As a business owner or independent contractor in Texas, you've likely encountered a W-9 form at some point. This crucial document plays a vital role in ensuring compliance with federal tax laws and regulations. In this article, we'll delve into five essential facts about W-9 forms in Texas, providing you with a comprehensive understanding of their importance, requirements, and best practices.

What is a W-9 Form?

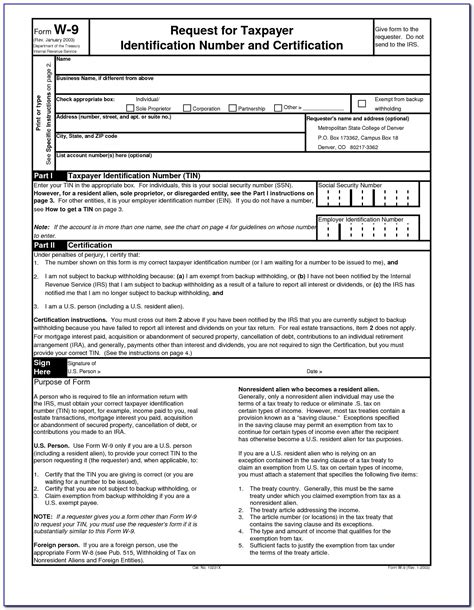

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the Internal Revenue Service (IRS) to verify the identity and tax status of individuals and businesses. It's typically required when working with freelancers, independent contractors, or vendors who will receive payments from your business.

Why Do I Need a W-9 Form in Texas?

In Texas, businesses are required to obtain a completed W-9 form from each independent contractor or freelancer before making payments to them. This ensures that the business can accurately report income and withhold taxes as required by the IRS. Failure to obtain a W-9 form can result in penalties and fines, making it essential to understand the requirements and deadlines.

Consequences of Not Obtaining a W-9 Form

- Back-up withholding: If you don't have a W-9 form on file, you may be required to withhold 24% of the payment and remit it to the IRS.

- Penalties and fines: You may be subject to penalties and fines for failure to comply with IRS regulations.

- Loss of tax benefits: Without a W-9 form, you may not be able to claim tax deductions or credits related to the payment.

How to Complete a W-9 Form in Texas

Completing a W-9 form in Texas is relatively straightforward. Here's a step-by-step guide:

- Download the W-9 form from the IRS website or use a template provided by your business.

- Provide your business name, address, and taxpayer identification number (TIN).

- Certify your tax classification (individual, sole proprietor, partnership, S corporation, C corporation, etc.).

- Sign and date the form.

- Return the completed form to the business requesting it.

Common Mistakes to Avoid When Completing a W-9 Form

- Inaccurate or incomplete information

- Failure to sign and date the form

- Using an outdated version of the W-9 form

W-9 Form Deadlines and Requirements in Texas

In Texas, the deadlines and requirements for W-9 forms vary depending on the specific situation. Here are some key considerations:

- New vendors or contractors: Obtain a completed W-9 form before making payments.

- Existing vendors or contractors: Update W-9 forms every three years or when information changes.

- Payment thresholds: You may need to file a Form 1099-MISC if you pay an independent contractor $600 or more in a calendar year.

W-9 Form Storage and Record-Keeping in Texas

Proper storage and record-keeping of W-9 forms are essential to maintain compliance with IRS regulations. Here are some best practices:

- Store W-9 forms electronically or in a secure physical location.

- Maintain accurate and up-to-date records.

- Ensure confidentiality and security of sensitive information.

By understanding these essential facts about W-9 forms in Texas, you can ensure compliance with federal tax laws and regulations, avoid penalties and fines, and maintain a smooth working relationship with independent contractors and vendors.

We hope this article has provided you with valuable insights into the world of W-9 forms in Texas. If you have any further questions or concerns, please don't hesitate to reach out.

What is the purpose of a W-9 form?

+The purpose of a W-9 form is to verify the identity and tax status of individuals and businesses, ensuring compliance with federal tax laws and regulations.

How often do I need to update W-9 forms in Texas?

+You should update W-9 forms every three years or when information changes, such as a change in business name or address.

What are the consequences of not obtaining a W-9 form in Texas?

+The consequences of not obtaining a W-9 form in Texas include back-up withholding, penalties and fines, and loss of tax benefits.