The world of court forms can be overwhelming, especially when dealing with complex issues like property rights and financial obligations. One such form that often sparks confusion is the FL-120 form in California. As a crucial document in family law cases, it's essential to understand its significance and how it impacts your rights and responsibilities.

In California, family law cases often involve complex financial arrangements, property divisions, and child custody agreements. Amidst the chaos, forms like the FL-120 can seem daunting. However, grasping its purpose and contents can empower you to navigate the court system more effectively.

What is the FL-120 Form in California?

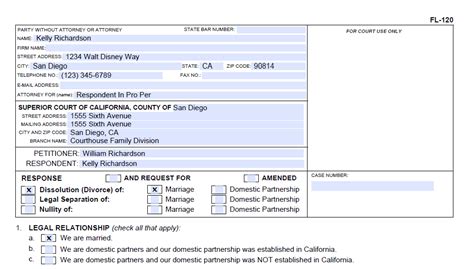

The FL-120 form, also known as the "Declaration of Disclosure," is a mandatory document in California family law cases. Its primary purpose is to provide a comprehensive disclosure of financial information between spouses or partners in a marital or domestic partnership dissolution. This form helps ensure that both parties have a clear understanding of their financial obligations, assets, and debts.

Who Needs to Complete the FL-120 Form?

In California, both spouses or partners in a marital or domestic partnership dissolution are required to complete the FL-120 form. This includes:

- Spouses in a divorce or separation

- Domestic partners in a dissolution of partnership

- Parties in a legal separation or annulment

It's essential to note that even if you're not contesting the divorce or separation, you still need to complete this form to ensure that you've made a full disclosure of your financial information.

What Information is Required on the FL-120 Form?

The FL-120 form requires you to disclose a wide range of financial information, including:

- Income and expenses

- Assets, such as:

- Real property

- Personal property

- Investments

- Retirement accounts

- Debts and liabilities

- Employment information

- Business interests

- Other financial obligations

This information helps the court to make informed decisions about property division, spousal support, and other financial arrangements.

Consequences of Not Completing the FL-120 Form

Failure to complete the FL-120 form can result in severe consequences, including:- Sanctions or penalties

- Delays in the court process

- Incomplete or inaccurate financial disclosure

- Potential loss of rights or benefits

It's essential to take the FL-120 form seriously and provide accurate and complete information to avoid these consequences.

How to Complete the FL-120 Form

To complete the FL-120 form, follow these steps:

- Download the form from the California Courts website or obtain a copy from your local court.

- Read the instructions carefully and ensure you understand what information is required.

- Gather all necessary financial documents and information.

- Complete the form accurately and thoroughly.

- Sign and date the form.

- Serve the form on the other party.

- File the form with the court.

It's recommended that you seek the advice of an attorney or a qualified family law professional to ensure that you complete the form correctly and accurately.

Additional Tips and Reminders

- Make sure to keep a copy of the completed form for your records.

- Serve the form on the other party within the required timeframe (usually 60 days).

- File the form with the court and obtain a proof of filing.

- Be prepared to provide additional information or documentation if requested by the court.

By understanding the FL-120 form and its significance in California family law cases, you can ensure that you're prepared for the court process and empowered to make informed decisions about your financial rights and responsibilities.

We encourage you to share your experiences or ask questions about the FL-120 form in the comments below. If you found this article informative, please share it with others who may benefit from this information.

What is the purpose of the FL-120 form in California?

+The FL-120 form, also known as the "Declaration of Disclosure," is a mandatory document in California family law cases that provides a comprehensive disclosure of financial information between spouses or partners in a marital or domestic partnership dissolution.

Who needs to complete the FL-120 form?

+Both spouses or partners in a marital or domestic partnership dissolution are required to complete the FL-120 form, including those in a divorce, separation, or annulment.

What information is required on the FL-120 form?

+The FL-120 form requires disclosure of financial information, including income and expenses, assets, debts, employment information, business interests, and other financial obligations.