Filing taxes can be a daunting task, especially for those who are new to the process or are unfamiliar with the specific requirements of their state. Louisiana, like many other states, has its own unique tax laws and regulations that must be followed when filing taxes. In this article, we will provide a comprehensive guide to filing Louisiana tax form, making it easier for you to navigate the process and ensure that you are in compliance with all state tax laws.

Whether you are a resident of Louisiana or a non-resident who earned income in the state, you are required to file a Louisiana tax return if your gross income exceeds a certain threshold. The threshold varies depending on your filing status and age, but generally, if you are single and under 65, you must file a return if your gross income is $12,000 or more. If you are married filing jointly and both spouses are under 65, you must file a return if your combined gross income is $24,000 or more.

Understanding the Different Types of Louisiana Tax Forms

Before we dive into the specifics of filing Louisiana tax form, it's essential to understand the different types of forms that are available. The Louisiana Department of Revenue offers several forms, including:

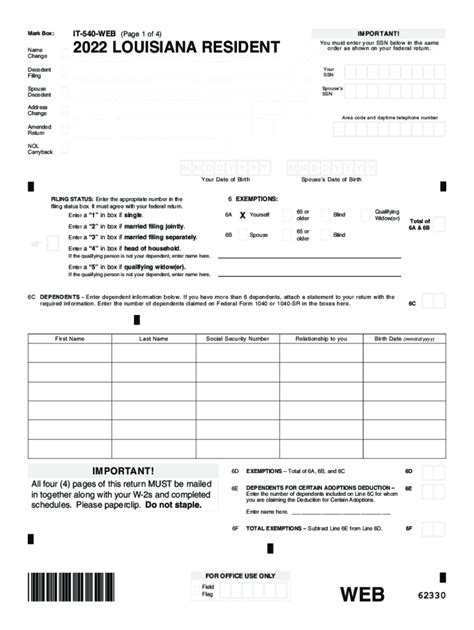

- Form IT-540: This is the standard Louisiana income tax return form for individuals.

- Form IT-540B: This form is used for non-residents and part-year residents who need to report income earned in Louisiana.

- Form IT-540ES: This form is used for estimated tax payments, which are required if you expect to owe more than $500 in taxes for the year.

Gathering Necessary Documents and Information

Before you start filling out your Louisiana tax form, it's crucial to gather all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs (if claiming dependents)

- W-2 forms from all employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

Filing Status and Exemptions

Your filing status and exemptions can significantly impact your tax liability. Louisiana recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You may also be eligible for certain exemptions, such as the standard exemption, personal exemption, or exemption for dependents.

Step-by-Step Guide to Filing Louisiana Tax Form

Now that we've covered the basics, let's move on to the step-by-step guide to filing Louisiana tax form.

Step 1: Determine Your Filing Status and Exemptions

As mentioned earlier, your filing status and exemptions can impact your tax liability. Take the time to review the different filing statuses and exemptions to ensure you are claiming the correct ones.

Step 2: Gather All Necessary Documents and Information

Make sure you have all the necessary documents and information before starting the filing process.

Step 3: Choose Your Filing Method

You can file your Louisiana tax return electronically or by mail. Electronic filing is generally faster and more convenient, but you can also file by mail if you prefer.

Step 4: Complete Form IT-540 or Other Relevant Forms

Fill out Form IT-540 or other relevant forms, such as Form IT-540B or Form IT-540ES, according to the instructions provided.

Step 5: Calculate Your Tax Liability

Use the tax tables or tax calculator to determine your tax liability.

Step 6: Pay Any Tax Due or Claim a Refund

If you owe taxes, you can pay online, by phone, or by mail. If you are due a refund, you can choose to receive it via direct deposit or check.

Common Mistakes to Avoid When Filing Louisiana Tax Form

When filing Louisiana tax form, there are several common mistakes to avoid, including:

- Failing to report all income

- Claiming incorrect exemptions or deductions

- Failing to sign and date the return

- Failing to include all required documentation

By avoiding these common mistakes, you can ensure a smooth and stress-free filing process.

Additional Resources and Support

If you need additional help or support with filing Louisiana tax form, there are several resources available, including:

- Louisiana Department of Revenue website

- Tax professionals and accountants

- Tax preparation software

Conclusion and Next Steps

Filing Louisiana tax form doesn't have to be a daunting task. By following the steps outlined in this guide, you can ensure a smooth and stress-free filing process. Remember to gather all necessary documents and information, choose your filing method, complete the relevant forms, calculate your tax liability, and pay any tax due or claim a refund. If you need additional help or support, don't hesitate to reach out to the resources available.

We encourage you to share your experiences and tips for filing Louisiana tax form in the comments section below. Your feedback and insights can help others navigate the process with ease.

What is the deadline for filing Louisiana tax form?

+The deadline for filing Louisiana tax form is typically April 15th of each year, but it may vary depending on the specific circumstances.

Can I file Louisiana tax form electronically?

+Yes, you can file Louisiana tax form electronically through the Louisiana Department of Revenue website or through tax preparation software.

What is the penalty for late filing of Louisiana tax form?

+The penalty for late filing of Louisiana tax form is typically 5% of the unpaid tax due, plus interest and any additional penalties.