The importance of a seamless payroll process cannot be overstated, especially when it comes to ensuring that employees receive their wages on time. One crucial aspect of this process is setting up direct deposit, which allows employers to transfer funds directly into their employees' bank accounts. Intuit, a leading provider of financial and accounting software, offers a direct deposit form that simplifies this process. In this article, we will break down the 5 easy steps to complete the Intuit direct deposit form, making it easier for employers to manage their payroll efficiently.

Understanding the Importance of Direct Deposit

Before we dive into the steps to complete the Intuit direct deposit form, it's essential to understand the benefits of direct deposit. This payment method offers numerous advantages, including reduced paperwork, increased efficiency, and improved security. By using direct deposit, employers can avoid the hassle of printing and distributing paper checks, reducing the risk of lost or stolen payments. Moreover, direct deposit enables employees to access their wages faster, which can improve their overall financial well-being.

Step 1: Gather Required Information

To complete the Intuit direct deposit form, you'll need to gather some essential information from your employees. This includes their:

- Bank account number

- Bank routing number

- Bank name and address

- Account type (checking or savings)

It's crucial to ensure that the information provided is accurate and up-to-date to avoid any errors or delays in the direct deposit process.

Verifying Employee Information

Before proceeding, verify the employee's information to ensure that it matches the details on file. This includes checking their name, address, and Social Security number or Taxpayer Identification Number (TIN). Any discrepancies may lead to issues with the direct deposit process.

Step 2: Access the Intuit Direct Deposit Form

To access the Intuit direct deposit form, follow these steps:

- Log in to your Intuit account and navigate to the payroll section.

- Click on the "Direct Deposit" or "Payroll" tab, depending on your Intuit software version.

- Select the employee for whom you want to set up direct deposit.

- Click on the "Add Direct Deposit" or "Set up Direct Deposit" button.

The Intuit direct deposit form will be displayed, and you can proceed to fill in the required information.

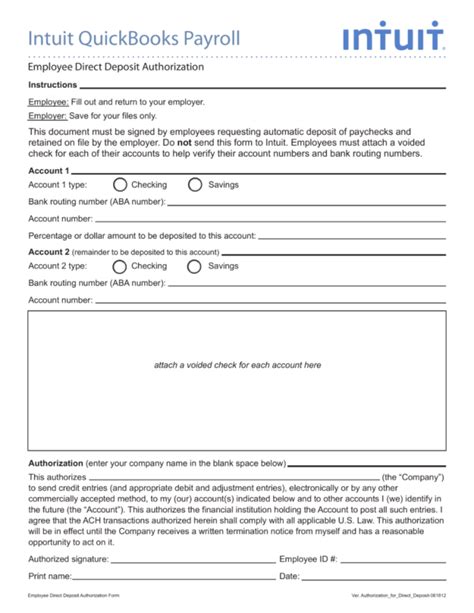

Understanding the Intuit Direct Deposit Form

The Intuit direct deposit form typically includes the following sections:

- Employee information

- Bank account information

- Deposit allocation (optional)

Take a moment to review the form and ensure that you understand the required information and any specific instructions.

Step 3: Fill in the Direct Deposit Form

Carefully fill in the Intuit direct deposit form, ensuring that all required fields are completed accurately. This includes:

- Employee name and address

- Bank account number and routing number

- Bank name and address

- Deposit allocation (if applicable)

Double-check the information to avoid any errors or omissions.

Common Mistakes to Avoid

When filling in the direct deposit form, be cautious of common mistakes, such as:

- Incorrect bank account or routing numbers

- Misspelled employee names or addresses

- Insufficient or missing information

These errors can lead to delays or issues with the direct deposit process.

Step 4: Review and Submit the Form

Once you've completed the Intuit direct deposit form, review it carefully to ensure that all information is accurate and complete. Make any necessary corrections before submitting the form.

Submission Options

You can typically submit the direct deposit form through the Intuit software or online portal. Follow the on-screen instructions to complete the submission process.

Step 5: Verify Direct Deposit Setup

After submitting the direct deposit form, verify that the setup is complete and accurate. You can do this by:

- Checking the employee's payroll record

- Reviewing the direct deposit confirmation notification

- Verifying the bank account information

By following these 5 easy steps, you can complete the Intuit direct deposit form and ensure a smooth payroll process for your employees.

Now that you've completed the Intuit direct deposit form, take a moment to review the benefits of this payment method. By using direct deposit, you can streamline your payroll process, reduce errors, and improve employee satisfaction. Share your experiences or tips for managing direct deposit in the comments below!

What is the benefit of using direct deposit?

+The benefits of using direct deposit include reduced paperwork, increased efficiency, and improved security. It also enables employees to access their wages faster.

How do I access the Intuit direct deposit form?

+To access the Intuit direct deposit form, log in to your Intuit account and navigate to the payroll section. Click on the "Direct Deposit" or "Payroll" tab, select the employee, and click on the "Add Direct Deposit" or "Set up Direct Deposit" button.

What information do I need to gather from employees?

+You'll need to gather the employee's bank account number, bank routing number, bank name and address, and account type (checking or savings).