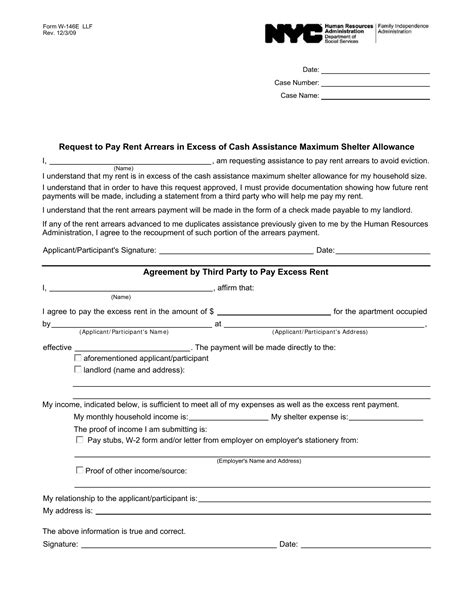

As a taxpayer, it's essential to understand the various tax forms and their purposes. One such form is the W-146e, which is used by the Social Security Administration (SSA) to report income and taxes withheld from certain types of income. In this article, we'll delve into the world of the W-146e form, exploring its importance, benefits, and providing a step-by-step guide on how to complete it.

Understanding the W-146e Form

The W-146e form is a tax document used to report income and taxes withheld from non-employee compensation, such as freelance work, independent contracting, and other types of self-employment income. This form is similar to the W-2 form, which is used to report employee wages and taxes withheld. However, the W-146e form is specifically designed for non-employee compensation, which is subject to different tax rules and regulations.

Benefits of the W-146e Form

The W-146e form provides several benefits to taxpayers, including:

- Accurate reporting of income and taxes withheld

- Helps to prevent errors and discrepancies in tax returns

- Enables taxpayers to claim credits and deductions for taxes withheld

- Provides a record of income and taxes paid for future reference

Who Needs to File the W-146e Form?

The W-146e form is typically filed by payers who have made payments to non-employees, such as:

- Freelancers and independent contractors

- Self-employed individuals

- Small business owners

- Companies that have made payments to non-employees

Step-by-Step Guide to Completing the W-146e Form

Completing the W-146e form can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you get started:

Step 1: Gather Required Information

Before you start filling out the W-146e form, make sure you have the following information:

- Payer's name and address

- Payer's Employer Identification Number (EIN)

- Payee's name and address

- Payee's Social Security number or Individual Taxpayer Identification Number (ITIN)

- Dates of payments made

- Amounts of payments made

- Amounts of taxes withheld

Step 2: Fill Out Box 1-5

Boxes 1-5 of the W-146e form require the following information:

- Box 1: Payer's name and address

- Box 2: Payer's EIN

- Box 3: Payee's name and address

- Box 4: Payee's Social Security number or ITIN

- Box 5: Dates of payments made

Step 3: Fill Out Box 6-10

Boxes 6-10 of the W-146e form require the following information:

- Box 6: Amounts of payments made

- Box 7: Amounts of federal income tax withheld

- Box 8: Amounts of state and local taxes withheld

- Box 9: Amounts of other taxes withheld (such as Medicare tax)

- Box 10: Total amount of taxes withheld

Step 4: Fill Out Box 11-13

Boxes 11-13 of the W-146e form require the following information:

- Box 11: Amounts of non-employee compensation

- Box 12: Amounts of other income (such as interest and dividends)

- Box 13: Total amount of income reported

Step 5: Sign and Date the Form

Once you've completed the W-146e form, sign and date it. Make sure to keep a copy for your records and provide a copy to the payee.

Common Mistakes to Avoid

When completing the W-146e form, make sure to avoid the following common mistakes:

- Incorrect or missing information

- Inaccurate calculations

- Failure to sign and date the form

- Failure to provide a copy to the payee

Tips and Tricks

Here are some tips and tricks to help you complete the W-146e form:

- Use a calculator to ensure accurate calculations

- Double-check your information for accuracy

- Keep a copy of the completed form for your records

- Provide a copy to the payee promptly

Conclusion

Completing the W-146e form is a straightforward process that requires attention to detail and accuracy. By following the step-by-step guide outlined in this article, you'll be able to complete the form with ease. Remember to avoid common mistakes and take advantage of the tips and tricks provided. If you have any questions or concerns, don't hesitate to reach out to a tax professional for assistance.

FAQ Section:

Who needs to file the W-146e form?

+The W-146e form is typically filed by payers who have made payments to non-employees, such as freelancers and independent contractors.

What information is required to complete the W-146e form?

+To complete the W-146e form, you'll need to provide information such as the payer's name and address, payee's name and address, dates of payments made, and amounts of payments made.

How do I avoid common mistakes when completing the W-146e form?

+To avoid common mistakes, make sure to double-check your information for accuracy, use a calculator to ensure accurate calculations, and keep a copy of the completed form for your records.