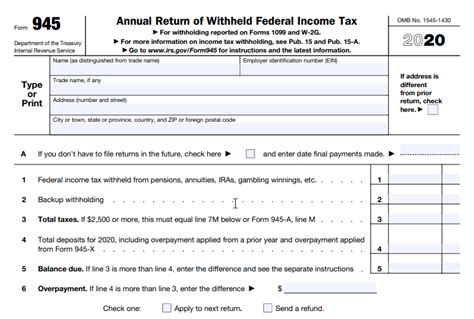

The Form 945 is a crucial document for the Internal Revenue Service (IRS) that is used to report and pay federal income tax withheld from nonpayroll payments, such as backup withholding and withholding on pensions, annuities, and certain other deferred income. Filing this form accurately and on time is essential for individuals and businesses to avoid penalties and interest.

Understanding Form 945

Form 945 is an annual return that reports the total amount of federal income tax withheld from nonpayroll payments during the calendar year. This form is typically filed by January 31st of each year, covering the preceding tax year. The form is used to report the total amount of tax withheld, as well as any deposits made to the IRS during the year.

Who Needs to File Form 945?

Not everyone needs to file Form 945. Generally, the following individuals and businesses are required to file this form:

- Payers of nonpayroll payments, such as pensions, annuities, and certain other deferred income

- Withholding agents who withheld federal income tax from nonpayroll payments

- Businesses that made deposits to the IRS for federal income tax withheld from nonpayroll payments

How to Complete Form 945

Completing Form 945 requires accurate and detailed information about the nonpayroll payments made during the tax year. Here are the steps to follow:

- Gather required information: Collect all relevant documents, including Form W-2, Form 1099, and any other records showing nonpayroll payments and tax withheld.

- Complete Part 1: Report the total amount of federal income tax withheld from nonpayroll payments, as well as any deposits made to the IRS during the year.

- Complete Part 2: Report the total amount of tax withheld from each type of nonpayroll payment, such as pensions, annuities, and deferred income.

- Sign and date the form: Ensure the form is signed and dated by the appropriate individual or authorized representative.

Tips for Filing Form 945

- File the form on time to avoid penalties and interest.

- Ensure accurate and complete information to avoid errors and delays.

- Use the IRS's online filing system, the Electronic Federal Tax Payment System (EFTPS), to make deposits and file the form electronically.

- Keep accurate records of all nonpayroll payments and tax withheld, as well as any deposits made to the IRS.

Filing Form 945 Online

Filing Form 945 online is a convenient and efficient way to submit the form and make deposits to the IRS. Here are the steps to follow:

- Create an EFTPS account: Register for an EFTPS account on the IRS's website.

- Gather required information: Collect all relevant documents, including Form W-2, Form 1099, and any other records showing nonpayroll payments and tax withheld.

- Complete the online form: Enter the required information into the online form, following the prompts and instructions provided.

- Submit the form: Submit the completed form and make any necessary deposits to the IRS.

Benefits of Filing Form 945 Online

- Convenience: File the form from anywhere with an internet connection.

- Efficiency: Reduce paperwork and processing time.

- Accuracy: Minimize errors and delays.

- Security: Ensure the security and confidentiality of your tax information.

Common Errors to Avoid When Filing Form 945

When filing Form 945, it's essential to avoid common errors that can delay processing and result in penalties. Here are some errors to watch out for:

- Inaccurate or incomplete information: Ensure all required information is accurate and complete.

- Late filing: File the form on time to avoid penalties and interest.

- Insufficient deposits: Make timely and sufficient deposits to the IRS to avoid penalties and interest.

Tips for Avoiding Errors

- Double-check all information for accuracy and completeness.

- File the form on time to avoid penalties and interest.

- Make timely and sufficient deposits to the IRS.

Conclusion

Filing Form 945 is a critical step in reporting and paying federal income tax withheld from nonpayroll payments. By understanding the form, gathering required information, and completing the form accurately, individuals and businesses can avoid penalties and interest. Filing online through the EFTPS system is a convenient and efficient way to submit the form and make deposits to the IRS. By following these tips and avoiding common errors, you can ensure a smooth and successful filing process.

Who needs to file Form 945?

+Payers of nonpayroll payments, such as pensions, annuities, and certain other deferred income, as well as withholding agents who withheld federal income tax from nonpayroll payments, and businesses that made deposits to the IRS for federal income tax withheld from nonpayroll payments.

What is the deadline for filing Form 945?

+January 31st of each year, covering the preceding tax year.

Can I file Form 945 online?

+Yes, you can file Form 945 online through the IRS's Electronic Federal Tax Payment System (EFTPS).