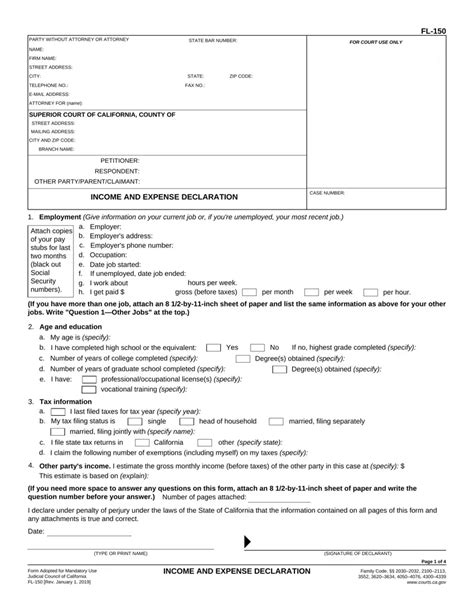

The FL-150 form, also known as the Income and Expense Declaration, is a crucial document in California family law cases. It is used to provide a detailed picture of a party's financial situation, including their income, expenses, assets, and debts. Filling out the FL-150 form correctly is essential to ensure that the court has an accurate understanding of your financial situation, which can impact various aspects of your case, such as spousal support, child support, and property division.

Failing to complete the form accurately can lead to delays, additional costs, and even sanctions. In this article, we will guide you through the process of filling out the FL-150 form correctly, highlighting the most common mistakes to avoid and providing practical tips to ensure you get it right.

Understanding the FL-150 Form

Before we dive into the specifics of filling out the form, it's essential to understand its purpose and structure. The FL-150 form is divided into several sections, each designed to capture different aspects of your financial situation.

The form is typically used in family law cases, such as divorce, legal separation, or child custody disputes. It is usually required by the court to help determine the financial circumstances of each party, which can impact various aspects of the case.

Section 1: Income

The first section of the FL-150 form requires you to list all sources of income, including employment, self-employment, investments, and any other regular income. You will need to provide details about your income, such as the source, frequency, and amount.

When filling out this section, make sure to:

- Include all sources of income, no matter how small or irregular

- Provide accurate and detailed information about each income source

- Attach supporting documentation, such as pay stubs or tax returns, to verify your income

Section 2: Expenses

The second section of the FL-150 form requires you to list all your monthly expenses, including rent/mortgage, utilities, food, transportation, and any other regular expenses. You will need to provide details about each expense, such as the amount and frequency.

When filling out this section, make sure to:

- Include all regular expenses, no matter how small or irregular

- Provide accurate and detailed information about each expense

- Attach supporting documentation, such as receipts or invoices, to verify your expenses

5 Ways to Fill Out the FL-150 Form Correctly

Filling out the FL-150 form correctly requires attention to detail, accuracy, and completeness. Here are five ways to ensure you get it right:

- Gather all necessary documents: Before starting to fill out the form, gather all necessary documents, such as pay stubs, tax returns, receipts, and invoices. This will help you provide accurate and detailed information about your income and expenses.

- Be thorough and accurate: Take your time when filling out the form, and make sure to include all sources of income and expenses. Double-check your calculations and ensure that your entries are accurate and consistent.

- Use supporting documentation: Attach supporting documentation to verify your income and expenses. This can include pay stubs, tax returns, receipts, and invoices.

- Be consistent: Use the same format and terminology throughout the form. For example, if you use a specific term to describe a particular income source, use the same term throughout the form.

- Seek help if needed: If you are unsure about how to fill out the form or need help with a particular section, consider seeking the advice of a family law attorney or a financial advisor.

Common Mistakes to Avoid

When filling out the FL-150 form, there are several common mistakes to avoid:

- Omitting income or expenses: Failing to include all sources of income or expenses can lead to an inaccurate picture of your financial situation.

- Providing incomplete or inaccurate information: Failing to provide complete or accurate information about your income or expenses can lead to delays or additional costs.

- Not attaching supporting documentation: Failing to attach supporting documentation can make it difficult for the court to verify your income and expenses.

Conclusion

Filling out the FL-150 form correctly is crucial to ensure that the court has an accurate understanding of your financial situation. By following the tips and guidelines outlined in this article, you can avoid common mistakes and ensure that your form is complete, accurate, and thorough.

Remember to take your time, be thorough, and seek help if needed. Don't hesitate to ask questions or seek clarification if you are unsure about any aspect of the form.

What is the purpose of the FL-150 form?

+The FL-150 form, also known as the Income and Expense Declaration, is used to provide a detailed picture of a party's financial situation, including their income, expenses, assets, and debts.

What are the common mistakes to avoid when filling out the FL-150 form?

+Common mistakes to avoid include omitting income or expenses, providing incomplete or inaccurate information, and not attaching supporting documentation.

What should I do if I am unsure about how to fill out the FL-150 form?

+If you are unsure about how to fill out the form, consider seeking the advice of a family law attorney or a financial advisor.