Form SSA-3380-BK, also known as the "Report of Workers' Compensation Public Disability Benefits," is a crucial document that individuals receiving Social Security Disability Insurance (SSDI) benefits must complete to report their workers' compensation (WC) or public disability benefits. The purpose of this form is to ensure that the Social Security Administration (SSA) accurately calculates an individual's SSDI benefits, taking into account any workers' compensation or public disability benefits they receive.

In this article, we will break down the Form SSA-3380-BK and provide guidance on how to complete it accurately and efficiently.

Understanding Form SSA-3380-BK

Before we dive into the details, it's essential to understand the importance of Form SSA-3380-BK. The SSA requires SSDI recipients to report any workers' compensation or public disability benefits they receive to ensure that their SSDI benefits are adjusted correctly. Failure to report this information accurately can result in an overpayment of SSDI benefits, which must be repaid.

Who Needs to Complete Form SSA-3380-BK?

Individuals who receive SSDI benefits and also receive workers' compensation or public disability benefits must complete Form SSA-3380-BK. This includes:

- Workers who receive workers' compensation benefits due to a work-related injury or illness

- Individuals who receive public disability benefits, such as disability retirement benefits from a state or local government

- SSDI recipients who also receive other types of disability benefits, such as veterans' disability benefits

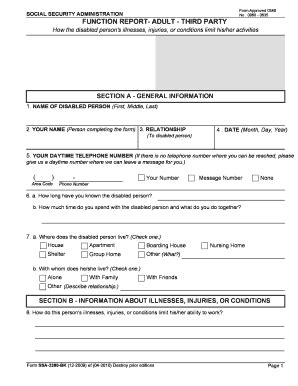

How to Complete Form SSA-3380-BK

Completing Form SSA-3380-BK requires attention to detail and accurate reporting. Here's a step-by-step guide to help you complete the form:

- Section 1: Claimant Information

- Provide your name, Social Security number, and date of birth

- List your mailing address and phone number

- Section 2: Workers' Compensation or Public Disability Benefits

- Identify the type of benefits you receive (workers' compensation or public disability benefits)

- Provide the name and address of the agency or organization paying the benefits

- List the date you began receiving benefits and the amount of benefits you receive

- Section 3: Benefit Amount and Payment Information

- Report the gross amount of benefits you receive

- List the payment frequency (e.g., monthly, bi-weekly)

- Provide the payment start date and end date (if applicable)

- Section 4: Lump-Sum Payment Information

- If you received a lump-sum payment, report the amount and date received

- Section 5: Certification

- Sign and date the form

- Provide your Social Security number again

Additional Tips and Reminders

- Ensure you complete the form accurately and thoroughly to avoid delays or incorrect processing

- Keep a copy of the completed form for your records

- Submit the form to the SSA as soon as possible, ideally within 30 days of receiving workers' compensation or public disability benefits

- If you have any questions or concerns, contact the SSA or consult with a representative

Common Mistakes to Avoid

When completing Form SSA-3380-BK, it's essential to avoid common mistakes that can lead to delays or incorrect processing. Some common mistakes to avoid include:

- Failing to report all workers' compensation or public disability benefits

- Providing inaccurate or incomplete information

- Not signing and dating the form

- Not submitting the form to the SSA in a timely manner

Conclusion

Completing Form SSA-3380-BK may seem daunting, but with this guide, you'll be well-equipped to report your workers' compensation or public disability benefits accurately and efficiently. Remember to take your time, ensure accuracy, and submit the form to the SSA as soon as possible. If you have any questions or concerns, don't hesitate to reach out for support.

What is Form SSA-3380-BK used for?

+Form SSA-3380-BK is used to report workers' compensation or public disability benefits to the Social Security Administration (SSA) to ensure accurate calculation of SSDI benefits.

Who needs to complete Form SSA-3380-BK?

+Individuals who receive SSDI benefits and also receive workers' compensation or public disability benefits must complete Form SSA-3380-BK.

What happens if I don't complete Form SSA-3380-BK accurately?

+Failure to report accurate information on Form SSA-3380-BK can result in an overpayment of SSDI benefits, which must be repaid.