As the tax season approaches, residents of New Jersey are gearing up to file their state income tax returns. The NJ Form 1040 is the standard form used by the New Jersey Division of Taxation for individuals to report their income and claim deductions and credits. In this article, we will provide a step-by-step guide to help you navigate the NJ Form 1040 instructions and ensure a smooth filing process.

Understanding the NJ Form 1040

The NJ Form 1040 is a complex document that requires careful attention to detail. The form is divided into several sections, each dealing with a specific aspect of your income and tax obligations. Before we dive into the instructions, it's essential to understand the different types of income that are subject to New Jersey state income tax.

Types of Income Subject to New Jersey State Income Tax

New Jersey taxes various types of income, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Rental income

- Royalties

- Pension and annuity income

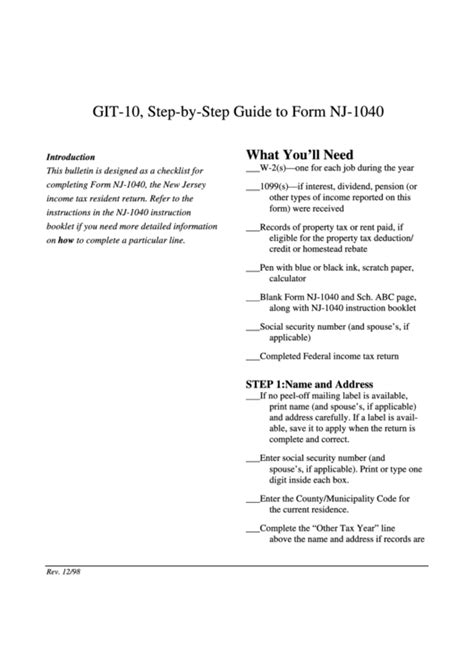

Gathering Required Documents

Before you start filling out the NJ Form 1040, make sure you have all the necessary documents and information. These may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, dividends, and capital gains

- Schedule C (Form 1040) for self-employment income

- Schedule D (Form 1040) for capital gains and losses

- Form 1098 for mortgage interest

- Form 5498 for IRA contributions

Filing Status and Residency

Your filing status and residency status will determine which sections of the NJ Form 1040 you need to complete. New Jersey recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You will also need to indicate your residency status, which can be either:

- Resident

- Nonresident

- Part-year resident

Completing the NJ Form 1040

Now that you have gathered all the necessary documents and information, it's time to start filling out the NJ Form 1040. Here's a step-by-step guide to help you complete the form:

Section 1: Income

- Report your total income from all sources, including wages, salaries, tips, and self-employment income.

- List your income from each source on a separate line, using the codes provided in the instructions.

Section 2: Adjustments to Income

- Claim deductions for contributions to a traditional IRA, student loan interest, and tuition and fees.

- Report alimony paid and deductible moving expenses.

Section 3: Taxable Income

- Calculate your taxable income by subtracting your adjustments to income from your total income.

- Apply the New Jersey income tax rates to your taxable income to determine your tax liability.

Section 4: Tax Credits

- Claim credits for taxes paid to other states, earned income tax credit, and child and dependent care credit.

- Report any other credits you are eligible for, such as the New Jersey property tax credit.

Section 5: Payments and Credits

- Report any payments you made towards your New Jersey state income tax liability, including withholding and estimated tax payments.

- Claim any credits you are eligible for, such as the earned income tax credit.

Section 6: Refund or Amount Due

- Calculate your refund or amount due by subtracting your total payments and credits from your tax liability.

- If you owe taxes, you can pay online, by phone, or by mail.

Additional Forms and Schedules

Depending on your specific situation, you may need to complete additional forms and schedules, such as:

- Schedule A (Form 1040) for itemized deductions

- Schedule B (Form 1040) for interest and dividend income

- Schedule C (Form 1040) for self-employment income

- Schedule D (Form 1040) for capital gains and losses

Electronic Filing Options

New Jersey offers several electronic filing options, including:

- NJ WebFile: a free online filing system for individuals and businesses

- e-File: a paid filing system for individuals and businesses

- Tax preparation software: such as TurboTax, H&R Block, and TaxAct

Conclusion

Filing your NJ Form 1040 can be a complex and time-consuming process. By following these step-by-step instructions and gathering all the necessary documents and information, you can ensure a smooth filing process and avoid any errors or penalties. If you have any questions or need further assistance, you can contact the New Jersey Division of Taxation or seek the help of a tax professional.

We hope this guide has been helpful in navigating the NJ Form 1040 instructions. If you have any questions or comments, please feel free to share them below.

FAQ Section

What is the deadline for filing the NJ Form 1040?

+The deadline for filing the NJ Form 1040 is April 15th of each year.

Can I file the NJ Form 1040 electronically?

+Yes, you can file the NJ Form 1040 electronically using NJ WebFile or e-File.

What is the New Jersey income tax rate?

+The New Jersey income tax rate ranges from 5.525% to 10.75%.