As a business owner in Connecticut, you're likely no stranger to the various forms and filings required by the state to maintain your company's good standing. One of these forms is the CT UC-61, also known as the "Quarterly Contribution Return and Payment of Unemployment Compensation." This form is a crucial part of your business's tax obligations, and it's essential to understand how to fill it out and submit it correctly. In this article, we'll guide you through the process of downloading and filing the CT UC-61 form, making it easier for you to comply with Connecticut's unemployment compensation requirements.

Understanding the CT UC-61 Form

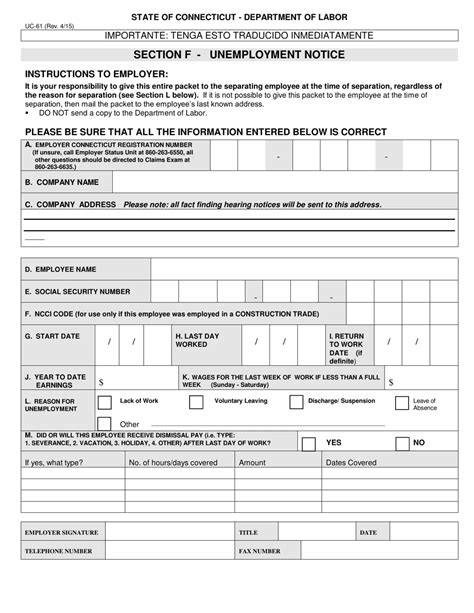

The CT UC-61 form is used to report your business's quarterly unemployment compensation tax liability to the Connecticut Department of Labor. This form is typically filed on a quarterly basis, with due dates falling on April 30th, July 31st, October 31st, and January 31st for the first, second, third, and fourth quarters, respectively. The form requires you to provide information about your business, including your employer account number, business name, and address, as well as details about your employees, such as their wages and hours worked.

Downloading the CT UC-61 Form

To download the CT UC-61 form, you can visit the Connecticut Department of Labor's website. The form is available in a fillable PDF format, making it easy to complete and print. You can also obtain a copy of the form by contacting the Connecticut Department of Labor directly.

Filling Out the CT UC-61 Form

When filling out the CT UC-61 form, make sure to have the following information readily available:

- Your employer account number

- Business name and address

- Employee information, including names, social security numbers, wages, and hours worked

- Total wages paid during the quarter

- Total unemployment compensation tax liability

The form is divided into several sections, each requiring specific information. Here's a brief overview of what you'll need to complete:

- Section 1: Employer Information - Provide your employer account number, business name, and address.

- Section 2: Employee Information - List each employee, including their name, social security number, wages, and hours worked.

- Section 3: Total Wages and Tax Liability - Calculate your total wages paid during the quarter and your unemployment compensation tax liability.

- Section 4: Payment - Indicate how you'll be making payment, either by check or electronic funds transfer.

Submitting the CT UC-61 Form

Once you've completed the CT UC-61 form, you can submit it to the Connecticut Department of Labor along with your payment. You can file the form online through the Connecticut Department of Labor's website or by mail. Make sure to keep a copy of the form and payment receipt for your records.

Payment Options

You can make payment for your unemployment compensation tax liability by check or electronic funds transfer. If you're filing online, you can pay by credit card or e-check.

Penalties for Late Filing or Payment

It's essential to file and pay your unemployment compensation tax liability on time to avoid penalties. Late filing or payment can result in interest charges and penalties, which can add up quickly.

CT UC-61 Form FAQs

Here are some frequently asked questions about the CT UC-61 form:

- What is the due date for filing the CT UC-61 form? The CT UC-61 form is due on the last day of the month following the end of the quarter. For example, the first quarter form is due on April 30th.

- Can I file the CT UC-61 form online? Yes, you can file the CT UC-61 form online through the Connecticut Department of Labor's website.

- What happens if I miss the filing deadline? If you miss the filing deadline, you may be subject to interest charges and penalties.

What is the CT UC-61 form used for?

+The CT UC-61 form is used to report your business's quarterly unemployment compensation tax liability to the Connecticut Department of Labor.

How do I download the CT UC-61 form?

+You can download the CT UC-61 form from the Connecticut Department of Labor's website or by contacting the department directly.

What information do I need to complete the CT UC-61 form?

+You'll need to provide information about your business, including your employer account number, business name, and address, as well as details about your employees, such as their wages and hours worked.

In conclusion, the CT UC-61 form is a critical part of your business's tax obligations in Connecticut. By understanding how to fill out and submit the form, you can avoid penalties and ensure your business remains in good standing. Remember to file the form on time and make payment by the due date to avoid interest charges and penalties. If you have any questions or concerns, don't hesitate to reach out to the Connecticut Department of Labor for guidance.