Kansas quitclaim deeds are a crucial tool for property owners looking to transfer ownership of real estate. Whether you're a homeowner, a buyer, or a seller, understanding the quitclaim deed process can save you time, money, and stress. In this comprehensive guide, we'll walk you through the ins and outs of Kansas quitclaim deeds, providing you with the knowledge you need to navigate this complex process.

Kansas quitclaim deeds are used to transfer the interest of one party to another. This type of deed is commonly used in situations where the grantor (the party transferring the property) wants to release their interest in the property without guaranteeing that they have clear title. In other words, the grantor is essentially saying, "I'm giving you whatever interest I have in this property, but I'm not promising that it's free from encumbrances or defects."

Benefits of a Kansas Quitclaim Deed

Using a Kansas quitclaim deed can be beneficial in several ways:

- Simplified process: Quitclaim deeds are generally less complicated than other types of deeds, making the transfer process smoother and faster.

- Lower costs: Quitclaim deeds typically require fewer fees and expenses compared to other types of deeds.

- Flexibility: Quitclaim deeds can be used to transfer property between family members, friends, or business partners.

When to Use a Kansas Quitclaim Deed

Kansas quitclaim deeds are commonly used in the following situations:

- Divorce: Quitclaim deeds are often used to transfer property from one spouse to another as part of a divorce settlement.

- Inheritance: Quitclaim deeds can be used to transfer property from an estate to beneficiaries.

- Gifts: Quitclaim deeds can be used to transfer property as a gift from one party to another.

- Business transactions: Quitclaim deeds can be used to transfer property between business partners or entities.

Step-by-Step Guide to Creating a Kansas Quitclaim Deed

Creating a Kansas quitclaim deed involves several steps:

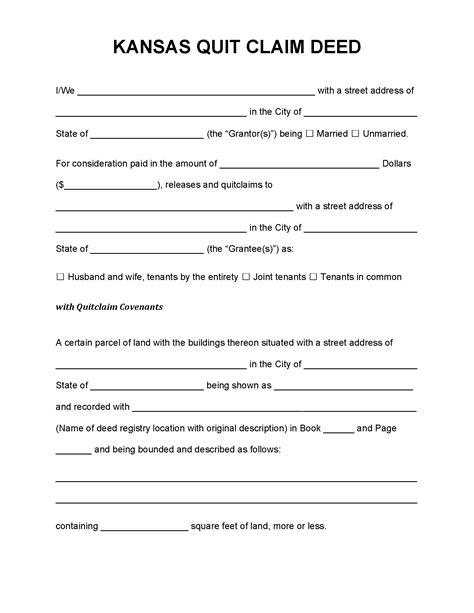

- Gather information: Collect the necessary information, including the property description, grantor's and grantee's names, and addresses.

- Choose a form: Select a Kansas quitclaim deed form that meets your needs. You can find templates online or consult with an attorney.

- Fill out the form: Complete the form with the required information, making sure to include the following:

- Grantor's information: Name, address, and signature.

- Grantee's information: Name, address, and signature.

- Property description: Include the property's legal description, which can be found on the property deed or county records.

- Sign and notarize: Sign the deed in front of a notary public, who will verify your identity and witness your signature.

- Record the deed: Record the deed with the county recorder's office, which will make the transfer public record.

Recording Requirements

In Kansas, quitclaim deeds must be recorded with the county recorder's office to be considered valid. The requirements for recording a quitclaim deed in Kansas include:

- Original signature: The grantor's signature must be original and witnessed by a notary public.

- Notary acknowledgement: The notary public must acknowledge the grantor's signature.

- Recording fees: Pay the required recording fees, which vary by county.

Risks and Considerations

While Kansas quitclaim deeds can be a useful tool for transferring property, there are risks and considerations to keep in mind:

- Lack of guarantee: Quitclaim deeds do not guarantee that the grantor has clear title to the property.

- Potential for errors: Quitclaim deeds can be challenged if there are errors in the property description or grantor's signature.

- Tax implications: Transferring property can have tax implications, including potential capital gains tax.

Alternatives to Quitclaim Deeds

In some situations, alternatives to quitclaim deeds may be more suitable. These include:

- Warranty deeds: Warranty deeds provide a guarantee that the grantor has clear title to the property.

- Special warranty deeds: Special warranty deeds provide a limited guarantee that the grantor has clear title to the property.

Conclusion

Kansas quitclaim deeds can be a valuable tool for transferring property, but it's essential to understand the benefits, risks, and considerations involved. By following the steps outlined in this guide and consulting with an attorney if necessary, you can ensure a smooth and successful transfer of property.

Take the next step:

- Download a Kansas quitclaim deed form: Use a reputable online source to download a template that meets your needs.

- Consult with an attorney: If you're unsure about the quitclaim deed process or have complex circumstances, consider consulting with an attorney.

Share your thoughts:

- Comment below: Share your experiences with Kansas quitclaim deeds or ask questions about the process.

- Share this article: Help others understand the Kansas quitclaim deed process by sharing this article on social media.

What is a quitclaim deed?

+A quitclaim deed is a type of deed that transfers the interest of one party to another without guaranteeing that the grantor has clear title to the property.

What are the benefits of a Kansas quitclaim deed?

+The benefits of a Kansas quitclaim deed include a simplified process, lower costs, and flexibility.

When should I use a Kansas quitclaim deed?

+Kansas quitclaim deeds are commonly used in situations such as divorce, inheritance, gifts, and business transactions.