $10,000 |

Best Practices for Billing Retainage on AIA Form G703

To ensure accurate and timely billing, follow these best practices when billing retainage on AIA Form G703:

- Clearly indicate the amount of retainage being withheld.

- Provide a detailed explanation of the retainage calculation, including the percentage and amount.

- Use a separate line item or payment application for retainage, if required.

- Ensure that the retainage percentage is accurate and agreed upon in the contract.

- Review and verify the retainage calculation before submitting the payment application.

By following these best practices and using one of the five methods outlined above, you can ensure accurate and timely billing of retainage on AIA Form G703.

We hope this article has helped you understand the different methods of billing retainage on AIA Form G703. If you have any questions or comments, please feel free to share them below.

What is the purpose of retainage in construction projects?

+Retainage is a practice of withholding a portion of the payment due to a contractor or subcontractor until the project is complete or a milestone is reached. This practice helps ensure that the contractor completes the project as agreed upon.

What is AIA Form G703, and how is it used?

+AIA Form G703, also known as the Continuation Sheet, is a document used in conjunction with AIA Form G702, the Application and Certificate for Payment. The G703 form provides a detailed breakdown of the work completed, including the percentage of completion and the amount of retainage.

Can I bill retainage as a separate payment application?

+Yes, you can bill retainage as a separate payment application using a separate G703 form for the retainage amount. This approach requires you to complete a separate form for the retainage, clearly indicating the amount and calculation.