As a taxpayer, you're likely familiar with the numerous forms and documents required to file your taxes. One such form is the 2210 tax form, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts form. This form is used to calculate and report any penalties for underpaying estimated taxes throughout the year. In this article, we'll delve into the details of the 2210 tax form, exploring its purpose, who needs to file it, and how to complete it accurately.

What is the 2210 Tax Form?

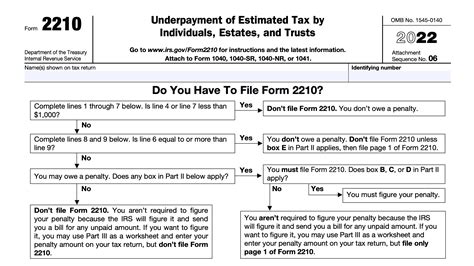

The 2210 tax form is an annual return used to report and calculate any penalties for underpaying estimated taxes. The form is used by individuals, estates, and trusts to determine if they owe any penalties for not making sufficient estimated tax payments throughout the year. The IRS requires taxpayers to make estimated tax payments each quarter if they expect to owe $1,000 or more in taxes for the year.

Who Needs to File the 2210 Tax Form?

Not everyone needs to file the 2210 tax form. You'll need to file this form if you're an individual, estate, or trust that meets any of the following conditions:

- You owe $1,000 or more in taxes for the year

- You didn't make any estimated tax payments throughout the year

- You made estimated tax payments, but they were insufficient to cover your tax liability

- You're subject to the annualized income installment method (more on this later)

Calculating the Underpayment Penalty

To calculate the underpayment penalty, you'll need to complete the 2210 tax form. Here's a step-by-step guide to help you calculate the penalty:

- Determine your total tax liability for the year

- Calculate your required annual payment, which is the lesser of 90% of your current year's tax liability or 100% of your prior year's tax liability (110% if your adjusted gross income is over $150,000)

- Calculate your total estimated tax payments made throughout the year

- Subtract your total estimated tax payments from your required annual payment to determine the underpayment amount

- Multiply the underpayment amount by the applicable penalty rate (typically 3.25% or 3.5% per quarter)

Annualized Income Installment Method

The annualized income installment method is an alternative method for calculating estimated tax payments. This method is used when you have a fluctuating income throughout the year, making it difficult to determine your estimated tax liability. To use this method, you'll need to file Form 2210 and complete Schedule AI.

Waiver of Penalty

In some cases, you may be eligible for a waiver of the underpayment penalty. To qualify, you'll need to meet one of the following conditions:

- You didn't owe any taxes in the prior tax year

- You're a first-time filer

- You experience a casualty, disaster, or other unusual circumstances that prevent you from making estimated tax payments

To request a waiver, you'll need to complete Form 2210 and attach a statement explaining the reasons for your waiver request.

Filing the 2210 Tax Form

To file the 2210 tax form, you'll need to follow these steps:

- Complete the form accurately and thoroughly

- Attach any required schedules or statements (such as Schedule AI for the annualized income installment method)

- Sign and date the form

- File the form with your annual tax return (Form 1040)

Tips and Reminders

Here are some tips and reminders to keep in mind when dealing with the 2210 tax form:

- Make timely estimated tax payments to avoid underpayment penalties

- Use Form 2210 to calculate and report any underpayment penalties

- Consider using the annualized income installment method if you have a fluctuating income

- Request a waiver of penalty if you meet the eligibility requirements

By understanding the 2210 tax form and following the steps outlined in this article, you can ensure accurate and timely filing of your estimated tax payments and avoid any potential penalties.

We hope this article has provided you with a comprehensive understanding of the 2210 tax form. If you have any questions or concerns, feel free to comment below. Don't forget to share this article with others who may find it helpful.

FAQ Section:

What is the purpose of the 2210 tax form?

+The 2210 tax form is used to calculate and report any penalties for underpaying estimated taxes throughout the year.

Who needs to file the 2210 tax form?

+Individuals, estates, and trusts that owe $1,000 or more in taxes for the year and didn't make sufficient estimated tax payments need to file the 2210 tax form.

How do I calculate the underpayment penalty?

+To calculate the underpayment penalty, you'll need to complete the 2210 tax form and follow the steps outlined in the article.