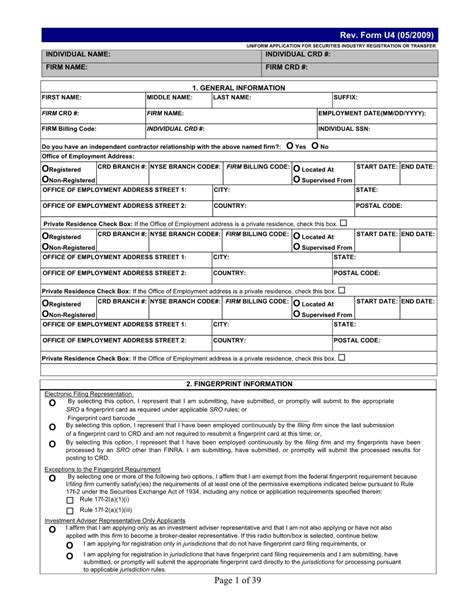

In the financial industry, Form U4 is a crucial document that plays a significant role in determining an individual's eligibility to work in various capacities, such as a broker, dealer, or investment advisor. However, a Form U4 statutory disqualification can pose a significant obstacle to one's career aspirations. In this article, we will delve into the world of Form U4 statutory disqualification and explore five ways to overcome it.

Understanding Form U4 Statutory Disqualification

Before we dive into the ways to overcome Form U4 statutory disqualification, it's essential to understand what it entails. A statutory disqualification is a regulatory action that prohibits an individual from associating with a member firm or engaging in certain activities in the financial industry. This can result from various reasons, including disciplinary actions, regulatory violations, or criminal convictions.

Types of Statutory Disqualifications

There are two primary types of statutory disqualifications:

-

Statutory Disqualification under Section 3(a)(39) of the Exchange Act

* This type of disqualification arises from disciplinary actions, such as suspension or expulsion, from a self-regulatory organization (SRO) or a securities exchange. -

Statutory Disqualification under Section 15(b)(4) of the Exchange Act

* This type of disqualification results from certain types of convictions, such as felonies or misdemeanors involving securities, commodities, or banking.

5 Ways to Overcome Form U4 Statutory Disqualification

While a Form U4 statutory disqualification can be a significant hurdle, it's not insurmountable. Here are five ways to overcome it:

1. File a Request for Waiver or Exemption

The first step to overcoming a Form U4 statutory disqualification is to file a request for waiver or exemption with the relevant regulatory authority. This involves submitting a detailed application, including supporting documentation and explanations, to demonstrate why the disqualification should be waived or exempted.

2. Seek SEC Approval

SEC Approval Process

In some cases, individuals may need to seek approval from the Securities and Exchange Commission (SEC) to overcome a Form U4 statutory disqualification. This involves filing a request with the SEC, which will review the application and make a determination.

3. Apply for Reinstatement

Reinstatement Process

If an individual's registration has been revoked or suspended, they may be eligible to apply for reinstatement. This involves submitting an application to the relevant regulatory authority, which will review the individual's eligibility and make a determination.

4. Obtain a No-Action Letter

No-Action Letter

In some cases, individuals may be able to obtain a no-action letter from the SEC or another regulatory authority. This letter indicates that the regulatory authority will not take enforcement action against the individual, effectively overriding the statutory disqualification.

5. Seek Professional Guidance

Importance of Professional Guidance

Finally, it's essential to seek professional guidance when dealing with a Form U4 statutory disqualification. A qualified attorney or regulatory expert can provide valuable guidance and support throughout the process, helping individuals navigate the complex regulatory landscape.

Conclusion

A Form U4 statutory disqualification can be a significant obstacle to one's career aspirations in the financial industry. However, by understanding the types of statutory disqualifications and the ways to overcome them, individuals can take the necessary steps to overcome this hurdle. Whether it's filing a request for waiver or exemption, seeking SEC approval, applying for reinstatement, obtaining a no-action letter, or seeking professional guidance, there are various options available to help individuals overcome a Form U4 statutory disqualification.

We encourage you to share your thoughts and experiences with Form U4 statutory disqualification in the comments below. Have you or someone you know dealt with a statutory disqualification? What steps did you take to overcome it? Share your story and help others who may be facing similar challenges.

What is a Form U4 statutory disqualification?

+A Form U4 statutory disqualification is a regulatory action that prohibits an individual from associating with a member firm or engaging in certain activities in the financial industry.

How do I overcome a Form U4 statutory disqualification?

+There are several ways to overcome a Form U4 statutory disqualification, including filing a request for waiver or exemption, seeking SEC approval, applying for reinstatement, obtaining a no-action letter, and seeking professional guidance.

What is the difference between a statutory disqualification under Section 3(a)(39) and Section 15(b)(4) of the Exchange Act?

+A statutory disqualification under Section 3(a)(39) arises from disciplinary actions, such as suspension or expulsion, from a self-regulatory organization (SRO) or a securities exchange. A statutory disqualification under Section 15(b)(4) results from certain types of convictions, such as felonies or misdemeanors involving securities, commodities, or banking.