Understanding the intricacies of social services and the paperwork involved can be a daunting task for many. The LDSS 2221A form, specifically, is a document that plays a crucial role in various social services scenarios. In this article, we'll delve into five key scenarios where you might need to file an LDSS 2221A form.

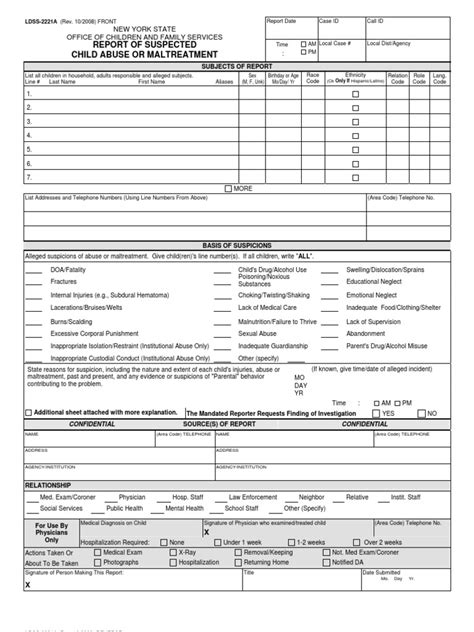

What is the LDSS 2221A Form?

Before we dive into the scenarios, it's essential to understand what the LDSS 2221A form is. The LDSS 2221A form is a document used by social services agencies to gather information about an individual's or family's income and expenses. This information is crucial in determining eligibility for various social services programs, such as Medicaid, food stamps, and temporary assistance for needy families (TANF).

Scenario 1: Applying for Medicaid

One of the most common scenarios where you might need to file an LDSS 2221A form is when applying for Medicaid. Medicaid is a joint federal-state program that provides health insurance coverage to low-income individuals and families. To determine eligibility for Medicaid, social services agencies will typically require applicants to complete an LDSS 2221A form.

This form will ask for detailed information about your income, expenses, and assets. The information provided on this form will help the agency determine whether you meet the income and resource requirements for Medicaid.

What to Expect

When applying for Medicaid, you can expect the social services agency to review your LDSS 2221A form carefully. They will verify the information provided on the form, and may request additional documentation to support your application.

If your application is approved, you will be eligible for Medicaid coverage, which can help you access necessary healthcare services.

Scenario 2: Receiving Temporary Assistance for Needy Families (TANF)

Another scenario where you might need to file an LDSS 2221A form is when receiving TANF. TANF is a program that provides financial assistance to low-income families with children.

To determine eligibility for TANF, social services agencies will typically require recipients to complete an LDSS 2221A form on a regular basis. This form will help the agency determine whether you continue to meet the income and resource requirements for TANF.

What to Expect

When receiving TANF, you can expect the social services agency to review your LDSS 2221A form regularly. They will verify the information provided on the form, and may request additional documentation to support your continued eligibility for TANF.

If your eligibility is approved, you will continue to receive TANF benefits, which can help you provide for your family's basic needs.

Scenario 3: Applying for Food Stamps

A third scenario where you might need to file an LDSS 2221A form is when applying for food stamps. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide financial assistance to low-income individuals and families to purchase food.

To determine eligibility for food stamps, social services agencies will typically require applicants to complete an LDSS 2221A form. This form will ask for detailed information about your income, expenses, and assets.

What to Expect

When applying for food stamps, you can expect the social services agency to review your LDSS 2221A form carefully. They will verify the information provided on the form, and may request additional documentation to support your application.

If your application is approved, you will be eligible for food stamps, which can help you access nutritious food for yourself and your family.

Scenario 4: Receiving Child Care Assistance

A fourth scenario where you might need to file an LDSS 2221A form is when receiving child care assistance. Child care assistance programs provide financial assistance to low-income families to help them pay for child care costs.

To determine eligibility for child care assistance, social services agencies will typically require recipients to complete an LDSS 2221A form. This form will ask for detailed information about your income, expenses, and assets.

What to Expect

When receiving child care assistance, you can expect the social services agency to review your LDSS 2221A form regularly. They will verify the information provided on the form, and may request additional documentation to support your continued eligibility for child care assistance.

If your eligibility is approved, you will continue to receive child care assistance, which can help you access quality child care for your children.

Scenario 5: Applying for Home Energy Assistance

A fifth scenario where you might need to file an LDSS 2221A form is when applying for home energy assistance. Home energy assistance programs provide financial assistance to low-income households to help them pay for home energy costs.

To determine eligibility for home energy assistance, social services agencies will typically require applicants to complete an LDSS 2221A form. This form will ask for detailed information about your income, expenses, and assets.

What to Expect

When applying for home energy assistance, you can expect the social services agency to review your LDSS 2221A form carefully. They will verify the information provided on the form, and may request additional documentation to support your application.

If your application is approved, you will be eligible for home energy assistance, which can help you access affordable home energy for yourself and your family.

Conclusion

In conclusion, the LDSS 2221A form is an essential document that plays a crucial role in various social services scenarios. Whether you're applying for Medicaid, receiving TANF, applying for food stamps, receiving child care assistance, or applying for home energy assistance, the LDSS 2221A form will help determine your eligibility for these programs.

By understanding the scenarios where you might need to file an LDSS 2221A form, you can better navigate the complex world of social services and access the benefits you need to support yourself and your family.

What is the LDSS 2221A form used for?

+The LDSS 2221A form is used by social services agencies to gather information about an individual's or family's income and expenses to determine eligibility for various social services programs.

Who needs to file an LDSS 2221A form?

+Individuals and families who are applying for or receiving social services programs, such as Medicaid, TANF, food stamps, child care assistance, and home energy assistance, may need to file an LDSS 2221A form.

What information is required on the LDSS 2221A form?

+The LDSS 2221A form requires detailed information about your income, expenses, and assets, including employment income, benefits, and financial resources.