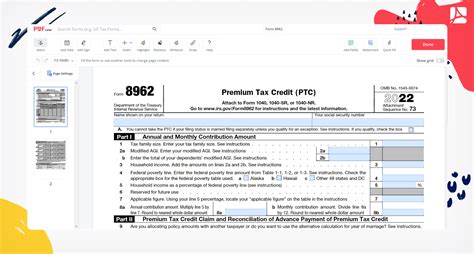

Receiving Form 8962 is a crucial step in the process of claiming the Premium Tax Credit (PTC) on your tax return. The Form 8962, also known as the Premium Tax Credit (PTC) form, is used to reconcile the advance payments of the Premium Tax Credit (APTC) with the actual credit due. In this article, we will explore five ways to obtain Form 8962.

Understanding the Importance of Form 8962

Before we dive into the ways to obtain Form 8962, it's essential to understand its significance. The Premium Tax Credit (PTC) is a refundable tax credit designed to help eligible individuals and families with low to moderate income afford health insurance purchased through the Health Insurance Marketplace. Form 8962 is necessary to calculate the actual PTC amount, which may be different from the advance payments made.

Method 1: Download from the IRS Website

One of the most convenient ways to obtain Form 8962 is by downloading it from the official IRS website. You can visit the IRS website () and search for "Form 8962" in the search bar. Once you find the form, you can download it in PDF format and print it.

Method 2: Contact the IRS Call Center

Another way to obtain Form 8962 is by contacting the IRS call center. You can call the IRS at 1-800-829-1040 (individuals) or 1-800-829-4933 (businesses) and request Form 8962. The IRS representative will mail the form to you or provide you with instructions on how to access it online.

Method 3: Visit a Local IRS Office

If you prefer to obtain Form 8962 in person, you can visit a local IRS office. You can find the nearest IRS office by visiting the IRS website and using the "Office Locator" tool. Once you arrive at the office, you can request Form 8962 from an IRS representative.

Method 4: Use Tax Preparation Software

If you use tax preparation software, such as TurboTax or H&R Block, you may be able to access Form 8962 through the software. Many tax preparation software programs offer Form 8962 as part of their tax preparation package. You can contact the software provider's customer support to confirm availability.

Method 5: Contact Your Health Insurance Marketplace

Finally, you can also contact your Health Insurance Marketplace (HIM) to obtain Form 8962. The HIM may be able to provide you with the form or direct you to a website where you can access it. You can visit the HealthCare.gov website () to find contact information for your HIM.

Conclusion

In this article, we explored five ways to obtain Form 8962, a crucial document for claiming the Premium Tax Credit (PTC) on your tax return. By following these methods, you can access Form 8962 and accurately calculate your PTC amount. Remember to also keep accurate records of your health insurance premiums and other relevant documents to ensure a smooth tax filing process.

What's Next?

If you have any questions or concerns about obtaining Form 8962 or claiming the Premium Tax Credit (PTC), please share them in the comments section below. We encourage you to share this article with friends and family who may benefit from this information. Stay informed and stay ahead of the tax season!

What is Form 8962 used for?

+Form 8962 is used to reconcile the advance payments of the Premium Tax Credit (APTC) with the actual credit due.

How do I qualify for the Premium Tax Credit (PTC)?

+To qualify for the PTC, you must meet certain income and eligibility requirements, which can be found on the IRS website.

Can I file my tax return without Form 8962?

+No, if you received advance payments of the PTC, you must file Form 8962 with your tax return to reconcile the payments.