As the new tax season approaches, it's essential for taxpayers to stay informed about the latest forms and deadlines. One of the critical forms that have gained significant attention is Form 8915-F, specifically designed for retired federal employees and their spouses. In this article, we will delve into the Form 8915-F release date, its purpose, and what you need to know to ensure a smooth tax filing process.

The Importance of Staying Informed About Tax Forms

Tax laws and regulations are constantly evolving, and it's crucial for taxpayers to stay up-to-date with the latest changes. The IRS regularly updates and releases new forms to reflect these changes, and Form 8915-F is one such example. As a retired federal employee or spouse, understanding the purpose and significance of this form is vital to ensure you take advantage of the available tax benefits.

What is Form 8915-F?

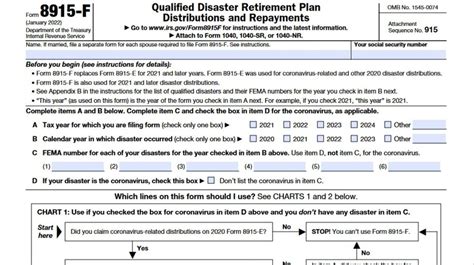

Form 8915-F, also known as the Qualified 2018 Disaster Retirement Plan Distributions and Repayments form, is specifically designed for retired federal employees and their spouses. This form allows taxpayers to report qualified disaster retirement plan distributions and repayments. The form is essential for those who have taken distributions from their retirement plans due to a qualified disaster and want to report these distributions to the IRS.

When is the Form 8915-F Release Date?

The IRS typically releases new forms and updates existing ones in late December or early January. However, the exact release date for Form 8915-F may vary from year to year. As of now, the IRS has announced that Form 8915-F will be available on their website in late December 2022. Taxpayers can check the IRS website for the latest updates on the form's availability.

Key Features of Form 8915-F

Form 8915-F is designed to help retired federal employees and their spouses report qualified disaster retirement plan distributions and repayments. Here are some key features of the form:

- Qualified Disaster Retirement Plan Distributions: The form allows taxpayers to report distributions from their retirement plans due to a qualified disaster.

- Repayments: Taxpayers can also report repayments made to their retirement plans.

- Tax Benefits: By reporting qualified disaster retirement plan distributions and repayments, taxpayers can take advantage of available tax benefits.

Who Needs to File Form 8915-F?

Retired federal employees and their spouses who have taken distributions from their retirement plans due to a qualified disaster need to file Form 8915-F. This includes:

- Retired Federal Employees: Those who have retired from federal service and have taken distributions from their retirement plans due to a qualified disaster.

- Spouses of Retired Federal Employees: Spouses of retired federal employees who have taken distributions from their retirement plans due to a qualified disaster.

How to File Form 8915-F

Filing Form 8915-F is a straightforward process. Here are the steps to follow:

- Download the Form: Taxpayers can download Form 8915-F from the IRS website once it's available.

- Fill Out the Form: Fill out the form accurately and completely, ensuring all required information is provided.

- Attach Supporting Documents: Attach supporting documents, such as proof of qualified disaster retirement plan distributions and repayments.

- Submit the Form: Submit the form to the IRS by the required deadline.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing Form 8915-F:

- Check the IRS Website: Regularly check the IRS website for updates on the form's availability and any changes to the filing process.

- Consult a Tax Professional: If you're unsure about the filing process or need help with completing the form, consult a tax professional.

- Meet the Deadline: Ensure you submit the form by the required deadline to avoid any penalties or fines.

Common Mistakes to Avoid

When filing Form 8915-F, it's essential to avoid common mistakes that can lead to delays or penalties. Here are some mistakes to avoid:

- Inaccurate Information: Ensure all information provided on the form is accurate and complete.

- Missing Supporting Documents: Attach all required supporting documents, such as proof of qualified disaster retirement plan distributions and repayments.

- Late Submission: Submit the form by the required deadline to avoid any penalties or fines.

Conclusion

In conclusion, Form 8915-F is a critical form for retired federal employees and their spouses who have taken distributions from their retirement plans due to a qualified disaster. Understanding the purpose and significance of this form is essential to ensure a smooth tax filing process. By following the tips and reminders outlined in this article, taxpayers can ensure they take advantage of available tax benefits and avoid common mistakes.

Stay ahead of the game by regularly checking the IRS website for updates on the form's availability and any changes to the filing process. If you're unsure about the filing process or need help with completing the form, consult a tax professional.

FAQs

What is the purpose of Form 8915-F?

+Form 8915-F is designed for retired federal employees and their spouses to report qualified disaster retirement plan distributions and repayments.

Who needs to file Form 8915-F?

+Retired federal employees and their spouses who have taken distributions from their retirement plans due to a qualified disaster need to file Form 8915-F.

How do I file Form 8915-F?

+Download the form from the IRS website, fill it out accurately and completely, attach supporting documents, and submit it to the IRS by the required deadline.