The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is a crucial document that employers must file quarterly to report their federal income taxes, social security taxes, and Medicare taxes. Filing this form accurately and on time is essential to avoid penalties and interest. In this article, we will guide you through the process of filing Form 941 electronically with the IRS.

Benefits of E-Filing Form 941

E-filing Form 941 offers numerous benefits, including:

- Convenience: E-filing is a faster and more convenient way to file your tax return compared to paper filing.

- Accuracy: The IRS's electronic filing system checks your return for errors and inconsistencies, reducing the likelihood of errors.

- Speed: E-filing allows you to receive your refund faster, typically within 1-2 weeks.

- Security: E-filing is a secure way to file your tax return, reducing the risk of identity theft and other security breaches.

- Environmentally Friendly: E-filing reduces paper waste and minimizes the carbon footprint of the tax filing process.

How to E-File Form 941

To e-file Form 941, you will need to follow these steps:

- Gather Required Information: Before you start the e-filing process, make sure you have all the necessary information, including:

- Your employer identification number (EIN)

- Your business name and address

- Your tax liability for the quarter

- Your payment information (if applicable)

- Choose an E-File Option: The IRS offers two e-file options:

- IRS Free File: If your annual gross receipts are $200,000 or less, you may be eligible for the IRS Free File program.

- Authorized IRS e-File Provider: You can also use an authorized IRS e-file provider, such as TurboTax or QuickBooks, to e-file your Form 941.

- Prepare Your Return: Use the e-file option you have chosen to prepare your Form 941. Make sure to complete all the required fields and schedules.

- Submit Your Return: Once you have prepared your return, submit it to the IRS electronically.

IRS Requirements for E-Filing Form 941

To e-file Form 941, you must meet the following IRS requirements:

- Electronic Filing Requirements: You must have a minimum of 250 returns to file electronically. If you have fewer than 250 returns, you can still e-file voluntarily.

- EIN Requirements: You must have an EIN to e-file Form 941.

- Tax Year Requirements: You must file Form 941 for the correct tax year.

Schedules and Attachments

When e-filing Form 941, you may need to attach schedules and other supporting documentation, including:

- Schedule B: Report your tax liability for the quarter.

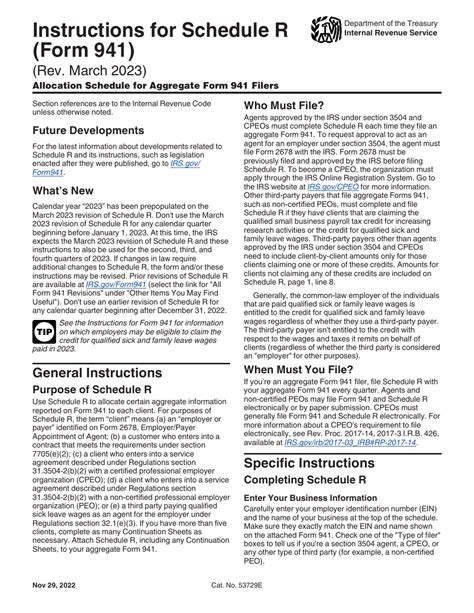

- Schedule R: Report your tax liability for the quarter if you are a railroad employer.

- Form 8974: Report your qualified small business payroll tax credit.

Payment Options

If you owe taxes, you can pay electronically using:

- Electronic Federal Tax Payment System (EFTPS): Make online payments through the EFTPS system.

- Credit or Debit Card: Pay using a credit or debit card through an approved payment processor.

Tips for E-Filing Form 941

To ensure a smooth e-filing experience, follow these tips:

- File on Time: File your Form 941 on or before the due date to avoid penalties and interest.

- Double-Check Your Return: Review your return carefully to ensure accuracy and completeness.

- Use the Correct EIN: Use the correct EIN on your return to avoid errors and delays.

Common Errors to Avoid

When e-filing Form 941, avoid the following common errors:

- Incorrect EIN: Using an incorrect EIN can delay processing and lead to errors.

- Incorrect Tax Year: Filing for the incorrect tax year can lead to delays and penalties.

- Incomplete or Inaccurate Information: Incomplete or inaccurate information can delay processing and lead to errors.

Conclusion

E-filing Form 941 is a convenient and efficient way to report your federal income taxes, social security taxes, and Medicare taxes. By following the steps outlined in this article and avoiding common errors, you can ensure a smooth e-filing experience. Remember to file on time, double-check your return, and use the correct EIN to avoid delays and penalties.

Frequently Asked Questions

What is the due date for filing Form 941?

+The due date for filing Form 941 is the last day of the month following the end of the quarter.

Can I file Form 941 electronically if I have fewer than 250 returns?

+Yes, you can still e-file voluntarily if you have fewer than 250 returns.

What is the Electronic Federal Tax Payment System (EFTPS)?

+The EFTPS is an online system that allows you to make electronic payments to the IRS.