With the increasing complexity of tax laws and regulations, it's essential to stay on top of your tax obligations to avoid any penalties or fines. One crucial document that can help you with this is Form 15G. In this article, we'll guide you on how to download Form 15G in Word format instantly and easily.

What is Form 15G?

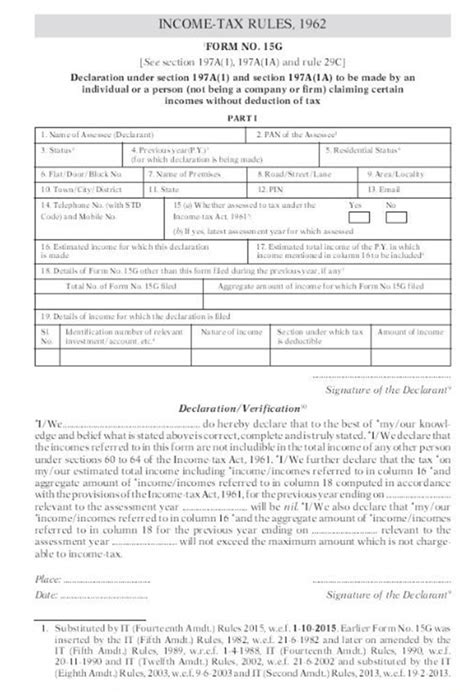

Form 15G is a declaration under the Income-tax Act, 1961, that can be submitted by individuals to claim exemption from Tax Deduction at Source (TDS) on certain types of income. This form is typically used by individuals who do not have a taxable income and want to avoid TDS on their interest income from fixed deposits, recurring deposits, or other investments.

Why is Form 15G important?

Form 15G is essential because it helps individuals avoid unnecessary TDS on their income. If you don't submit this form, the bank or financial institution may deduct TDS on your interest income, which can lead to a significant reduction in your earnings. By submitting Form 15G, you can ensure that your interest income is not subject to TDS, thereby maximizing your returns.

How to download Form 15G in Word format?

Downloading Form 15G in Word format is a straightforward process. Here are the steps to follow:

- Visit the official website: You can download Form 15G from the official website of the Income Tax Department of India.

- Click on the "Forms" section: On the website, click on the "Forms" section, which is usually located on the top navigation bar.

- Select "Form 15G": From the list of available forms, select "Form 15G".

- Choose the format: You will be given the option to download the form in either PDF or Word format. Select "Word" to download the form in Word format.

- Save the file: Once the file is downloaded, save it to your computer.

How to fill Form 15G?

Filling Form 15G is a relatively simple process. Here are the steps to follow:

**Steps to fill Form 15G**

- Enter your personal details: Fill in your name, address, and PAN number.

- Enter your income details: Provide details of your income from interest on fixed deposits, recurring deposits, or other investments.

- Declare your tax liability: Declare that you do not have any tax liability and that your income is below the taxable limit.

- Sign the form: Sign the form in the presence of a witness.

Benefits of Form 15G

Form 15G offers several benefits to individuals who submit it. Some of the key benefits include:

**Exemption from TDS**

- By submitting Form 15G, individuals can claim exemption from TDS on their interest income.

- This means that they will not have to pay any tax on their interest income.

**Increased earnings**

- By avoiding TDS, individuals can increase their earnings from their investments.

- This can help them achieve their financial goals more quickly.

**Simplified tax compliance**

- Form 15G simplifies tax compliance for individuals who do not have a taxable income.

- They do not have to worry about filing their tax returns or paying any tax on their interest income.

Common mistakes to avoid

When filling Form 15G, there are several common mistakes that individuals should avoid. Some of these mistakes include:

**Inaccurate personal details**

- Make sure to fill in your personal details accurately, including your name, address, and PAN number.

- Any inaccuracies can lead to rejection of the form.

**Incomplete income details**

- Make sure to provide complete details of your income from interest on fixed deposits, recurring deposits, or other investments.

- Any omissions can lead to rejection of the form.

**Incorrect tax liability declaration**

- Make sure to declare your tax liability accurately.

- Any incorrect declarations can lead to rejection of the form.

Frequently asked questions

Here are some frequently asked questions about Form 15G:

Who can submit Form 15G?

+Individuals who do not have a taxable income can submit Form 15G.

What is the purpose of Form 15G?

+The purpose of Form 15G is to claim exemption from TDS on interest income.

How do I download Form 15G in Word format?

+You can download Form 15G in Word format from the official website of the Income Tax Department of India.

Take action today!

If you're an individual who does not have a taxable income and wants to claim exemption from TDS on your interest income, download Form 15G in Word format today. Fill in the form accurately and submit it to your bank or financial institution to avoid unnecessary TDS on your interest income.