If you're a non-resident of California, you're required to file a state income tax return if you have income from California sources. The California Form 540NR is used for this purpose, and in this article, we'll guide you through the instructions and filing process.

Understanding California Form 540NR

The California Form 540NR is a non-resident income tax return form used by individuals who are not residents of California but have income from California sources. This form is used to report income from sources such as employment, self-employment, and investments that are subject to California state income tax. The form is similar to the California Form 540, which is used by residents, but it has some key differences.

Who Needs to File Form 540NR?

You need to file Form 540NR if you're a non-resident of California and you have income from California sources that is subject to state income tax. This includes:

- Wages, salaries, and tips from a job in California

- Self-employment income from a business or profession in California

- Income from California real estate, such as rental income or gains from the sale of property

- Income from a California trust or estate

- Income from a California partnership or S corporation

Gathering Required Documents

Before you start filing your Form 540NR, you'll need to gather some required documents. These include:

- Your federal income tax return (Form 1040)

- Your W-2 forms from California employers

- Your 1099 forms for self-employment income, interest, dividends, and capital gains

- Your California real estate tax statements

- Any other relevant tax documents

Filing Status

Your filing status on Form 540NR is the same as your filing status on your federal income tax return. This means that if you're single on your federal return, you'll be single on your California return, and so on.

Exemptions and Deductions

As a non-resident, you're not eligible for the same exemptions and deductions as California residents. However, you may be eligible for certain deductions and credits, such as:

- The standard deduction

- Itemized deductions, such as mortgage interest and property taxes

- The California earned income tax credit (CalEITC)

- The California education credit

Filing Form 540NR

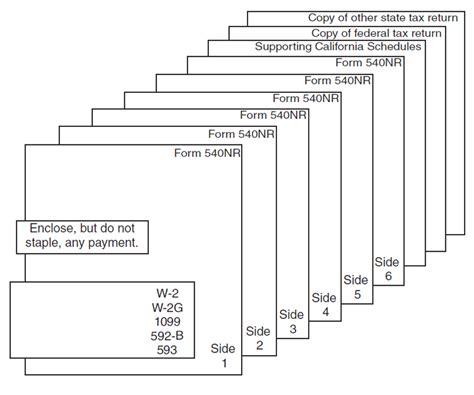

To file Form 540NR, you'll need to follow these steps:

- Download and complete the form from the California Franchise Tax Board (FTB) website or use tax preparation software.

- Enter your personal and tax information, including your name, address, and Social Security number.

- Report your income from California sources, including wages, self-employment income, and real estate income.

- Claim any exemptions and deductions you're eligible for.

- Calculate your tax liability and pay any tax due.

Payment Options

If you owe tax, you can pay it by:

- Check or money order

- Electronic funds withdrawal (EFW)

- Credit card

- Online payment through the FTB website

Filing Deadline

The filing deadline for Form 540NR is the same as the filing deadline for your federal income tax return, which is typically April 15th. If you need an extension, you can file Form 3519, which will give you an automatic six-month extension.

Amending Your Return

If you need to amend your Form 540NR, you can file Form 540X. This form is used to correct errors or make changes to your original return.

California Form 540NR Instructions and Filing Guide

Here is a step-by-step guide to filing Form 540NR:

Section 1: Personal and Tax Information

- Enter your name, address, and Social Security number.

- Check the box if you're filing jointly with your spouse.

Section 2: Income

- Report your income from California sources, including wages, self-employment income, and real estate income.

- Use the worksheets provided to calculate your income.

Section 3: Exemptions and Deductions

- Claim any exemptions and deductions you're eligible for.

- Use the worksheets provided to calculate your exemptions and deductions.

Section 4: Tax Calculation

- Calculate your tax liability using the tax tables provided.

- Enter your tax liability on line 31.

Section 5: Payment and Refund

- If you owe tax, enter the amount on line 32.

- If you're due a refund, enter the amount on line 33.

Section 6: Signatures

- Sign and date your return.

- If you're filing jointly, your spouse must also sign and date the return.

FAQs

Who needs to file Form 540NR?

+You need to file Form 540NR if you're a non-resident of California and you have income from California sources that is subject to state income tax.

What is the filing deadline for Form 540NR?

+The filing deadline for Form 540NR is the same as the filing deadline for your federal income tax return, which is typically April 15th.

Can I e-file Form 540NR?

+Yes, you can e-file Form 540NR through the California Franchise Tax Board (FTB) website or through tax preparation software.

We hope this guide has helped you understand the California Form 540NR instructions and filing process. If you have any further questions or need help with your return, don't hesitate to contact a tax professional or the California Franchise Tax Board (FTB).