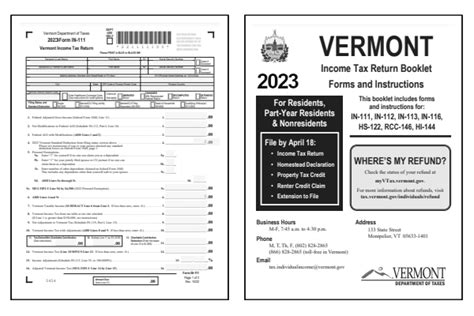

Vermont Tax Form In-111 Instructions Guide

Each year, Vermont residents and non-residents who earned income from Vermont sources are required to file a state income tax return. The Vermont Tax Form In-111 is the standard form used for this purpose. Understanding the instructions and requirements for completing this form is essential to ensure accurate and timely filing. In this guide, we will walk you through the steps and provide valuable insights to help you navigate the Vermont Tax Form In-111.

Who Needs to File Vermont Tax Form In-111?

Before diving into the instructions, it's essential to determine if you need to file a Vermont state income tax return. You are required to file if:

- You are a resident of Vermont and have a federal gross income that exceeds the filing threshold.

- You are a non-resident with Vermont-source income that exceeds the filing threshold.

- You have Vermont tax withheld from any income, regardless of the amount.

- You are eligible for a refund or credit.

Step-by-Step Instructions for Completing Vermont Tax Form In-111

Section 1: Personal Information

- Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Check the box indicating your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)).

Section 2: Income

- Report all income from Form W-2, Wage and Tax Statement, and Form 1099-MISC, Miscellaneous Income.

- List all sources of income, including wages, salaries, tips, and self-employment income.

- Enter the total amount of income from all sources.

Section 3: Adjustments to Income

- Claim adjustments to income, such as alimony paid, student loan interest, and moving expenses.

Section 4: Credits

- Claim credits for taxes withheld, earned income tax credit, and child tax credit.

- List any other credits you are eligible for, such as the Vermont earned income tax credit.

Section 5: Tax Computation

- Calculate your total tax liability using the Vermont tax tables or tax rate schedules.

- Enter the total tax liability and any additional taxes owed.

Section 6: Payments and Refunds

- Report any tax withheld, estimated tax payments, and prior-year refunds applied to this year's tax.

- Enter the amount of refund due or additional tax owed.

Additional Requirements and Supporting Documents

In addition to completing the Vermont Tax Form In-111, you may need to provide supporting documents, such as:

- Form W-2 and Form 1099-MISC for each employer or payer.

- Schedule A, Itemized Deductions, if you claim itemized deductions.

- Schedule B, Interest and Dividend Income, if you have interest or dividend income.

- Schedule C, Business Income and Expenses, if you are self-employed.

Tips and Reminders for Filing Vermont Tax Form In-111

- File your Vermont state income tax return by the deadline to avoid penalties and interest.

- Use black ink and print or type your return to ensure readability.

- Keep a copy of your return and supporting documents for at least three years.

- If you are due a refund, consider direct deposit for faster processing.

Common Errors to Avoid When Filing Vermont Tax Form In-111

- Inaccurate or missing Social Security numbers or ITINs.

- Incorrect filing status or number of dependents.

- Failure to report all income or claim all eligible credits.

- Math errors or incorrect tax computation.

Conclusion

Filing your Vermont state income tax return can seem daunting, but by following these step-by-step instructions and tips, you can ensure accurate and timely filing. Remember to review your return carefully, and don't hesitate to seek help if you need it. If you have any questions or concerns, feel free to comment below or share this article with others who may benefit from this guide.

What is the deadline for filing Vermont Tax Form In-111?

+The deadline for filing Vermont Tax Form In-111 is typically April 15th of each year.

Do I need to file a Vermont state income tax return if I am a non-resident?

+Yes, if you have Vermont-source income that exceeds the filing threshold, you are required to file a Vermont state income tax return.

Can I file my Vermont state income tax return electronically?

+Yes, Vermont offers e-file options for state income tax returns. You can file electronically through the Vermont Department of Taxes website or through a tax preparation software.