The IRS Form 7203, S Corporation Shareholder Based Adjustments to Stock Basis, is an essential document for certain S corporation shareholders. Despite its importance, many taxpayers are unclear about who needs to file this form and why. In this article, we will delve into the details of Form 7203, its purpose, and who is required to file it.

The S corporation is a popular business entity choice for many entrepreneurs due to its tax benefits and flexibility. One of the key advantages of an S corporation is that it allows shareholders to pass corporate income, losses, deductions, and credits to their personal tax returns. However, this pass-through taxation also means that shareholders must keep track of their stock basis, which can be affected by various adjustments. This is where Form 7203 comes into play.

Who Needs to File Form 7203?

Form 7203 is used by S corporation shareholders to report adjustments to their stock basis. The form is typically required for shareholders who have a negative adjustment to their stock basis, which can occur due to various reasons such as:

- Losses or deductions exceeding the shareholder's stock basis

- Distribution of cash or property exceeding the shareholder's stock basis

- Certain types of income, such as built-in gains or excess net passive income

Shareholders who need to file Form 7203 include:

- Shareholders who have a negative adjustment to their stock basis

- Shareholders who have an increase in their stock basis due to certain types of income

- Shareholders who are required to report a built-in gain or excess net passive income

Why is Form 7203 Important?

Form 7203 is crucial because it allows shareholders to accurately report their stock basis adjustments to the IRS. Failure to file this form can result in penalties, interest, and even loss of S corporation status. By filing Form 7203, shareholders can:

- Avoid penalties and interest for underreporting or overreporting their stock basis

- Ensure accurate reporting of their stock basis, which affects their personal tax liability

- Maintain the integrity of their S corporation status

How to File Form 7203

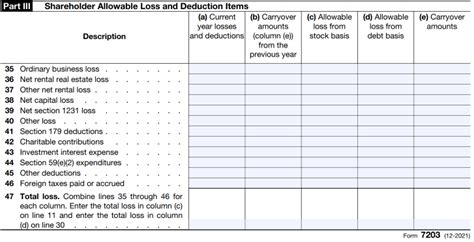

Filing Form 7203 is a straightforward process. Shareholders must complete the form and attach it to their personal tax return (Form 1040). The form requires shareholders to report their stock basis adjustments, including any negative adjustments, increases in stock basis, and built-in gains or excess net passive income.

Shareholders must also provide documentation to support their stock basis adjustments, such as:

- S corporation financial statements

- Distribution records

- Records of built-in gains or excess net passive income

Tips for Accurate Filing

To ensure accurate filing of Form 7203, shareholders should:

- Keep accurate records of their stock basis adjustments

- Consult with a tax professional or accountant to ensure accurate reporting

- Review their S corporation financial statements and distribution records carefully

Benefits of Filing Form 7203

Filing Form 7203 provides several benefits to S corporation shareholders, including:

- Accurate reporting of stock basis adjustments

- Avoidance of penalties and interest

- Maintenance of S corporation status

- Reduced risk of audit or examination

Common Mistakes to Avoid

When filing Form 7203, shareholders should avoid common mistakes, such as:

- Failure to report negative adjustments to stock basis

- Inaccurate reporting of increases in stock basis

- Failure to provide supporting documentation

By avoiding these mistakes, shareholders can ensure accurate filing and avoid potential penalties and interest.

Conclusion

In conclusion, Form 7203 is an essential document for S corporation shareholders who need to report adjustments to their stock basis. By understanding who needs to file this form and why, shareholders can ensure accurate reporting and avoid potential penalties and interest. By following the tips and guidelines outlined in this article, shareholders can navigate the Form 7203 filing process with confidence.

If you have any questions or concerns about Form 7203 or S corporation taxation, please leave a comment below. Share this article with others who may benefit from this information.

Who needs to file Form 7203?

+Shareholders who have a negative adjustment to their stock basis, increase in stock basis due to certain types of income, or are required to report built-in gains or excess net passive income.

Why is Form 7203 important?

+Form 7203 is crucial for accurate reporting of stock basis adjustments, avoiding penalties and interest, and maintaining S corporation status.

How do I file Form 7203?

+Complete Form 7203 and attach it to your personal tax return (Form 1040). Provide supporting documentation, such as S corporation financial statements and distribution records.