The world of tax forms can be overwhelming, especially when it comes to complex topics like unallowed losses on Form 8582. As a taxpayer, understanding how to navigate these forms is crucial to ensure you're taking advantage of the deductions you're eligible for. In this article, we'll break down the concept of unallowed losses on Form 8582, making it easier for you to grasp and apply to your tax situation.

The Importance of Understanding Unallowed Losses

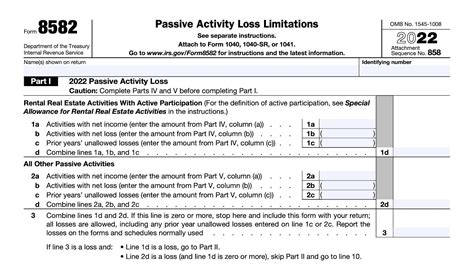

Unallowed losses on Form 8582 are a critical aspect of the Passive Activity Loss (PAL) rules. These rules are designed to limit the amount of losses that can be deducted from passive activities, such as rental real estate or investments. If you're not familiar with the PAL rules, you may end up missing out on deductions or, worse, facing penalties and interest on underpaid taxes.

Passive Activity Loss Rules

To understand unallowed losses on Form 8582, it's essential to have a basic understanding of the PAL rules. These rules were introduced to prevent taxpayers from using losses from passive activities to offset income from other sources. The PAL rules limit the amount of losses that can be deducted from passive activities to the amount of income generated from those same activities.

Form 8582: The Key to Reporting Unallowed Losses

Form 8582 is used to report passive activity losses, including unallowed losses. This form is filed annually with your tax return and is used to calculate the amount of losses that can be deducted from passive activities. The form requires you to report the income and losses from all your passive activities, including rental real estate, investments, and limited partnerships.

How Unallowed Losses Are Calculated

Unallowed losses on Form 8582 are calculated by subtracting the total income from passive activities from the total losses from those same activities. The resulting amount is the unallowed loss, which cannot be deducted in the current tax year. This loss is then carried forward to future tax years and can be deducted when there is sufficient income from passive activities to offset the loss.

Example: Calculating Unallowed Losses

Let's say you have a rental property that generates $10,000 in income and $20,000 in losses. You also have a limited partnership that generates $5,000 in income and $15,000 in losses. Your total income from passive activities is $15,000 ($10,000 + $5,000), and your total losses are $35,000 ($20,000 + $15,000). The unallowed loss would be $20,000 ($35,000 - $15,000).

Benefits of Understanding Unallowed Losses

Understanding unallowed losses on Form 8582 can have several benefits, including:

- Avoiding penalties and interest on underpaid taxes

- Maximizing deductions from passive activities

- Minimizing tax liability

- Improving cash flow

Benefits for Real Estate Investors

Real estate investors can particularly benefit from understanding unallowed losses on Form 8582. By accurately reporting losses from rental properties, investors can minimize their tax liability and maximize their deductions. This can lead to improved cash flow and increased returns on investment.

Common Mistakes to Avoid

When reporting unallowed losses on Form 8582, there are several common mistakes to avoid, including:

- Failing to report all passive activity losses

- Miscalculating the unallowed loss

- Failing to carry forward unallowed losses to future tax years

- Not keeping accurate records of passive activity income and losses

Best Practices for Reporting Unallowed Losses

To avoid common mistakes and ensure accurate reporting, follow these best practices:

- Keep accurate records of passive activity income and losses

- Consult with a tax professional or accountant

- Review Form 8582 carefully before filing

- Carry forward unallowed losses to future tax years

Conclusion: Taking Control of Your Tax Situation

Understanding unallowed losses on Form 8582 is a critical aspect of managing your tax situation. By grasping the concept of unallowed losses and following best practices for reporting, you can minimize your tax liability, maximize your deductions, and improve your cash flow. Don't let the complexity of tax forms hold you back – take control of your tax situation today.

We hope this article has provided you with a comprehensive understanding of unallowed losses on Form 8582. If you have any further questions or concerns, please don't hesitate to comment below or share this article with your network.

What is the purpose of Form 8582?

+Form 8582 is used to report passive activity losses, including unallowed losses.

How are unallowed losses calculated on Form 8582?

+Unallowed losses are calculated by subtracting the total income from passive activities from the total losses from those same activities.

What are the benefits of understanding unallowed losses on Form 8582?

+Understanding unallowed losses on Form 8582 can help avoid penalties and interest on underpaid taxes, maximize deductions from passive activities, minimize tax liability, and improve cash flow.