In today's fast-paced digital age, managing finances efficiently is crucial for individuals and businesses alike. One way to streamline financial transactions is by utilizing direct deposit services offered by reputable banking institutions like Wells Fargo. Direct deposit is a convenient and secure way to receive payments, including payroll, government benefits, and tax refunds, directly into your bank account. To set up direct deposit with Wells Fargo, you'll need to fill out a direct deposit form. In this article, we'll explore five ways to fill out the Wells Fargo direct deposit form, ensuring you can take advantage of this time-saving service.

Understanding the Importance of Direct Deposit

Before diving into the process of filling out the Wells Fargo direct deposit form, it's essential to understand the benefits of direct deposit. By choosing direct deposit, you can avoid the hassle of paper checks, reduce the risk of lost or stolen checks, and gain faster access to your funds. Additionally, direct deposit helps reduce the environmental impact of paper waste and supports a more sustainable financial system.

Option 1: Fill Out the Form Online

Wells Fargo offers a convenient online platform to fill out the direct deposit form. To access the form, follow these steps:

- Log in to your Wells Fargo online banking account.

- Navigate to the "Account Services" or "Direct Deposit" section.

- Click on the "Set up Direct Deposit" or "Enroll in Direct Deposit" option.

- Fill out the required information, including your account number, routing number, and deposit amount.

- Review and submit the form.

Benefits of Online Form Submission

- Quick and easy process

- Reduced risk of errors or lost paperwork

- Immediate confirmation of submission

Option 2: Visit a Wells Fargo Branch

If you prefer a more personal approach or need assistance with the form, you can visit a Wells Fargo branch near you. To fill out the form in-person, follow these steps:

- Locate a Wells Fargo branch in your area.

- Bring your account information and identification.

- Meet with a bank representative and request the direct deposit form.

- Fill out the form with the representative's assistance.

- Submit the completed form to the representative.

Benefits of In-Person Form Submission

- Personalized assistance from a bank representative

- Opportunity to ask questions and clarify any concerns

- Immediate submission and processing

Option 3: Call Wells Fargo Customer Service

If you prefer to fill out the form over the phone, you can contact Wells Fargo's customer service department. To fill out the form by phone, follow these steps:

- Call Wells Fargo's customer service number.

- Request the direct deposit form and provide your account information.

- Answer the representative's questions and provide required information.

- Confirm your submission and ask about any additional steps.

Benefits of Phone Form Submission

- Convenient and flexible option

- Opportunity to ask questions and clarify any concerns

- Quick and easy process

Option 4: Mail the Form

If you prefer to fill out the form manually and submit it by mail, you can do so by following these steps:

- Download and print the direct deposit form from the Wells Fargo website.

- Fill out the form accurately and completely.

- Sign and date the form.

- Mail the completed form to the address provided on the form.

Benefits of Mail Form Submission

- Flexibility to fill out the form at your own pace

- Opportunity to review and ensure accuracy before submission

- Permanent record of submission

Option 5: Use the Wells Fargo Mobile App

Wells Fargo offers a mobile app that allows you to manage your accounts and fill out the direct deposit form on-the-go. To fill out the form using the mobile app, follow these steps:

- Download and install the Wells Fargo mobile app.

- Log in to your account and navigate to the "Account Services" or "Direct Deposit" section.

- Click on the "Set up Direct Deposit" or "Enroll in Direct Deposit" option.

- Fill out the required information and review the form.

- Submit the form and receive confirmation.

Benefits of Mobile App Form Submission

- Convenient and flexible option

- Quick and easy process

- Access to your account information and transaction history

Regardless of the method you choose, filling out the Wells Fargo direct deposit form is a straightforward process that can help you streamline your finances and reduce the risk of lost or stolen checks. By following the steps outlined in this article, you can take advantage of the benefits of direct deposit and enjoy a more efficient financial experience.

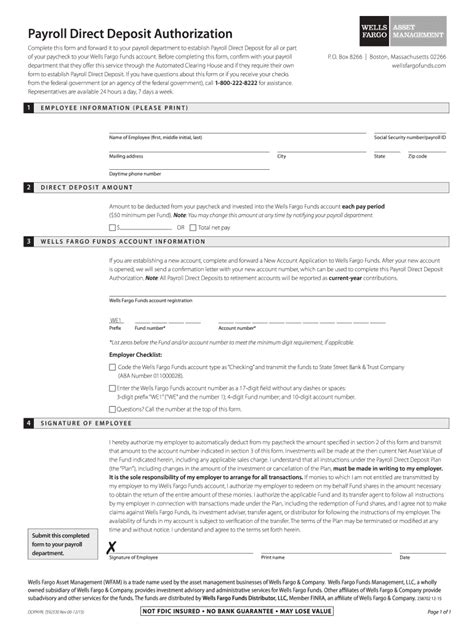

What is the Wells Fargo direct deposit form?

+The Wells Fargo direct deposit form is a document used to set up direct deposit services for payroll, government benefits, and tax refunds.

How do I fill out the Wells Fargo direct deposit form?

+You can fill out the form online, in-person at a Wells Fargo branch, by phone, by mail, or using the Wells Fargo mobile app.

What information do I need to provide on the direct deposit form?

+You'll need to provide your account number, routing number, and deposit amount, as well as your name and address.

We hope this article has provided you with a comprehensive guide to filling out the Wells Fargo direct deposit form. If you have any further questions or concerns, please don't hesitate to reach out to Wells Fargo's customer service department. By taking advantage of direct deposit services, you can simplify your financial transactions and enjoy a more streamlined banking experience.