The Bureau of Internal Revenue (BIR) has implemented various forms to facilitate tax compliance and reporting in the Philippines. One such form is the BIR Form 1904, which is used to report certain transactions and obtain certification from the BIR. In this article, we will delve into the essential things to know about BIR Form 1904.

Who Needs to File BIR Form 1904?

BIR Form 1904 is primarily used by individuals and businesses to report certain transactions and obtain certification from the BIR. Specifically, this form is used to report the following transactions:

- Registration of new businesses or individuals

- Cancellation of business registration

- Amendment of business registration

- Transfer of ownership or change of business name

Individuals and businesses that are required to file BIR Form 1904 include:

- Newly registered businesses

- Businesses that have undergone changes in ownership or structure

- Businesses that have changed their name or address

- Individuals who have started or ceased a business

What are the Requirements for Filing BIR Form 1904?

To file BIR Form 1904, the following requirements must be met:

- The taxpayer must be registered with the BIR

- The taxpayer must have a valid Tax Identification Number (TIN)

- The taxpayer must have the necessary documents and information to support the report

The required documents and information may include:

- Business registration documents

- Proof of identity and residency

- Proof of business ownership or structure

- Other relevant documents and information

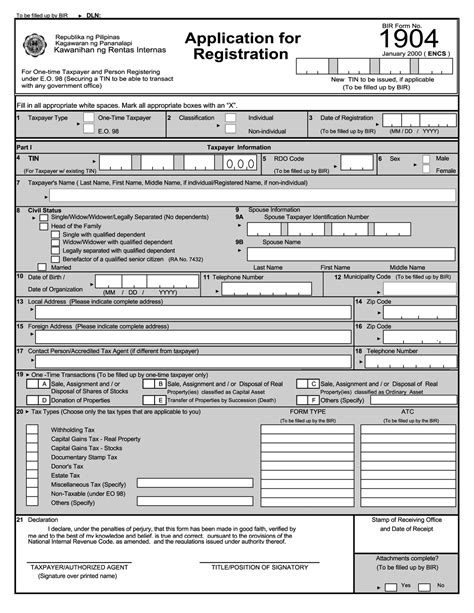

How to Fill Out BIR Form 1904?

Filling out BIR Form 1904 requires careful attention to detail and accuracy. The form is divided into several sections, each requiring specific information and documentation. Here is a general guide on how to fill out the form:

- Section 1: Taxpayer Information

- Enter the taxpayer's name, TIN, and address

- Enter the taxpayer's business name and address (if applicable)

- Section 2: Report of Transaction

- Enter the type of transaction being reported (e.g. registration, cancellation, amendment)

- Enter the date of the transaction

- Enter the relevant details of the transaction

- Section 3: Supporting Documents

- Attach the required supporting documents (e.g. business registration documents, proof of identity and residency)

- Ensure that the documents are certified true and correct

What are the Penalties for Non-Compliance?

Failure to file BIR Form 1904 or submitting inaccurate or incomplete information can result in penalties and fines. The BIR may impose the following penalties:

- P1,000 to P50,000 for failure to file or submit incomplete information

- P50,000 to P100,000 for submission of false or fraudulent information

- Imprisonment of up to 6 years for willful failure to file or submission of false or fraudulent information

What are the Benefits of Filing BIR Form 1904?

Filing BIR Form 1904 provides several benefits, including:

- Compliance with tax laws and regulations

- Avoidance of penalties and fines

- Obtainment of certification from the BIR

- Enhanced credibility and legitimacy of the business

Additionally, filing BIR Form 1904 can also help businesses to:

- Establish a good tax compliance record

- Facilitate future transactions and dealings with the BIR

- Avoid potential tax disputes and controversies

How to Submit BIR Form 1904?

BIR Form 1904 can be submitted to the BIR through the following channels:

- Manual submission at the BIR office

- Electronic submission through the BIR's online portal

- Submission through authorized agent or representative

It is recommended to submit the form through the electronic channel to avoid delays and ensure accuracy.

In conclusion, BIR Form 1904 is an essential document for individuals and businesses in the Philippines to report certain transactions and obtain certification from the BIR. By understanding the requirements, filling out the form accurately, and submitting it on time, taxpayers can avoid penalties and fines and enjoy the benefits of tax compliance.

We hope this article has provided you with a comprehensive understanding of BIR Form 1904. If you have any questions or concerns, please feel free to comment below. Don't forget to share this article with your friends and colleagues who may find it useful.

What is the purpose of BIR Form 1904?

+BIR Form 1904 is used to report certain transactions and obtain certification from the BIR.

Who needs to file BIR Form 1904?

+Individuals and businesses that are required to register with the BIR or report certain transactions.

What are the requirements for filing BIR Form 1904?

+The taxpayer must be registered with the BIR, have a valid TIN, and provide the necessary documents and information to support the report.