Understanding the W2 form is essential for both employees and employers in the United States. The W2 form, also known as the Wage and Tax Statement, is a crucial document that reports an employee's income and taxes withheld from their paycheck. In this article, we will explore five ways to understand the W2 form and its significance in the tax filing process.

What is a W2 Form?

A W2 form is a document that employers are required to provide to their employees and the Social Security Administration (SSA) by January 31st of each year. The form reports an employee's income, taxes withheld, and other relevant tax information for the previous tax year. The W2 form is used to calculate an employee's tax liability and to determine the amount of taxes owed or refunded.

Key Components of a W2 Form

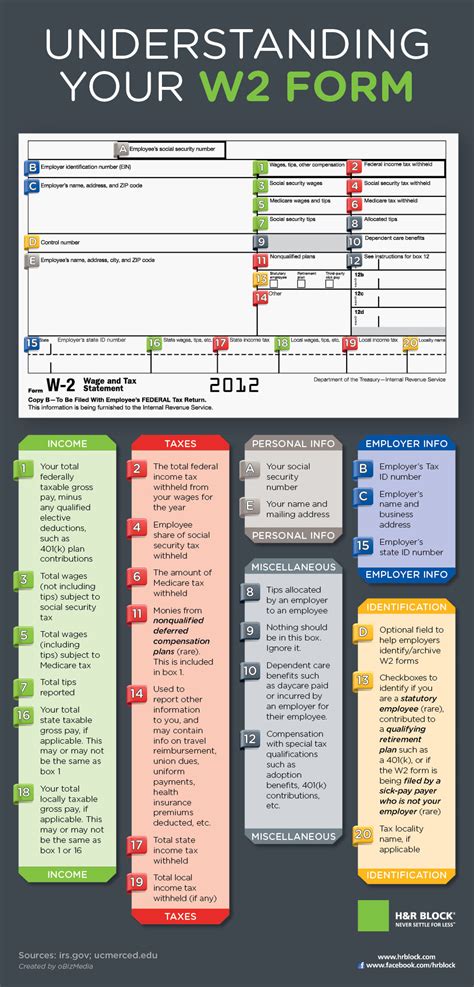

A W2 form typically includes the following information:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Employee's income and taxes withheld from their paycheck

- Other relevant tax information, such as tips reported and dependent care benefits

Why is a W2 Form Important?

A W2 form is essential for both employees and employers for several reasons:

- Tax Filing: A W2 form is required to file an individual's tax return. The form provides the necessary information to calculate an employee's tax liability and to determine the amount of taxes owed or refunded.

- Tax Withholding: A W2 form shows the amount of taxes withheld from an employee's paycheck. This information is used to calculate an employee's tax liability and to determine if they need to make adjustments to their tax withholding.

- Social Security Benefits: A W2 form is used to calculate an employee's Social Security benefits. The form reports an employee's income and taxes withheld, which are used to determine their Social Security benefits.

How to Read a W2 Form

Reading a W2 form can be confusing, but it's essential to understand the information reported. Here are the key components of a W2 form and how to read them:

- Box 1: Gross income

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

What to Do if You Don't Receive a W2 Form

If you don't receive a W2 form by January 31st, you should contact your employer to request a copy. If your employer is unable to provide a copy, you can contact the SSA for assistance. You can also use Form 4852, Substitute for Form W-2, to estimate your income and taxes withheld.

Common Issues with W2 Forms

Common issues with W2 forms include:

- Incorrect Information: If the information on your W2 form is incorrect, you should contact your employer to request a corrected copy.

- Missing Information: If your W2 form is missing information, such as your Social Security number or employer's EIN, you should contact your employer to request a corrected copy.

- Lost or Stolen W2 Form: If your W2 form is lost or stolen, you should contact your employer to request a replacement copy.

Conclusion

Understanding the W2 form is essential for both employees and employers. The form provides critical information for tax filing and Social Security benefits. By knowing how to read a W2 form and what to do if you don't receive one, you can ensure that you're in compliance with tax laws and regulations. If you have any questions or concerns about W2 forms, don't hesitate to reach out to a tax professional or the SSA for assistance.

We hope this article has helped you understand the W2 form and its significance in the tax filing process. If you have any questions or comments, please feel free to share them below.

What is the deadline for employers to provide W2 forms to employees?

+Employers are required to provide W2 forms to employees by January 31st of each year.

What information is reported on a W2 form?

+A W2 form reports an employee's income, taxes withheld, and other relevant tax information for the previous tax year.

What should I do if I don't receive a W2 form?

+If you don't receive a W2 form, you should contact your employer to request a copy. If your employer is unable to provide a copy, you can contact the SSA for assistance.