The state of Hawaii has a unique tax system, and one of the key forms businesses need to file is the General Excise Tax Form G-45. In this article, we will provide a comprehensive guide to help you understand the purpose of this form, who needs to file it, and the steps to complete it accurately.

What is the General Excise Tax Form G-45?

The General Excise Tax Form G-45 is a tax return form used by the state of Hawaii to report and pay the General Excise Tax (GET). The GET is a tax on the gross income of businesses operating in Hawaii, and it's similar to a sales tax in other states. The form is used to report the taxable gross income, deductions, and tax liability for a specific period.

Who Needs to File the General Excise Tax Form G-45?

Businesses that are required to file the General Excise Tax Form G-45 include:

- Sole proprietorships

- Partnerships

- Corporations

- Limited liability companies (LLCs)

- Other business entities that have a taxable presence in Hawaii

If your business is subject to the GET, you need to file the Form G-45 even if you don't have any tax liability. Failure to file the form can result in penalties and fines.

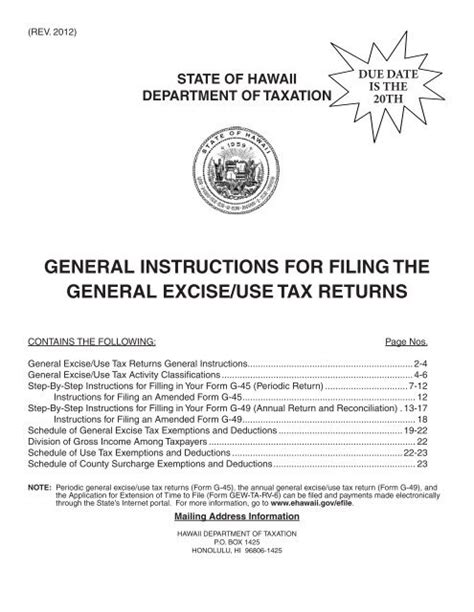

**When is the General Excise Tax Form G-45 Due?**

The General Excise Tax Form G-45 is typically due on the 20th day of the month following the end of the reporting period. For example, if you're filing for the month of January, the form is due on February 20th. You can file the form electronically or by mail.

How to Complete the General Excise Tax Form G-45

To complete the General Excise Tax Form G-45, you'll need to provide the following information:

- Business Information: Enter your business name, address, and tax identification number.

- Reporting Period: Enter the reporting period for which you're filing the form.

- Gross Income: Report your total gross income for the reporting period.

- Deductions: Claim any allowable deductions, such as cost of goods sold, salaries, and wages.

- Taxable Income: Calculate your taxable income by subtracting deductions from gross income.

- Tax Liability: Calculate your tax liability by multiplying the taxable income by the applicable tax rate.

- Payments and Credits: Report any payments or credits made during the reporting period.

**Additional Schedules and Attachments**

Depending on your business type and activities, you may need to complete additional schedules and attachments, such as:

- Schedule A: Cost of Goods Sold

- Schedule B: Deductions

- Schedule C: Tax Credits

- Schedule D: Additional Taxes and Fees

Tips for Filing the General Excise Tax Form G-45

- Make sure to file the form on time to avoid penalties and fines.

- Keep accurate records and documentation to support your tax return.

- Use the correct tax rates and calculations to avoid errors.

- Consider consulting a tax professional if you're unsure about any aspect of the form.

**Common Mistakes to Avoid**

When filing the General Excise Tax Form G-45, avoid the following common mistakes:

- Failing to report all gross income

- Claiming incorrect or unallowable deductions

- Miscalculating tax liability

- Failing to file additional schedules and attachments

- Missing the filing deadline

Conclusion

Filing the General Excise Tax Form G-45 is a critical task for businesses operating in Hawaii. By understanding the purpose of the form, who needs to file it, and the steps to complete it accurately, you can ensure compliance with Hawaii's tax laws and avoid costly mistakes. Remember to file the form on time, keep accurate records, and seek professional help if needed.

Take Action

If you have any questions or concerns about filing the General Excise Tax Form G-45, please leave a comment below or share this article with others who may benefit from it. Stay informed and stay compliant with Hawaii's tax laws!

What is the General Excise Tax (GET) in Hawaii?

+The General Excise Tax (GET) is a tax on the gross income of businesses operating in Hawaii. It's similar to a sales tax in other states.

Who needs to file the General Excise Tax Form G-45?

+Businesses that are subject to the GET, including sole proprietorships, partnerships, corporations, LLCs, and other business entities with a taxable presence in Hawaii.

What is the deadline for filing the General Excise Tax Form G-45?

+The form is typically due on the 20th day of the month following the end of the reporting period.