As a Weis Markets employee, you're likely familiar with the importance of tax season and the role that your W2 form plays in it. Your W2 form is a crucial document that provides a snapshot of your income and tax withholdings for the year, making it essential for filing your taxes accurately. In this comprehensive guide, we'll walk you through everything you need to know about your Weis Markets W2 form, including how to access it, what information it contains, and how to use it to file your taxes.

What is a W2 Form?

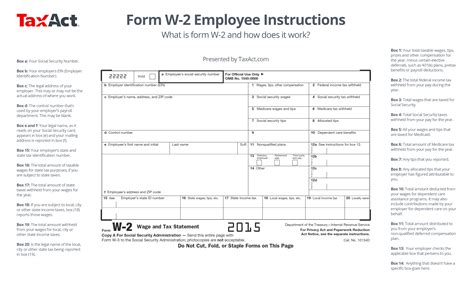

A W2 form, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees and the Social Security Administration (SSA) by the end of January each year. The form shows the amount of money you earned from your employer, as well as the amount of taxes withheld from your paycheck.

Why is My W2 Form Important?

Your W2 form is essential for filing your taxes accurately. The information on your W2 form is used to report your income and tax withholdings to the IRS, and it's also used to determine the amount of taxes you owe or the amount of your refund. Without your W2 form, you won't be able to file your taxes, and you may face delays or penalties.

How to Access Your Weis Markets W2 Form

As a Weis Markets employee, you can access your W2 form through the company's online portal or by contacting the HR department. Here are the steps to follow:

- Log in to the Weis Markets employee portal using your username and password.

- Click on the "Payroll" or "Benefits" tab, depending on the portal's layout.

- Look for the "W2 Form" or "Tax Documents" section.

- Click on the link to view or download your W2 form.

If you're having trouble accessing your W2 form online, you can contact the Weis Markets HR department for assistance.

What Information is on My W2 Form?

Your W2 form will contain the following information:

- Your name, address, and Social Security number

- Your employer's name, address, and Employer Identification Number (EIN)

- The amount of money you earned from your employer (Box 1)

- The amount of federal income tax withheld from your paycheck (Box 2)

- The amount of Social Security tax withheld from your paycheck (Box 4)

- The amount of Medicare tax withheld from your paycheck (Box 6)

- Any other relevant tax information, such as state or local taxes withheld

How to Use Your W2 Form to File Your Taxes

Using your W2 form to file your taxes is a straightforward process. Here are the steps to follow:

- Gather all your tax documents, including your W2 form, 1099 forms, and any other relevant documents.

- Choose a tax filing status, such as single, married filing jointly, or head of household.

- Report your income and tax withholdings on your tax return, using the information on your W2 form.

- Claim any deductions or credits you're eligible for, such as the earned income tax credit (EITC).

- File your tax return electronically or by mail, depending on your preference.

Tips for Filing Your Taxes Accurately

Here are some tips to help you file your taxes accurately:

- Double-check your W2 form for errors or discrepancies.

- Use tax software or consult with a tax professional if you're unsure about any part of the tax filing process.

- Keep accurate records of your tax documents, including your W2 form and tax return.

- File your tax return on time to avoid penalties and interest.

Common Errors to Avoid on Your W2 Form

Here are some common errors to avoid on your W2 form:

- Incorrect Social Security number or name

- Incorrect employer information

- Incorrect income or tax withholding amounts

- Failure to report all income or tax withholdings

What to Do if You Have Errors on Your W2 Form

If you notice errors on your W2 form, here are the steps to follow:

- Contact the Weis Markets HR department to report the error.

- Provide documentation to support the correction, such as a corrected W2 form or a letter from the employer.

- File an amended tax return (Form 1040X) to correct any errors on your original tax return.

Conclusion

Your Weis Markets W2 form is a critical document that plays a vital role in the tax filing process. By understanding what information is on your W2 form and how to use it to file your taxes, you can ensure an accurate and stress-free tax filing experience. Remember to double-check your W2 form for errors, use tax software or consult with a tax professional if needed, and file your tax return on time to avoid penalties and interest.

What is the deadline for receiving my W2 form?

+Employers are required to provide W2 forms to employees by January 31st of each year.

How do I correct errors on my W2 form?

+Contact the Weis Markets HR department to report the error and provide documentation to support the correction.

What if I don't receive my W2 form?

+Contact the Weis Markets HR department to request a replacement W2 form or to report the issue.