The Form 8886, Reportable Transaction Disclosure Statement, is a crucial document that taxpayers must submit to the Internal Revenue Service (IRS) when engaging in certain reportable transactions. These transactions often involve complex tax planning strategies or schemes that may be considered abusive or potentially non-compliant with tax laws. In this article, we will delve into the Form 8886 instructions, providing a step-by-step guide to help taxpayers navigate this process.

Understanding Reportable Transactions

Before diving into the Form 8886 instructions, it's essential to understand what constitutes a reportable transaction. The IRS identifies several types of transactions that require disclosure, including:

- Listed transactions: These are transactions specifically identified by the IRS as potentially abusive or non-compliant.

- Confidential transactions: These are transactions where the taxpayer has a confidentiality agreement with the promoter or advisor.

- Transactions with contractual protection: These are transactions where the taxpayer has a contractual agreement that limits their liability or provides other benefits.

Identifying Reportable Transactions

To determine if a transaction is reportable, taxpayers should consider the following factors:

- Is the transaction listed by the IRS as a reportable transaction?

- Is the transaction confidential or subject to a confidentiality agreement?

- Does the transaction involve contractual protection?

If a taxpayer answers "yes" to any of these questions, they may be required to file Form 8886.

Form 8886 Instructions: A Step-By-Step Guide

Filing Form 8886 can be a complex process, but by following these steps, taxpayers can ensure they meet the necessary requirements.

Step 1: Gather Required Information

Before starting the Form 8886, taxpayers should gather the necessary information, including:

- The name and identification number of the taxpayer

- The name and identification number of the promoter or advisor

- A detailed description of the transaction

- The date and amount of the transaction

Step 2: Complete Part I of Form 8886

Part I of Form 8886 requires taxpayers to provide general information about the transaction, including:

- The type of transaction (listed, confidential, or contractual protection)

- The date and amount of the transaction

- The name and identification number of the promoter or advisor

Step 3: Complete Part II of Form 8886

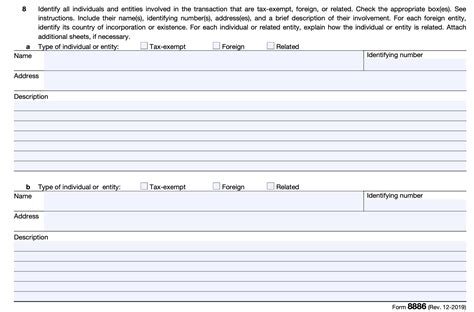

Part II of Form 8886 requires taxpayers to provide a detailed description of the transaction, including:

- A step-by-step explanation of the transaction

- A description of the parties involved

- A description of the assets or services exchanged

Step 4: Complete Part III of Form 8886

Part III of Form 8886 requires taxpayers to provide additional information about the transaction, including:

- A description of any related transactions

- A description of any tax benefits claimed

- A statement indicating whether the taxpayer has a confidentiality agreement or contractual protection

Step 5: Sign and Date the Form

Once the Form 8886 is complete, the taxpayer must sign and date the form. The signature confirms that the information provided is accurate and complete.

Step 6: File the Form 8886

The Form 8886 must be filed with the IRS by the taxpayer's tax return due date. Taxpayers can file the form electronically or by mail.

Penalties for Failure to File Form 8886

Failure to file Form 8886 can result in significant penalties, including:

- A penalty of $10,000 for individuals and $50,000 for corporations

- An extended statute of limitations for the IRS to assess tax and penalties

- Potential for audit and examination by the IRS

Conclusion

Filing Form 8886 is a critical step in complying with tax laws and regulations. By following these instructions, taxpayers can ensure they meet the necessary requirements and avoid potential penalties. If you're unsure about whether a transaction is reportable or need assistance with the Form 8886, consult with a qualified tax professional or the IRS directly.

Additional Resources

For more information on Form 8886 and reportable transactions, visit the IRS website or consult with a qualified tax professional.

Engage with Us

Have you had experience with Form 8886 or reportable transactions? Share your thoughts and insights in the comments below. Don't forget to share this article with others who may benefit from this information.

What is a reportable transaction?

+A reportable transaction is a transaction that requires disclosure on Form 8886, including listed transactions, confidential transactions, and transactions with contractual protection.

What is the penalty for failure to file Form 8886?

+The penalty for failure to file Form 8886 is $10,000 for individuals and $50,000 for corporations.

Can I file Form 8886 electronically?

+Yes, you can file Form 8886 electronically through the IRS website or by mail.