As a Whataburger employee, understanding your W2 form is crucial for managing your taxes and ensuring you receive the correct refund. The W2 form, also known as the Wage and Tax Statement, is a document that reports your income and taxes withheld from your employer to the Social Security Administration and the Internal Revenue Service (IRS). In this article, we will delve into the world of Whataburger W2 forms, explaining the importance of this document, how to obtain it, and what information it contains.

Why is the W2 Form Important for Whataburger Employees?

The W2 form is essential for Whataburger employees as it provides a record of their income and taxes withheld for the year. This information is used to file taxes, and any errors or discrepancies on the form can lead to delays or issues with tax refunds. Moreover, the W2 form is used to determine Social Security benefits and Medicare coverage, making it a vital document for employees to review and verify.

How to Obtain Your Whataburger W2 Form

Whataburger employees can obtain their W2 form through various channels:

- Online Access: Whataburger employees can access their W2 form online through the company's HR portal or the IRS website. Employees will need to log in using their employee ID and password to access the document.

- Mail: Whataburger will mail W2 forms to employees by January 31st of each year. Employees should ensure their address is up-to-date to receive the form promptly.

- HR Department: Employees can contact their HR representative to request a copy of their W2 form.

What Information Does the Whataburger W2 Form Contain?

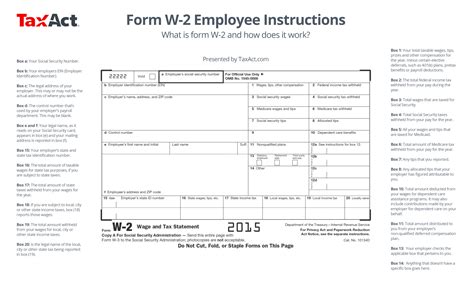

The Whataburger W2 form contains essential information about an employee's income and taxes withheld. The form is divided into several sections, including:

- Employee Information: This section includes the employee's name, address, and Social Security number or Taxpayer Identification Number (TIN).

- Employer Information: This section includes Whataburger's name, address, and Employer Identification Number (EIN).

- Wages and Taxes: This section reports the employee's total wages, tips, and taxes withheld, including federal income tax, Social Security tax, and Medicare tax.

- Tax Credits: This section lists any tax credits the employee is eligible for, such as the Earned Income Tax Credit (EITC).

Understanding the Different Boxes on the Whataburger W2 Form

The Whataburger W2 form contains several boxes that report different types of income and taxes withheld. Here's a breakdown of the most common boxes:

- Box 1: Wages, Tips, and Other Compensation: This box reports the employee's total wages, tips, and other compensation.

- Box 2: Federal Income Tax Withheld: This box reports the total federal income tax withheld from the employee's wages.

- Box 3: Social Security Wages: This box reports the employee's Social Security wages, which are subject to Social Security tax.

- Box 4: Social Security Tax Withheld: This box reports the total Social Security tax withheld from the employee's wages.

- Box 5: Medicare Wages: This box reports the employee's Medicare wages, which are subject to Medicare tax.

- Box 6: Medicare Tax Withheld: This box reports the total Medicare tax withheld from the employee's wages.

Common Issues with Whataburger W2 Forms

While the Whataburger W2 form is an essential document, employees may encounter issues with the form. Here are some common problems and solutions:

- Incorrect Social Security Number: If the Social Security number on the W2 form is incorrect, employees should contact the HR department to request a corrected form.

- Missing or Incorrect Information: If the W2 form is missing information or contains errors, employees should contact the HR department to request a corrected form.

- Delayed W2 Form: If the W2 form is not received by January 31st, employees should contact the HR department to request a copy.

Tips for Filing Taxes with Your Whataburger W2 Form

When filing taxes with your Whataburger W2 form, keep the following tips in mind:

- Verify Information: Ensure the information on the W2 form is accurate and complete.

- Report All Income: Report all income, including tips and other compensation, on your tax return.

- Claim Tax Credits: Claim any tax credits you are eligible for, such as the Earned Income Tax Credit (EITC).

- Consult a Tax Professional: If you are unsure about filing taxes or need assistance, consider consulting a tax professional.

Conclusion

The Whataburger W2 form is an essential document for employees to manage their taxes and ensure they receive the correct refund. By understanding the importance of the W2 form, how to obtain it, and what information it contains, employees can navigate the tax filing process with confidence. If you have any questions or concerns about your Whataburger W2 form, don't hesitate to reach out to the HR department or a tax professional for assistance.

Frequently Asked Questions

What is the deadline for receiving my Whataburger W2 form?

+Whataburger will mail W2 forms to employees by January 31st of each year.

How do I access my Whataburger W2 form online?

+Whataburger employees can access their W2 form online through the company's HR portal or the IRS website using their employee ID and password.

What if I encounter issues with my Whataburger W2 form?

+If you encounter issues with your W2 form, contact the HR department to request a corrected form or assistance with filing taxes.