As a resident of Wisconsin, it's essential to understand your tax obligations to avoid any penalties or fines. One crucial aspect of tax compliance is making estimated tax payments throughout the year. In this article, we'll delve into the world of Wisconsin Form 1-Es, which is used for estimated tax payments. We'll explore the importance of making these payments, who needs to make them, and provide a step-by-step guide on how to fill out the form.

Why Make Estimated Tax Payments?

Making estimated tax payments is a way to prepay your taxes throughout the year, rather than waiting until the end of the year to pay your tax bill in full. This approach helps to avoid penalties and fines, which can be substantial. By making estimated tax payments, you're essentially making a down payment on your tax bill, and this can help to reduce your tax liability when you file your annual tax return.

Who Needs to Make Estimated Tax Payments?

Not everyone needs to make estimated tax payments. However, if you're a Wisconsin resident and expect to owe more than $500 in taxes for the year, you're required to make estimated tax payments. This includes:

- Self-employed individuals

- Freelancers

- Business owners

- Investors

- Retirees with taxable income

Understanding Wisconsin Form 1-Es

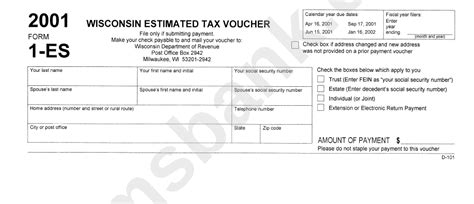

Wisconsin Form 1-Es is used to make estimated tax payments throughout the year. The form is relatively straightforward and requires you to provide some basic information, such as your name, address, and Social Security number. You'll also need to estimate your tax liability for the year and make a payment accordingly.

How to Fill Out Wisconsin Form 1-Es

To fill out Wisconsin Form 1-Es, follow these steps:

- Download and print the form: You can download the form from the Wisconsin Department of Revenue website or pick one up at your local library or post office.

- Gather required information: You'll need to provide your name, address, and Social Security number, as well as your estimated tax liability for the year.

- Estimate your tax liability: Use your previous year's tax return as a guide to estimate your tax liability for the current year. You can also use tax software or consult with a tax professional to help with this step.

- Calculate your payment: Once you've estimated your tax liability, calculate your payment by dividing the total amount by 4 (for quarterly payments).

- Complete the form: Fill out the form with your estimated tax liability and payment amount.

- Make a payment: You can make a payment online, by phone, or by mail.

Making Quarterly Payments

Estimated tax payments are due quarterly, and the due dates are as follows:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Penalties for Late or Underpayment

If you fail to make estimated tax payments or underpay your taxes, you may be subject to penalties and fines. The penalty for underpayment is 5% of the unpaid amount for each quarter, plus interest.

Additional Tips and Reminders

- Keep accurate records: Keep a record of your estimated tax payments, including the date and amount of each payment.

- Adjust your payments: If your income changes throughout the year, adjust your estimated tax payments accordingly.

- Consult a tax professional: If you're unsure about how to fill out the form or estimate your tax liability, consult with a tax professional.

Conclusion: Stay on Top of Your Tax Obligations

Making estimated tax payments is an essential part of tax compliance in Wisconsin. By following the steps outlined in this article, you can ensure that you're meeting your tax obligations and avoiding any penalties or fines. Remember to keep accurate records, adjust your payments as needed, and consult with a tax professional if you're unsure about any aspect of the process.

What is the due date for the first quarter estimated tax payment?

+The due date for the first quarter estimated tax payment is April 15th.

How do I estimate my tax liability for the year?

+You can estimate your tax liability for the year by using your previous year's tax return as a guide or by consulting with a tax professional.

What is the penalty for underpayment of estimated taxes?

+The penalty for underpayment is 5% of the unpaid amount for each quarter, plus interest.