For partnerships, the Form 1065 is a crucial tax document that requires careful preparation and submission to the Internal Revenue Service (IRS). In this article, we will delve into the intricacies of the Form 1065 instructions, providing a comprehensive guide for partnerships to navigate the complex world of tax filing.

Understanding the Purpose of Form 1065

The Form 1065, also known as the U.S. Return of Partnership Income, is an annual information return that partnerships must file with the IRS. The primary purpose of this form is to report the partnership's income, deductions, and credits, as well as to provide information about the partners and their respective interests in the partnership.

Who Must File Form 1065?

The following types of partnerships are required to file Form 1065:

- General partnerships

- Limited partnerships

- Limited liability partnerships (LLPs)

- Limited liability companies (LLCs) that are treated as partnerships for tax purposes

Form 1065 Instructions: Step-by-Step Guide

To ensure accurate and complete filing, follow these step-by-step instructions:

Step 1: Gather Required Information

Before starting the Form 1065, gather the following information:

- Partnership name, address, and Employer Identification Number (EIN)

- Partners' names, addresses, and Social Security numbers or Individual Taxpayer Identification Numbers (ITINs)

- Partnership income, deductions, and credits

- Depreciation and amortization records

- Records of partnership distributions and capital contributions

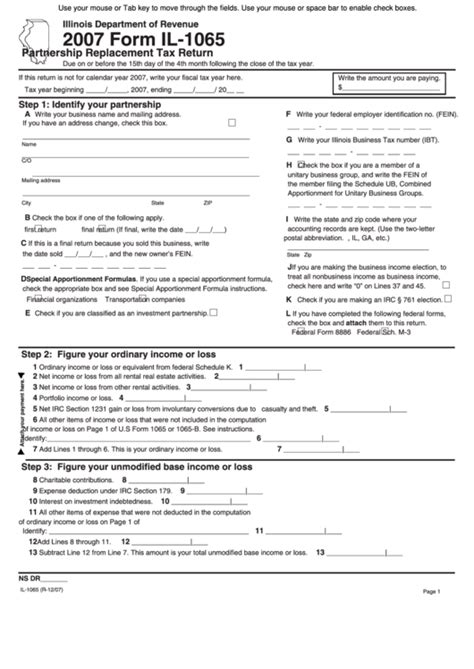

Step 2: Complete the Form 1065

Complete the Form 1065 by providing the required information, including:

- Partnership name, address, and EIN

- Partners' names, addresses, and Social Security numbers or ITINs

- Partnership income, deductions, and credits

- Depreciation and amortization records

- Records of partnership distributions and capital contributions

Step 3: Complete Schedules and Attachments

Complete the necessary schedules and attachments, including:

- Schedule B (Other Income)

- Schedule C (Additional Modifications to Taxable Income)

- Schedule D (Capital Gains and Losses)

- Schedule K-1 (Partner's Share of Income, Deductions, Credits, etc.)

Step 4: Sign and Date the Form

The partnership representative must sign and date the Form 1065.

Form 1065 Filing Requirements

The Form 1065 must be filed with the IRS by the 15th day of the fourth month following the end of the partnership's tax year. For example, if the partnership's tax year ends on December 31, the Form 1065 must be filed by April 15.

Extensions of Time to File

Partnerships can request an automatic six-month extension of time to file by submitting Form 7004. The extended due date will be the 15th day of the tenth month following the end of the partnership's tax year.

Penalties for Late Filing or Inaccurate Information

Partnerships that fail to file Form 1065 or provide inaccurate information may be subject to penalties, including:

- Late filing penalty: $205 per month or part of a month, up to a maximum of 12 months

- Accuracy-related penalty: 20% of the understated tax liability

Form 1065 Frequently Asked Questions

Q: What is the purpose of Form 1065?

A: The Form 1065 is an annual information return that partnerships must file with the IRS to report income, deductions, and credits.

Q: Who must file Form 1065?

A: General partnerships, limited partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs) that are treated as partnerships for tax purposes must file Form 1065.

Q: What is the deadline for filing Form 1065?

A: The Form 1065 must be filed with the IRS by the 15th day of the fourth month following the end of the partnership's tax year.

Q: Can I request an extension of time to file Form 1065?

A: Yes, partnerships can request an automatic six-month extension of time to file by submitting Form 7004.

Q: What are the penalties for late filing or inaccurate information?

A: Partnerships that fail to file Form 1065 or provide inaccurate information may be subject to penalties, including a late filing penalty and an accuracy-related penalty.

What is the purpose of Form 1065?

+The Form 1065 is an annual information return that partnerships must file with the IRS to report income, deductions, and credits.

Who must file Form 1065?

+General partnerships, limited partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs) that are treated as partnerships for tax purposes must file Form 1065.

What is the deadline for filing Form 1065?

+The Form 1065 must be filed with the IRS by the 15th day of the fourth month following the end of the partnership's tax year.

We hope this comprehensive guide to Form 1065 instructions has provided valuable insights and information for partnerships navigating the complex world of tax filing. By following these steps and understanding the requirements and penalties associated with Form 1065, partnerships can ensure accurate and timely filing. If you have any further questions or concerns, please don't hesitate to comment below.