Filing taxes can be a daunting task, especially for Wisconsin residents who need to navigate the state's specific income tax requirements. With the tax season approaching, it's essential to understand the process and tips to make filing your Wisconsin income tax form as smooth as possible. In this article, we'll provide you with five valuable tips to help you file your taxes accurately and efficiently.

Understanding Wisconsin Income Tax Forms

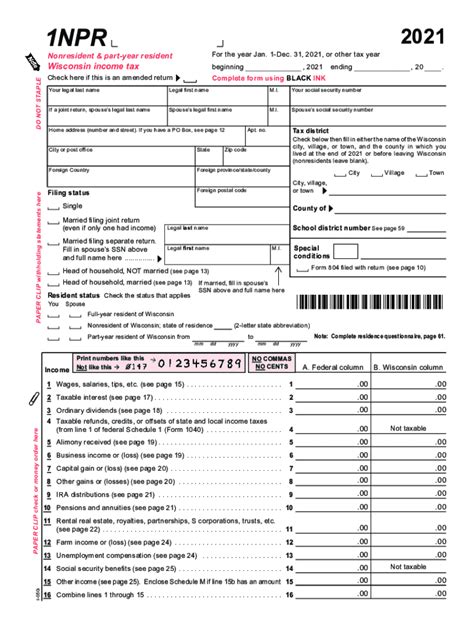

Before diving into the tips, let's briefly discuss the Wisconsin income tax forms. The Wisconsin Department of Revenue provides various forms, including Form 1, Form 1A, and Form WI-Z. Form 1 is the standard form for Wisconsin residents, while Form 1A is for non-residents and part-year residents. Form WI-Z is for individuals who want to claim a refund of overpaid taxes.

Tip 1: Gather Necessary Documents

To ensure accurate and efficient filing, gather all necessary documents before starting the process. These documents include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or other income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

Having all these documents ready will help you fill out the forms accurately and avoid errors.

Choosing the Right Filing Status

Wisconsin Filing Status Options

Wisconsin offers various filing status options, including:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Choose the correct filing status to ensure you're eligible for the right deductions and credits.

Tip 2: Claim Eligible Credits and Deductions

Wisconsin offers various credits and deductions to reduce your tax liability. Some of these include:

- Earned Income Tax Credit (EITC)

- Wisconsin Earned Income Tax Credit (WEC)

- Homestead Credit

- Child Tax Credit

- Education Expenses Deduction

Research and claim eligible credits and deductions to minimize your tax burden.

Tax Preparation Software

Popular Tax Preparation Software Options

Utilize tax preparation software to simplify the filing process. Some popular options include:

- TurboTax

- H&R Block

- TaxAct

- Credit Karma Tax

These software programs guide you through the filing process, ensuring accuracy and compliance with Wisconsin tax laws.

Tip 3: File Electronically

Filing electronically is faster, more accurate, and more secure than paper filing. The Wisconsin Department of Revenue offers e-file options through their website or through tax preparation software.

Tip 4: Take Advantage of Free Filing Options

If you meet certain income and eligibility requirements, you may be eligible for free filing options. The Wisconsin Department of Revenue offers free filing through their website for eligible taxpayers.

Tip 5: Seek Professional Help If Needed

If you're unsure about any aspect of the filing process, consider seeking professional help from a tax expert or accountant. They can guide you through the process and ensure accurate and efficient filing.

Additional Tips and Reminders

- File on time to avoid penalties and interest

- Keep accurate records of your tax-related documents

- Stay informed about changes to Wisconsin tax laws and regulations

By following these five tips and staying informed, you'll be well on your way to accurately and efficiently filing your Wisconsin income tax form.

What is the deadline for filing Wisconsin income tax forms?

+The deadline for filing Wisconsin income tax forms is typically April 15th.

Can I file my Wisconsin income tax form electronically?

+What is the Wisconsin Earned Income Tax Credit (WEC)?

+The Wisconsin Earned Income Tax Credit (WEC) is a refundable credit for eligible taxpayers who work and have earned income.